After a wild few years, the fine watch market is on a knife edge. Is it time to buy, sell, or hold?

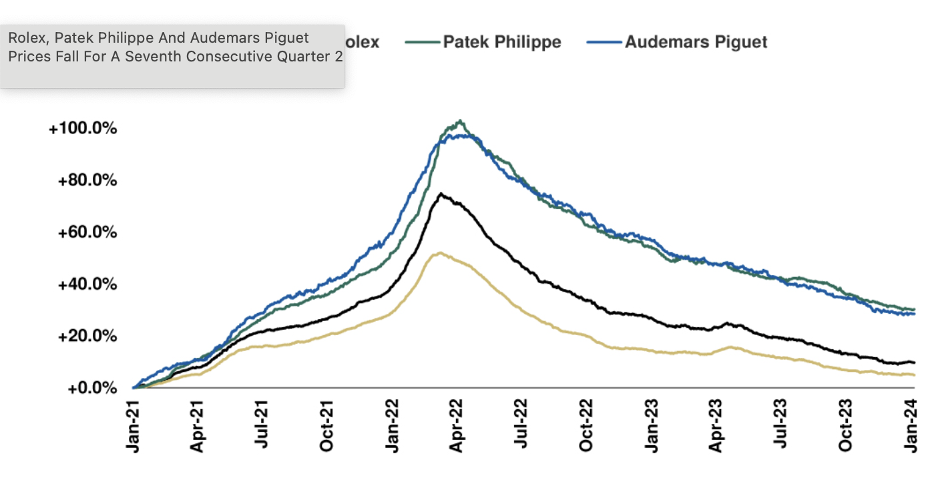

March 2, 2024 - PRLog -- The secondary market for luxury watches is worth $25 billion. Analysts say it will outstrip the primary market by 2032. However, the WatchCharts Overall Index is down almost 40% since its March 2022 peak.

While losses may have slowed in recent months, last year has been challenging for collectors. Here's the 12-month data on the average prices for top 5 brands.

- Rolex: $26,178 - down 8%

- Patek Philippe: $144,922 - down 14%

- Audemars Piguet: $68,092 - down 16%

- Omega: $8,939 - down 2.6%

- Cartier: $9,102 - up 1%

Buy, sell, or hold?

The market has been in decline for two years. But there are signs things are changing. In the last three months, the overall market is down almost 1%; February saw a slight uptick of 0.1%.

With the market in a precarious state, you've got three options:

Buy: Has the market reached the bottom? Are luxury watches available at a 40% discount?

Sell: Is there more pain to come in 2024? Is it time to cut your losses and exit the market?

Hold: The market has stabilised, but should I hold on to achieve better margins?

Listen to market experts, and you can find support for each option — things are really unpredictable now.

Another thing to consider is that only specific models are selling below retail. Right now, 68% percent of Rolex, 66% of Audemars Piguet, and 48% of Patek Phillippe models appreciate in price, even in the face of overall trends.

Of course, having access to watch market data isn't enough in this choppy market. You need a deeper understanding of the factors that will determine prices in 2024 if you want watches to make you money this year. Our Luxury Watch Market Report is here to help.

What's in the report?

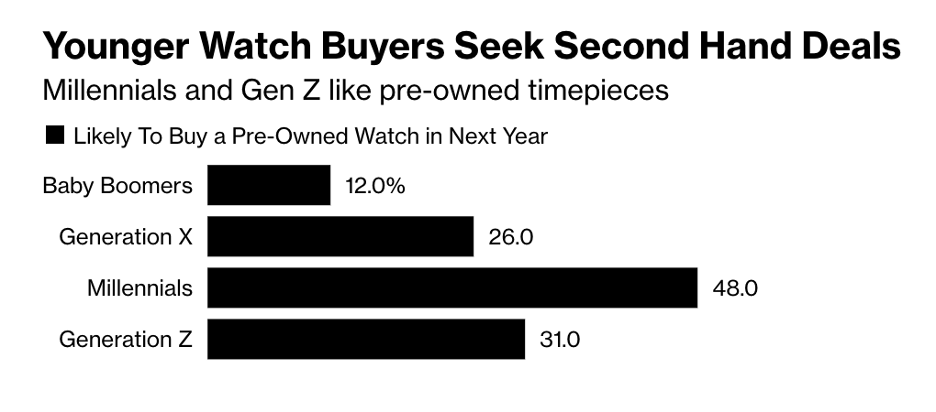

The future prices of luxury watches are inextricably tied to a confluence of events and players, such as interest rates, the cryptocurrency market, China, and changing demographics in the watch collecting space, to name a few.

Our luxury market report explores some of the big topics for 2024:

- Bitcoin is up 160% YoY — are the "crypto rich" returning to watches?

- What does China's 4% GDP growth mean for the market?

- Singapore's Swiss watch imports are up by 10% — will they become a bigger force in 2024?

- How will the primary market's improved supply affect the secondary market?

New Bond Street Pawnbrokers is a multi-award-winning watch broker that has been lending against luxury watches for 30 years. We provide the peerless service, discretion, professionalism, and fair terms that you deserve when you need to pawn your watch or other luxury items.

Contact

David Sonnenthal

***@newbondstreetpawnbrokers.com

Photos: (Click photo to enlarge)

Source: New Bond Street Pawnbrokers

Read Full Story - Have Luxury Watches Lost Their Shine? Market Analysis for 2024 | More news from this source

Press release distribution by PRLog