Stressed Small Business Owners Looking for Banks to Help Weather Tough Economy, J.D. Power Finds

Citi Ranks Highest in Small Business Banking Satisfaction

Small business owners are feeling the strain of a weakening economy and looking to their small business banking partners for help, but very few are receiving an exceptional experience. According to the J.D. Power 2022 U.S. Small Business Banking Satisfaction Study,SM released today, half of small businesses nationwide are now classified as financially unhealthy,1 and although 76% of them are interested in receiving financial advice from their bank, just 15% receive comprehensive advice.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221027005053/en/

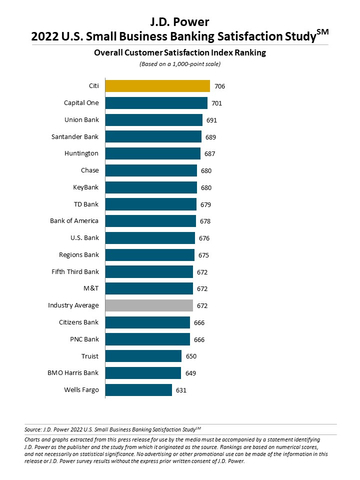

J.D. Power 2022 U.S. Small Business Banking Satisfaction Study (Graphic: Business Wire)

“Small business owners are staring down an increasingly ominous set of challenges that include everything from lingering supply chain issues to inflation to a talent scarcity, and they are looking to their banks for guidance on things like available credit, tips to reduce fees and technology that can benefit their businesses,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “This scenario presents an enormous opportunity for banks to deliver comprehensive advice that takes into account a full understanding of the company’s business goals and shows real, committed partnership. Right now, most small business banking customers are receiving only transactional advice or are receiving no advice at all from their bank.”

Following are some key findings of the 2022 study:

- Banks missing opportunity to deliver comprehensive advice: J.D. Power evaluates the small business banking advisory experience on a continuum from transactional to constructive to comprehensive based on the bank relationship manager’s overall responsiveness, understanding of the client’s business, and the bank’s fulfillment of the roles of a trusted advisor and partner. Currently, just 15% of small business banking customers are receiving comprehensive advice, while 27% are receiving constructive advice and 58% are receiving transactional advice. Overall customer satisfaction among customers who receive comprehensive advice is 858 (on a 1,000-point scale), which is 82 points higher than among those who receive constructive advice and 195 points higher than among those who receive transactional advice.

- Relationship managers play a key role: The biggest factors influencing small business banking customer satisfaction are trust and people, both areas where bank relationship managers play a key role of explaining fee structures, resolving problems and providing advice. In the eyes of small businesses, bank relationship managers who provide operational advice fulfill these roles but fall short of being viewed as a partner who acts with the company’s long-term interests in mind and helps the company grow.

- Small businesses feeling the strains of a weakening economy: Just 50% of small business banking customers are classified as financially healthy, while 25% fall into the cash- or capital-constrained category and 25% are in the financially vulnerable category. Some of the biggest factors influencing the financial health of small businesses are inflation (60%), supply chain disruptions (44%) and talent retention/acquisition (36%).

- Key pain points: Top areas where small businesses are seeking advice from their banking partners include practical guidance on ways to reduce banking fees; tips to help improve the business’s financial situation; and understanding how the bank’s technology can benefit the business.

Study Ranking

Citi ranks highest nationally in small business banking customer satisfaction with a score of 706. Capital One (701) ranks second and Union Bank (691) ranks third.

The 2022 U.S. Small Business Banking Satisfaction Study includes responses from 6,855 owners of—or financial decision-makers at—small businesses that use business banking services. The study was fielded from May through August 2022. The study also provides financial health support index benchmarking data evaluating banks’ proficiency in delivering financial support to small business customers. Top-performing banks in the small business banking financial health support index are (in alphabetical order): Bank of America, Capital One, Citi and Santander Bank.

For more information about the U.S. Small Business Banking Satisfaction Study, visit https://www.jdpower.com/resource/us-small-business-banking-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022152.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of a small business as a metric combining their timeliness of paying bills, cash reserve, credit worthiness and safety net items like insurance coverage. Small businesses are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221027005053/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.