Although The Boeing Company (BA) is benefitting from the continued recovery of air travel and its shares are flying higher, the aircraft manufacturer is crippled with several production issues.

This week, BA announced another delay in delivery of its 787 Dreamliner caused by a manufacturing issue involving a fitting on the part of the tail called the horizontal stabilizer. BA also had to suspend deliveries of the same aircraft previously due to some production flaw.

While the U.S. Federal Aviation Administration validated Boeing’s assessment that there was no immediate safety issue for 787s already in service, the inspections and the repairs will affect near-term deliveries.

Moreover, BA found a problem with fittings on its Max jets earlier this year. Production defects have plagued the 787 and the 737 Max.

In addition, the company was sued recently by Wilson Aerospace, which accused it of stealing trade secrets for NASA’s Space Launch System rocket and then building components with critical safety flaws that could endanger astronauts.

“Boeing has captured billions of dollars in revenue because of the infringement of Wilson’s trade secrets” and must turn over “all revenues and profits Boeing has obtained as a result,” the complaint said.

The company is plagued with operational headwinds and lawsuits, making it a risky stock to own now. Let’s look at some of its metrics to gauge its challenges.

Analysis of Boeing Company (BA) Performance over 3 Years

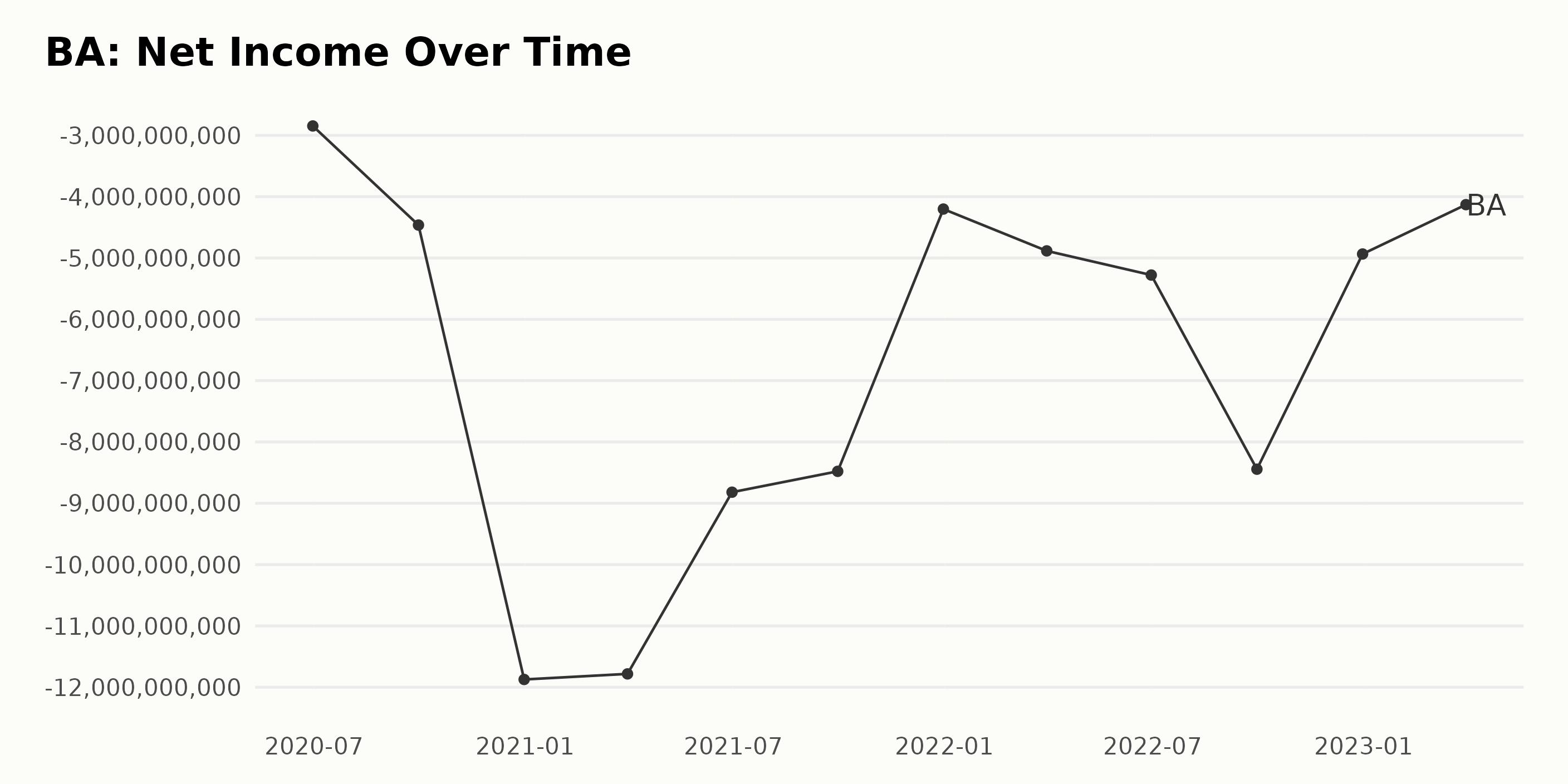

BA’s net income decreased since June 2020, when it was negative $2.85 billion. The net income experienced several fluctuations, including a negative $11.87 billion in December 2020 and a negative $420 million in December 2021. Net loss for the quarter ended March 2023 came in at $425 million.

BA’s revenue has shown a mixed trend, with a growth rate of 4.8% from its first reported value of $66.6 billion (June 2020) to its last reported value of $70.5 billion (March 2023). There have been fluctuations within this period, with the peak recorded in March 2023 and the lowest value recorded in December 2020, when revenue dropped by 3.2% from $60.7 billion to $58.2 billion.

