Sustainable investing has gained immense traction in recent years as investors strive to meet their values and positively impact the world. But not all investments in the name of sustainability are created equal.

In this article, we take a quick look at some of the key metrics of Essential Utilities, Inc. (WTRG), a water utility company, intending to make investors think twice before investing in its stock. WTRG has a long-standing history of supplying essential services to its customers, but its practices may serve as a red flag for investors who put sustainability at the top of their list.

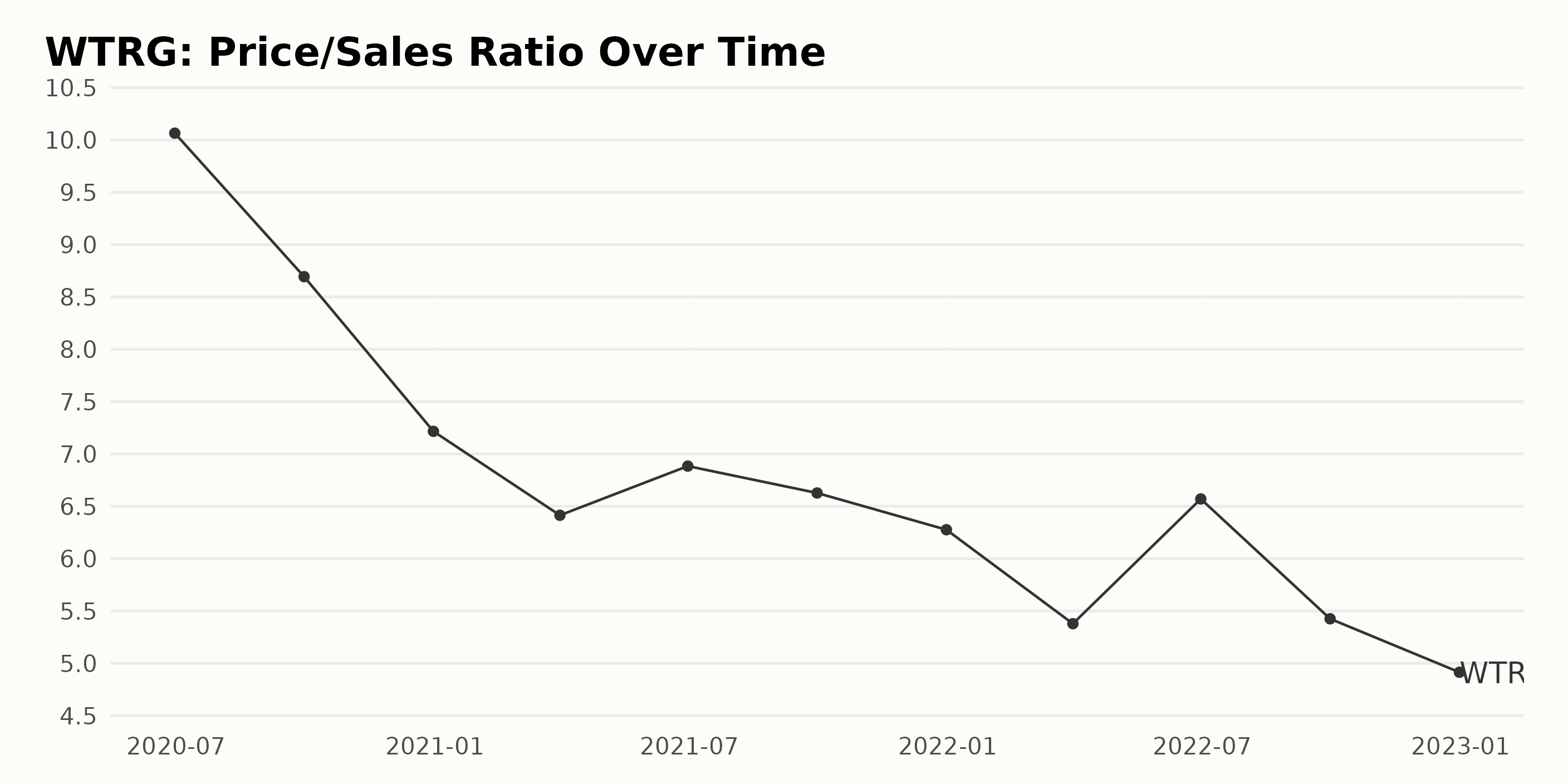

Also, the stock is trading at a premium to its peers. In terms of non-GAAP forward price/earnings ratio (P/E), WTRG is trading at 24.12, a 24.6% premium to the industry average of 19.36. The stock is trading at a forward Price/Sales (P/S) of 5.05x, a 134.5% premium to the industry average of 2.15x. Given the company’s declining gross margin, the premium valuation might lead to a downside in the stock.

An Analysis of WTRG's Financial Metrics Over the Last Two Years

WTRG’s P/E ratio has fluctuated over the past few years, growing from 40.01 in June 2020 to 42.87 in September 2020 before declining to 37.05 in December 2020. Subsequent months saw a further decline, reaching 27.31 in December 2021 and 24.17 in December 2022. Overall, the P/E ratio has grown by 22.26% since June 2020.

A trend of decreasing price/sales ratios (P/S) for WTRG can be observed from June 2020 - December 2022. The PS decreased from 10.1 in June 2020 to 4.9 in December 2022, representing a 51.1% decrease. Since March 2021, the fluctuations have been less pronounced, with a minor increase to 6.9 in June 2022, followed by a decrease to 4.9 in December 2022.

The gross margin of WTRG has generally been decreasing over the last two years, decreasing from 52.7% in June 2020 to 42.9% in December 2022. The fluctuations show that there have been some variations within this trend, as it reached a peak of 49.0% in March 2021 before dropping again to 44.7% in June 2022. Overall, the gross margin of WTRG has decreased by 9.8% over the last two years.

