Singapore, 26th March 2024, ZEX PR WIRE, Zoth, a real-world assets (RWA) protocol that bridges traditional finance with on-chain finance has successfully scaled its on-chain trade finance facility by tokenizing receivables in Southeast Asia using TradeFinex on the XDC Network. This expands Zoth’s vision across the Middle East, LATAM, and Southeast Asia, creating a global liquidity infrastructure to address global trade challenges. The receivables tokenization utilized TradeFinex’s open-source smart contract standards and was funded by Zoth’s LP Ecosystem using the Fathom Dollar $FXD.

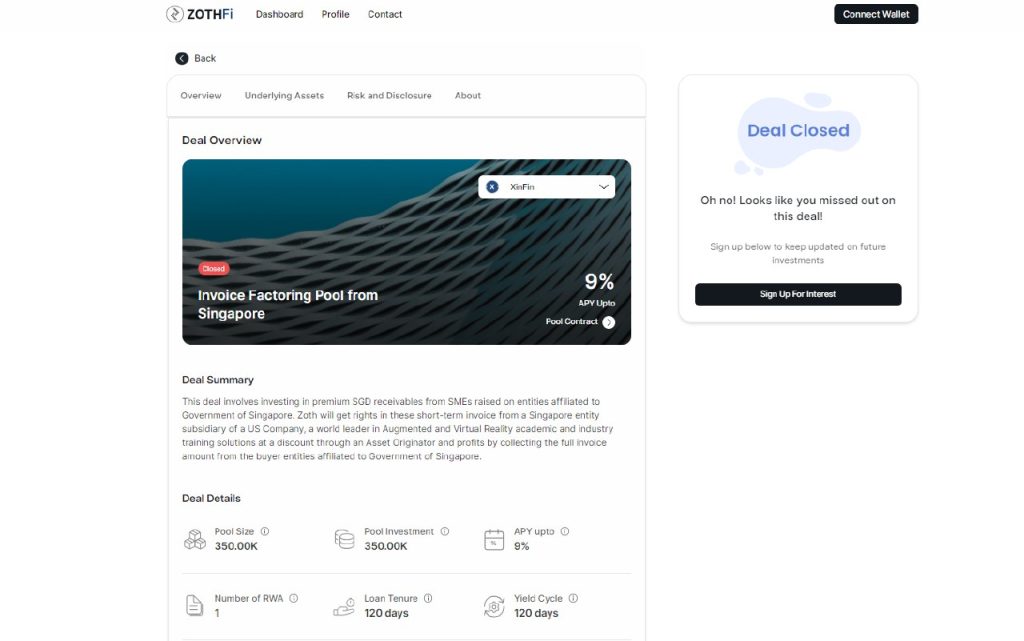

This deal involves Zoth facilitating liquidity for the Singapore subsidiary of a US entity, a global leader in e-learning, while the counterparty is a government entity of Singapore. The transaction was done on the XDC Network blockchain, with TradeFinex, a dApp within the XDC ecosystem being one of the liquidity providers for the deal. This facility raised $FXD 350,000 for the entity, with plans to expand financing to USD10 million via Zoth, which is focused on driving trade finance in Southeast Asia.

The success of this deal highlights the efficiency of blockchain-based financing for real-world challenges powered by Zoth’s proprietary Technology.

Dive into the pool details here:

https://app.zoth.io/trade_finance_receivables/65fb0052815b8a869d118c3b#underlying_assets

“Our collaboration with TradeFinex and XDC Network has led to a second successful deal. We’re building the first liquidity infrastructure focused on simplifying global finance and addressing the credit gap in emerging markets,” said Pritam Dutta, Founder of Zoth.

Added Chen Shanlong, Marketing and Partnerships Lead of XDC Network and TradeFinex, “This deal is in line with XDC Network’s emphasis in Real World Assets (RWA) and TradeFinex’s focus on supporting startups and in the process reducing the funding gap in the currently underserved Micro, Small and Medium Enterprises (MSME) space.”

Zoth successfully achieved several milestones during the pool:

- Conversion of paper-based invoices into electronic invoices.

- Tokenization and fractionalization of the electronic invoices.

- Provision of capital against the fractionalized electronic invoice for a 120-day period using the FXD stablecoin.

Participants in the pilot included:

- Zoth: Loan Originator & Tokenization Platform

- TradeFinex: Open Source Smart Contracts Standard Reshaping Trade Finance and Supply Chain Finance

- Fathom: FXD Stablecoin Issuer

- XDC Network: An enterprise-grade, carbon-neutral blockchain with fast transactions, near-zero gas fees, and interoperability, powering secure and efficient trade finance, payments, and RWA tokenization.

Solutions used in the pilot:

- TradeFinex: Blockchain-based P2P marketplace for trade financing. Resource for Open-Source Smart-Contract Standards for RWA Focused Private Credit Solutions

- Blockchain Network: XDC Network is an Enterprise-Grade, Open-Source Blockchain Protocol.

- $FXD: Stablecoin Soft Pegged to USD and Overcollateralized Using the $XDC Token

This is an important milestone between Zoth and TradeFinex, using the XDC Network protocol and $FXD as one of its stablecoins.

About Zoth:

Zoth is an ecosystem that bridges liquidity between traditional finance (TradFi) and on-chain finance, one RWA at a time, thereby facilitating the flow of assets and capital between these sectors.

The inaugural offering, Zoth — Fixed Income (Zoth-Fi), represents an institutional-grade fixed income marketplace that enables investor access to premium fixed-income assets through stablecoins. Zoth includes a wide range of asset classes, such as trade finance receivables, sovereign government bonds, and corporate credit.

About TradeFinex:

TradeFinex is an open TradeFi protocol and marketplace for real-world asset pools. It utilizes open-source smart contract technology for trade asset pooling, aggregation, and distribution to alternative asset investors. Built on the XDC Network, TradeFinex leverages blockchain technology to offer a secure, transparent, and efficient mechanism for various trade finance transactions.

About XDC Network:

XDC Network is an open-source, carbon-neutral, enterprise-grade, EVM-compatible, Layer 1 blockchain that has been operationally successful since 2019. The network obtains consensus via a specially delegated proof-of-stake (XDPoS) technique that allows for 2-second transaction times, near-zero gas expenses ($0.0001), over 2000 TPS, and interoperability with ISO 20022 financial messaging standards. The XDC Network powers a wide range of novel blockchain use cases, including trade finance, payment, and RWA tokenization, that are secure, scalable, and highly efficient.

Find more information about XDC Network by visiting our website XinFin.org, XDC.org and follow us on our social medias: Twitter || Telegram || LinkedIn || Reddit || Facebook || Forum