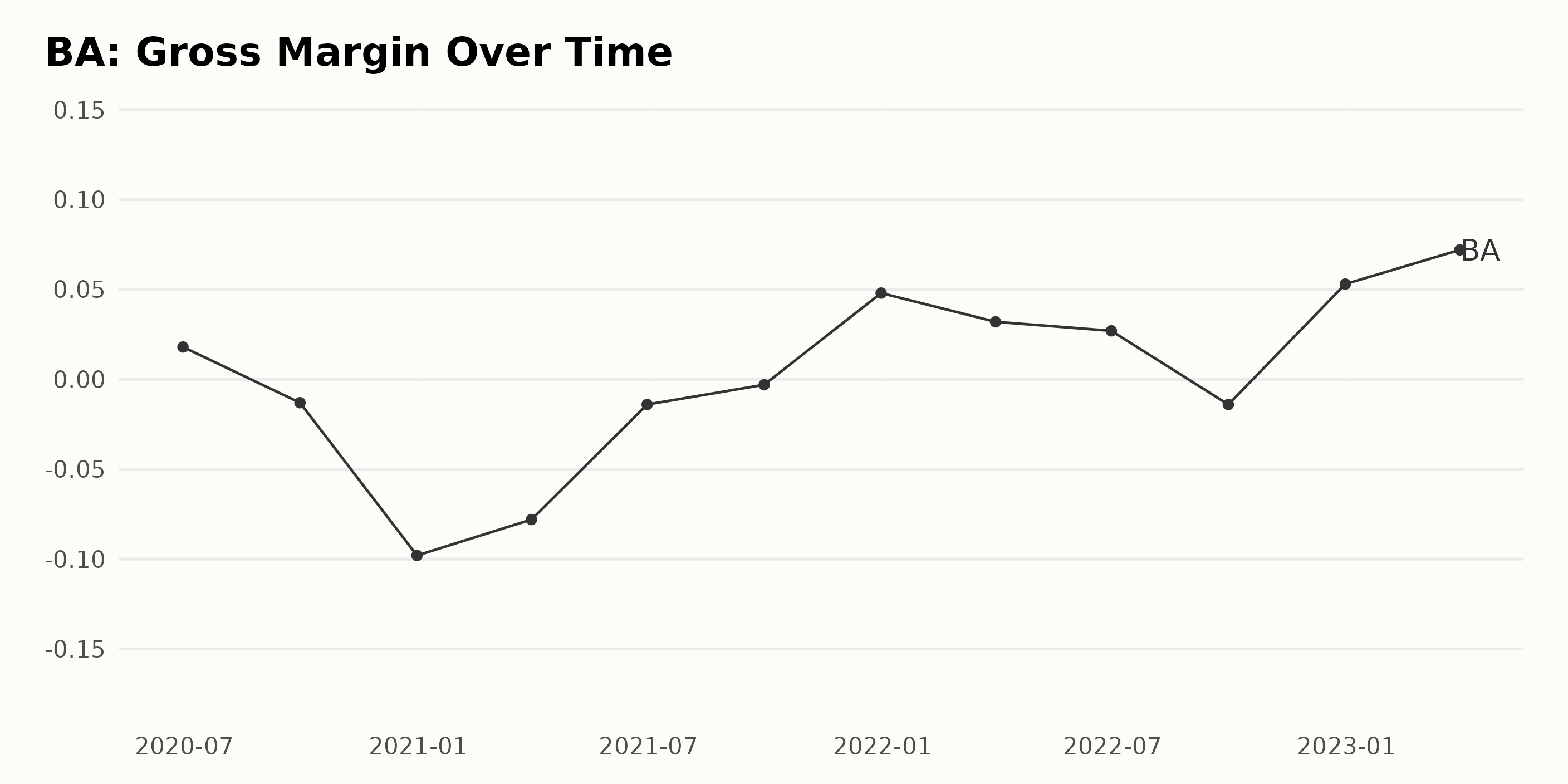

The company’s gross margin had a general downward trend from June 2020 to December 2020, with a low of negative 9.8%. Most recently, it was recorded at 7.2% in March 2023. Overall, the gross margin has increased by 8.4% since June 2020.

