Tesla Earnings Preview: What to Expect

Tesla, Inc. (TSLA), headquartered in Austin, Texas, is a company specializing in electric vehicles (EVs), energy storage, and clean energy solutions. Valued at $1.5 trillion by market cap, the company designs, manufactures, and sells a range of innovative products including luxury EVs like the Model S, Model X, and Model Y, as well as clean energy solutions like solar panels, solar roofs, and energy storage systems. The EV giant is expected to announce its fiscal fourth-quarter earnings for 2025 after the market closes on Wednesday, Jan. 28.

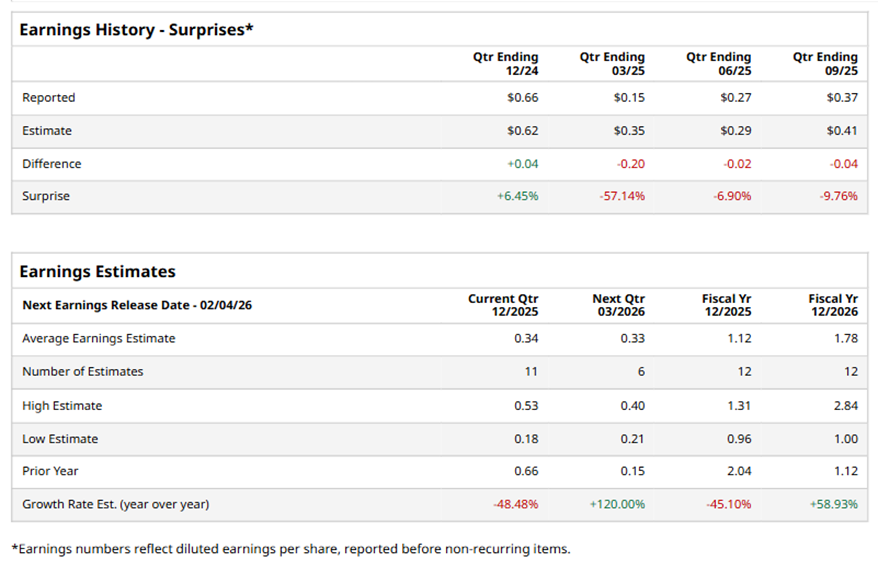

Ahead of the event, analysts expect TSLA to report a profit of $0.34 per share on a diluted basis, down 48.5% from $0.66 per share in the year-ago quarter. The company missed the consensus estimates in three of the last four quarters while surpassing the forecast on another occasion.

For the full year, analysts expect TSLA to report EPS of $1.12, down 45.1% from $2.04 in fiscal 2024. However, its EPS is expected to rise 58.9% year over year to $1.78 in fiscal 2026.

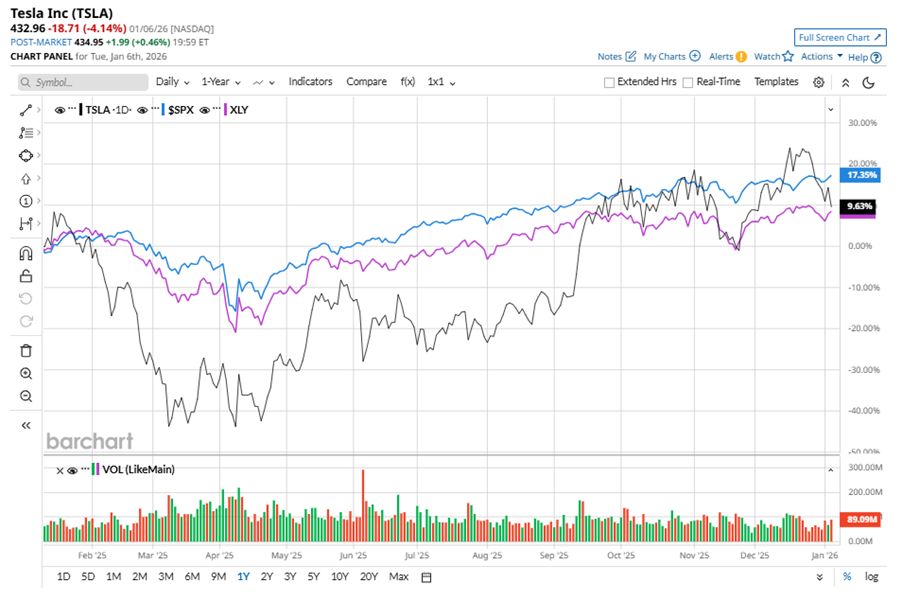

TSLA stock has underperformed the S&P 500 Index’s ($SPX) 16.2% gains over the past 52 weeks, with shares up 5.3% during this period. Similarly, it underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.8% returns over the same time frame.

Tesla's underperformance is due to declining production and deliveries, tough competition from Chinese rivals like BYD Company Limited (BYDDY) and XPeng Inc. (XPEV), and margin pressure. Models 3 and Y deliveries dropped YoY, and lower-priced models couldn't compensate. Chinese EV companies are gaining ground globally with competitive pricing, posing a challenge to Tesla's market share and valuation, particularly in AI and autonomous driving.

On Oct. 22, 2025, TSLA reported its Q3 results, and its shares closed up more than 2% in the following trading session. Its revenue stood at $28.1 billion, up 11.6% year over year. The company’s adjusted EPS declined 30.6% from the year-ago quarter to $0.50.

Analysts’ consensus opinion on TSLA stock is cautious, with a “Hold” rating overall. Out of 40 analysts covering the stock, 14 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 16 give a “Hold,” and nine recommend a “Strong Sell.” While TSLA currently trades above its mean price target of $395.32, the Street-high price target of $600 suggests an ambitious upside potential of 38.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The 3 Best AI Stocks to Buy for 2026

- Using VIX Butterflies as a Tactical Volatility Hedge

- S&P Futures Tick Lower With U.S. Jobs Data in Focus

- 'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.