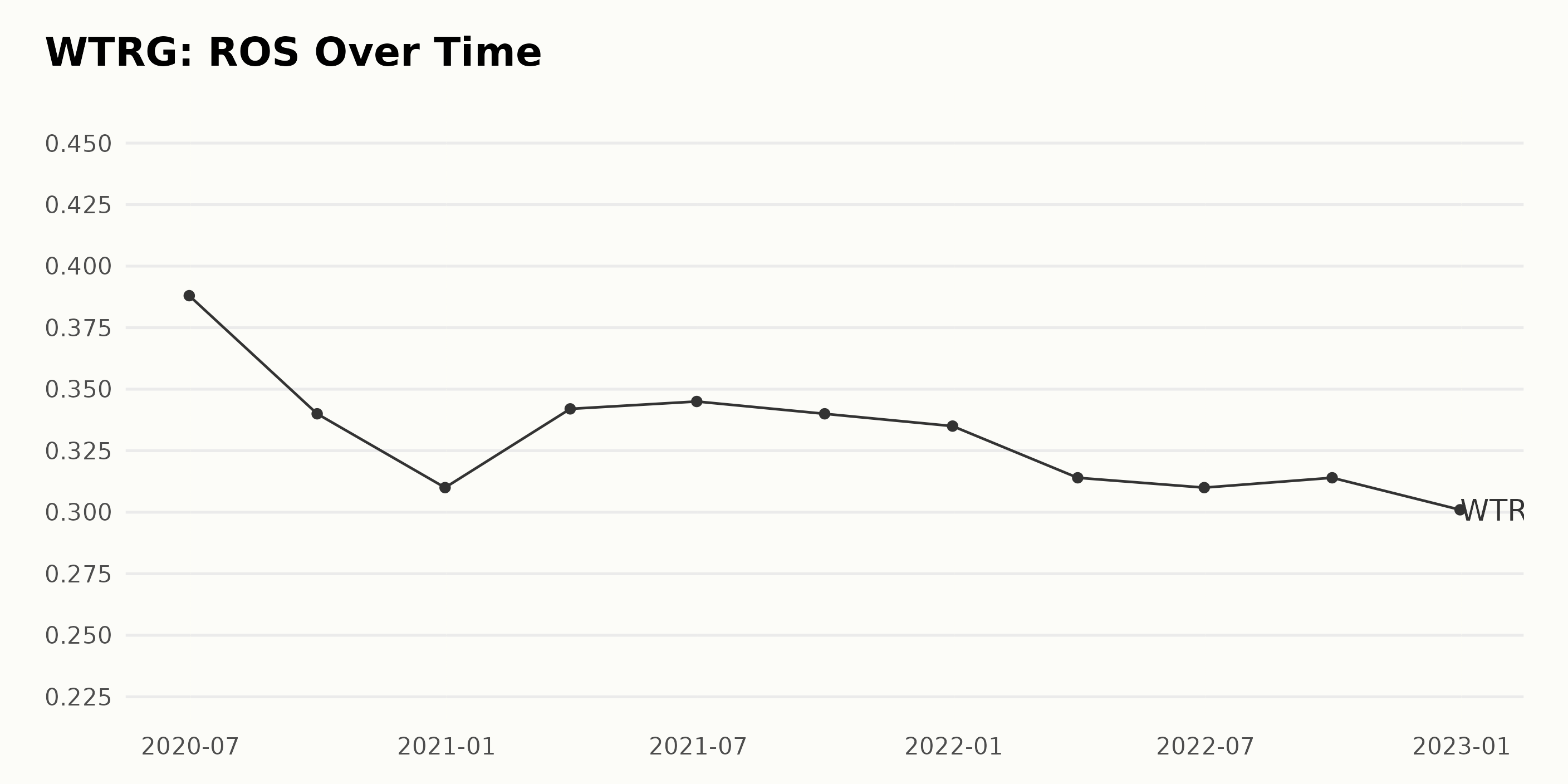

The Return on Sales (ROS) of WTRG appears to have a downward trend over the last two years, decreasing from 0.388 in June 2020 to 0.301 in December 2022. There are minor fluctuations throughout this period, with higher values in March 2021 (0.342) and June 2021 (0.345). The growth rate for the series is -22.2%, with the last value decreasing by 23.6% from the initial value.