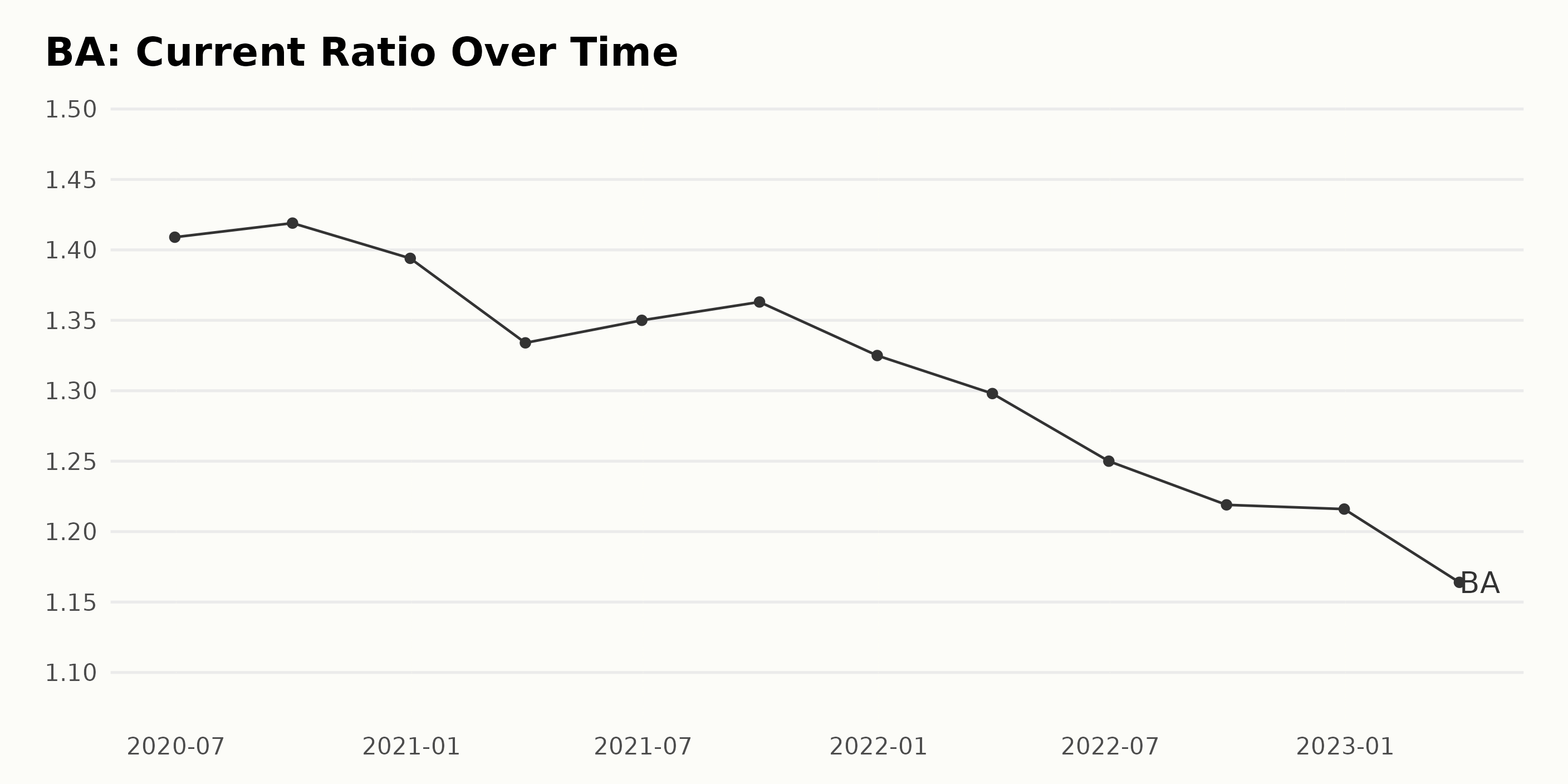

BA showed a downward trend from June 30, 2020, when the current ratio was 1.41, to March 31, 2023, when it decreased to 1.16. The rate of decrease was 8.2% over the three years. More recently, from March 31, 2021, to March 31, 2023, the current ratio decreased by 12.4%, from 1.334 to 1.164.

