China’s signature Belt and Road Initiative has failed to live up to Beijing’s original lofty goals, a new report by the Foundation for the Defense of Democracies (FDD) claims.

China celebrated the 10-year anniversary of the Belt and Road Initiative (BRI), Beijing’s ambitious infrastructure program that looked to link emerging markets and connect Asia with Europe and other parts of the world.

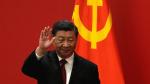

President Xi Jinping launched the BRI in 2013 as a transformative push to replicate the economic and political impact of the Silk Road, the old Eurasian trade route for more than 1,500 years. Instead, the report titled "Tightening the Belt or End of the Road? China’s BRI at 10," argues the BRI has wrought social, economic and environmental havoc. Massive corruption has also generated a political backlash against both China and the governments that took Beijing’s money.

The report examined case studies in Ecuador, Zambia and the Democratic Republic of the Congo, and what the authors found was that corruption and waste were rampant in China’s development funding, while the debt incurred by participating countries caused great harm.

The BRI sought to address pressing needs by unleashing a trillion dollars in capital toward infrastructure across emerging markets and many of the projects injected local communities with an economic boost. In practice, the BRI failed to live up to its intended goals.

"Unfortunately, productive assets were built with one hand while vanity projects were built with the other, poor cost projections and risk planning contributed to unneeded or inferior infrastructure, and opaque loans at market rates ramped up debt distress for countries that could least afford it," Josh Birenbaum, co-author of the report and deputy director of FDD’s Center on Economic and Financial Power, told Fox News Digital.

Critics say the Chinese Communist Party is not exactly transparent about how the program spends its money, either. The report notes that bureaucratic opacity makes it much harder for independent analysts to know when projects are failing. Beijing is also reluctant to establish monitoring agencies to effectively ensure that money is being well spent.

US AMBASSADOR TO CHINA DOESN'T 'FEEL OPTIMISTIC’ ABOUT FUTURE RELATIONS BETWEEN COUNTRIES

"We don’t need to look any further than failing to deliver infrastructure in the Democratic Republic of Congo in exchange for lucrative mining rights it continues to enjoy, or the corruption-ridden Coco Coda Sinclair dam in Ecuador, which is built at the foot of an active volcano and suffers from massive cracks in its foundation," Elaine Dezenski, senior director and head of the Center on Economic and Financial Power at FDD, told Fox News Digital.

What many borrower countries were left with was rapacious Chinese entities that partnered with corrupt officials to advance their own narrow interests, leading to what the report calls high-profile, low-quality projects that impressed domestic audiences in the short term, but which were often unneeded, poorly thought out, or defectively constructed.

BRI’s underwhelming results caused reputational damage to China’s ambitions of improving its image on the world stage. Italian Prime Minister Giorgia Meloni, the only G-7 member to sign on to the BRI, announced it would withdraw from Xi’s landmark initiative. Dezenski said China increased its volume of exports to Italy but failed to provide equal opportunity for Italian exports.

"We should applaud Italy’s move to limit the CCP’s coercive influence in its markets, Dezenski told Fox News Digital.

The report recommends that the U.S. and its allies need to have a stronger presence in developing nations to counter China’s growing influence by providing direct support and advancing projects of strategic value. The U.S. can do this by accelerating the work of the bipartisan BUILD Act, passed by Congress in 2019, which created the Development Finance Corporation and allows the government to invest in global infrastructure.

"Against a backdrop of Chinese opacity, corruption, and debt, the United States and its partners can build a strategic investment path based upon transparency, economic sustainability, and equitable partnerships," the report concludes.