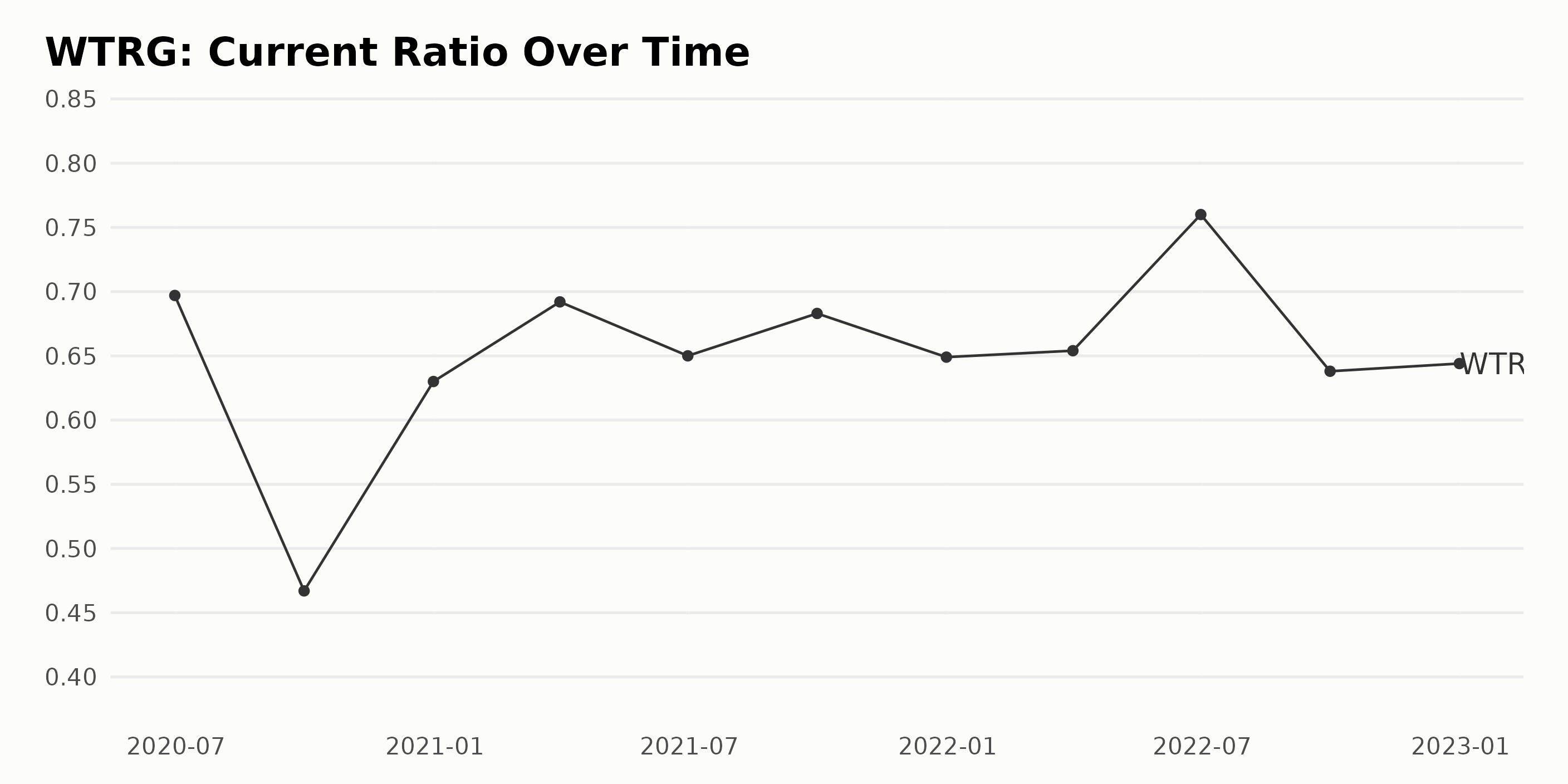

The current ratio of WTRG has had a generally upward trend over the past two years, starting at 0.697 in June 2020 and increasing to 0.76 by June 2022. However, there have been fluctuations along the way, with the most significant drops occurring between June 2021 (0.65) and September 2021 (0.683). Overall, the rate of growth since June 2020 has been approximately 8%.

A Decline in WTRG Share Price from November 2022-April 2023

The trend of the data suggests that the share price of WTRG has been decreasing overall from November 2022 to April 2023. Prices initially increased from $43.99 on November 4, 2022, to $44.93 on November 11 and then $46.91 on November 18, but have since decreased steadily.

For example, the share price decreased from $48.084 on December 9, 2022, to $47.04 on December 23, and then further to $42.756 on March 3, 2023. The price has gradually increased after March, from $41.912 on March 10, 2023, to $44.258 on April 14, 2023, but has yet to reach its original peak. Here is a chart of WTRG's price over the past 180 days.

High Momentum but Declining Value for WTRG

WTRG’s overall D rating translates to a Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree. It is ranked #9 out of 12 stocks in the D-rated Water industry.

Our proprietary rating system also evaluates each stock based on eight distinct categories. For WTRG, the POWR Ratings show the highest scores in Momentum, with a rating of 91 in November 2022 and 96 in January 2023. The ratings for Stability are also consistently high, with ratings of around 57 to 61 depending on the month and year.

The stock has a C grade for Quality, scoring 20 in November 2022 and 42 in April 2023. WTRG has an F grade for Value. There is a decreasing trend in the Value ratings over the given period, decreasing from 30 in November 2022 to 4 in April 2023.

How Does Essential Utilities, Inc. (WTRG) Stack Up Against its Peers?

Other stocks in the Water sector that may be worth considering are Consolidated Water Co. Ltd. (CWCO), Global Water Resources Inc. (GWRS), and The York Water Company (YORW) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

WTRG shares were trading at $42.71 per share on Monday afternoon, up $0.01 (+0.02%). Year-to-date, WTRG has declined -9.96%, versus a 9.16% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post The Dark Side of Sustainable Investing: 1 Risky Water Stock to Avoid in 2023 appeared first on StockNews.com