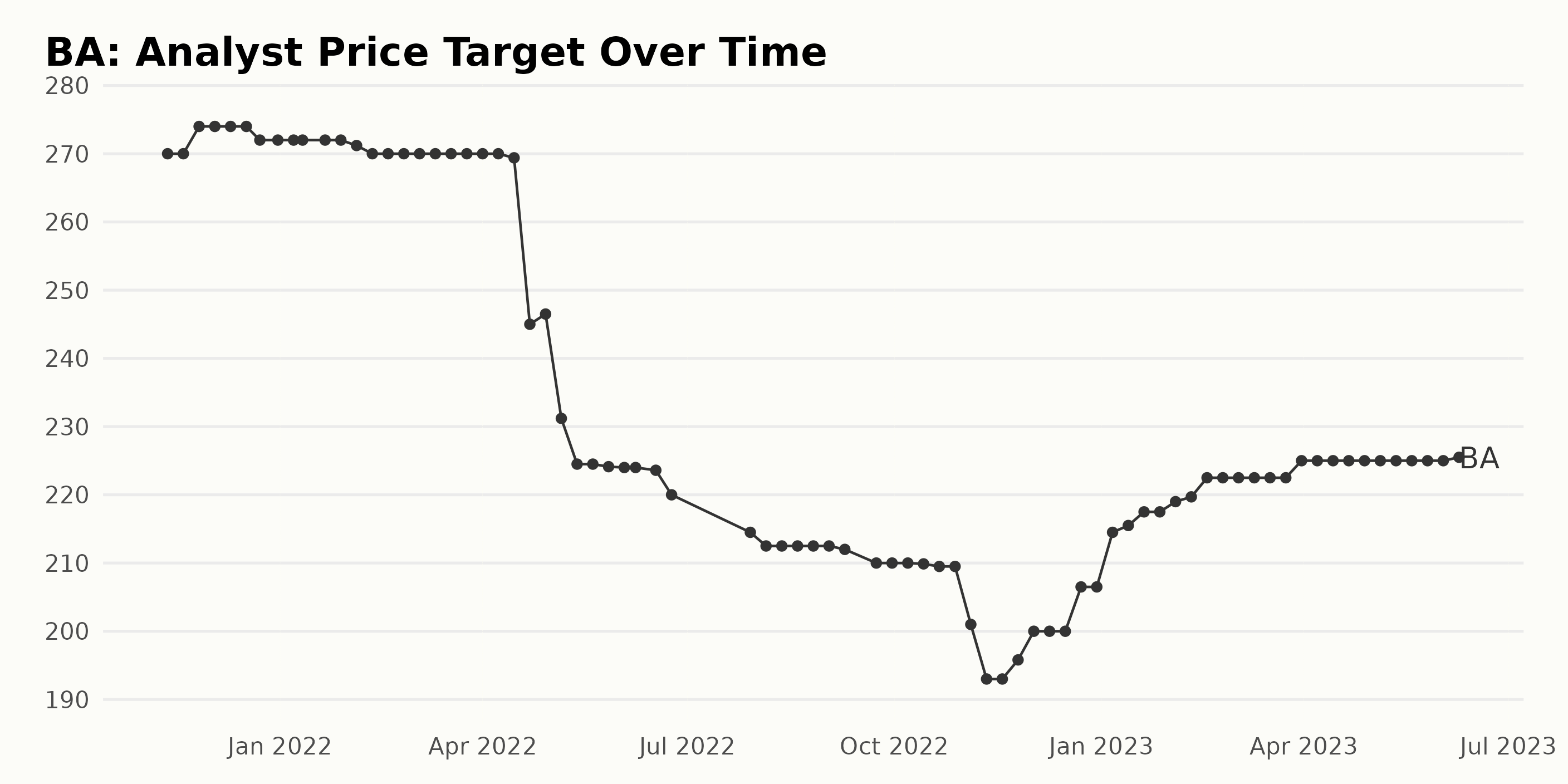

The Analyst Price Target for BA has fluctuated throughout the data series, with a growth rate of 0.17% from $270 on November 12, 2021, to $225 on June 8, 2023. It has displayed an overall downward trend, with the current last value significantly lower than the first value. The most significant fluctuations occurred between April 21, 2022, and January 13, 2023, when the price target dropped from $246.50 to $214.50 before slowly rising to its current level.

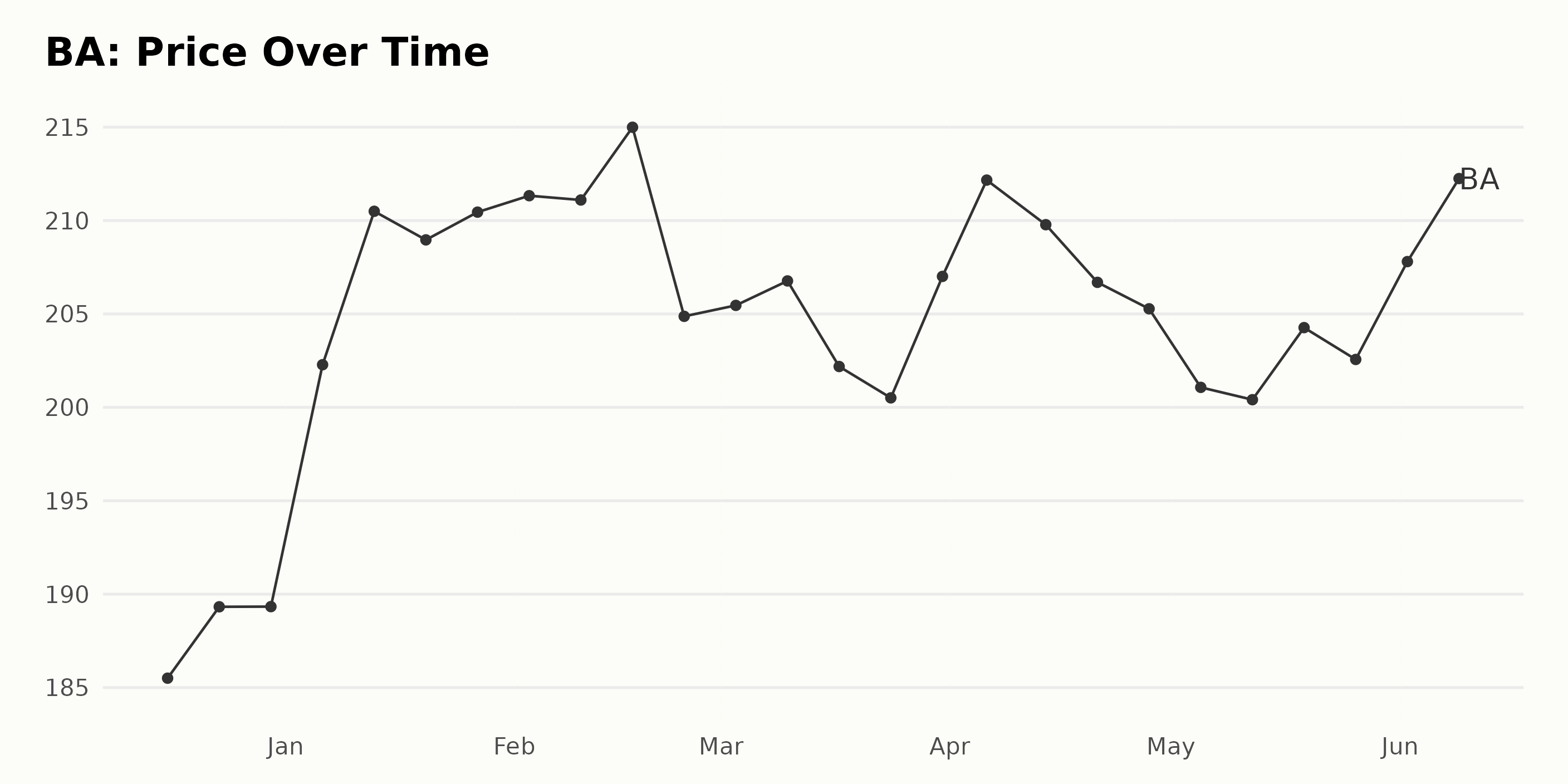

BA Share Price Accelerates Over 180 Days

BA’s share price has gradually increased over the past few months, from $185.50 on December 16, 2022, to $210.97 on June 8, 2023. Here is a chart of BA’s price over the past 180 days.

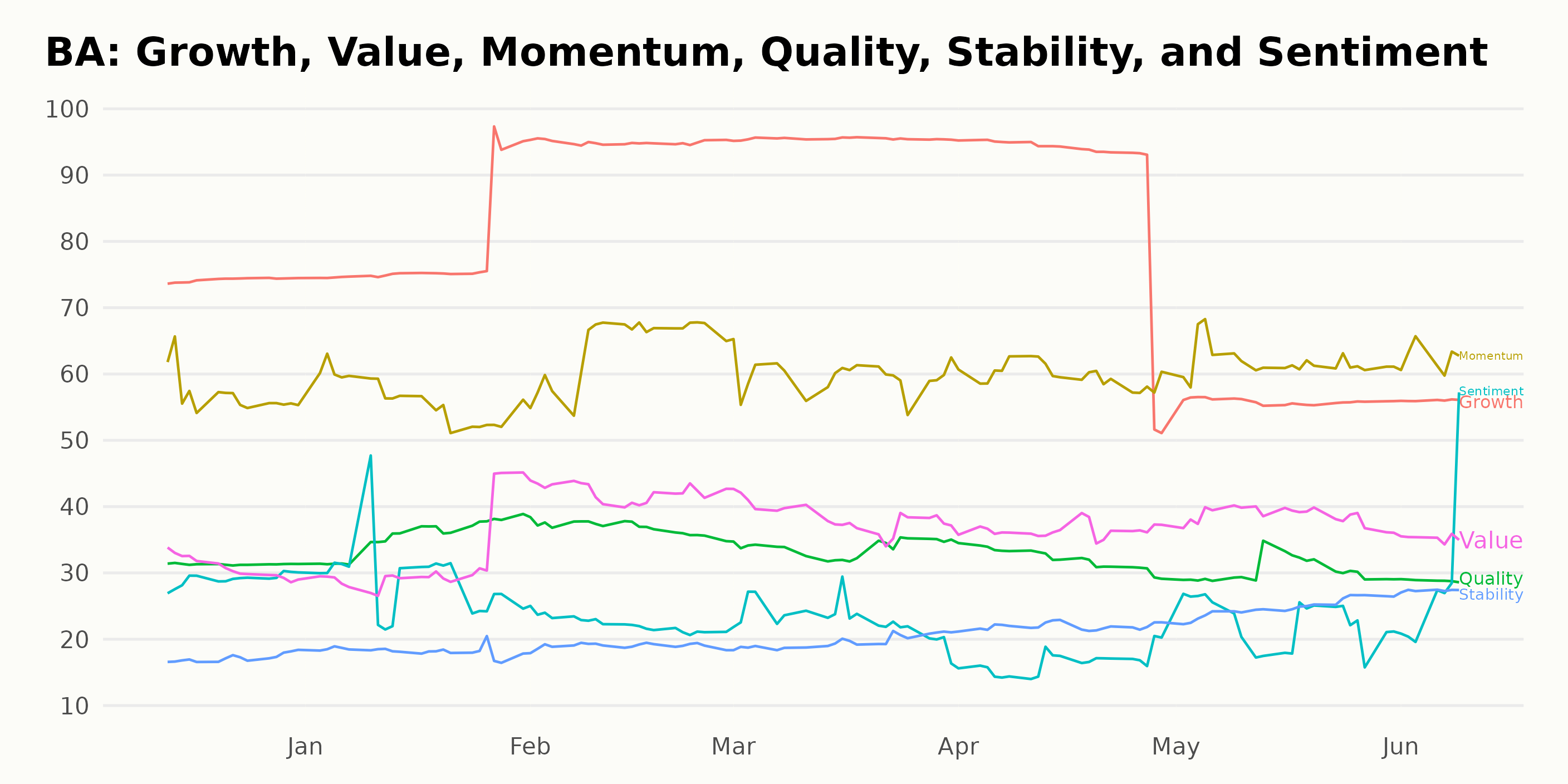

Unfavorable POWR Ratings

BA has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #49 out of 71 stocks in the Air/Defense Services category. It also has a C grade for Growth, Value, Momentum, Quality, Sentiment, and Stability.

How does The Boeing Company (BA) Stack Up Against its Peers?

Other stocks in the Air/Defense Services sector that may be worth considering are CPI Aerostructures Inc. (CVU), Willis Lease Finance Corporation (WLFC), and Cadre Holdings, Inc. (CDRE) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

BA shares were trading at $217.53 per share on Friday afternoon, down $0.58 (-0.27%). Year-to-date, BA has gained 14.19%, versus a 12.92% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Should You Buy Boeing (BA) Now? appeared first on StockNews.com