Fintech Lenders Gain Traction as Consumer Loan Satisfaction Increases, J.D. Power Finds

American Express Ranks Highest in Personal Loan Customer Satisfaction

After a challenging period during the pandemic, the consumer lending space has come back stronger than ever in the form of digital, frictionless loans that consumers can access in minutes. According to the J.D. Power 2023 U.S. Consumer Lending Satisfaction StudySM, released today, that focus on delivering a streamlined digital loan process has helped the newer crop of fintech lenders play catch-up with traditional brands. Across this year’s study, fintech lenders have seen the sharpest rate of improvement in overall customer satisfaction.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230510005027/en/

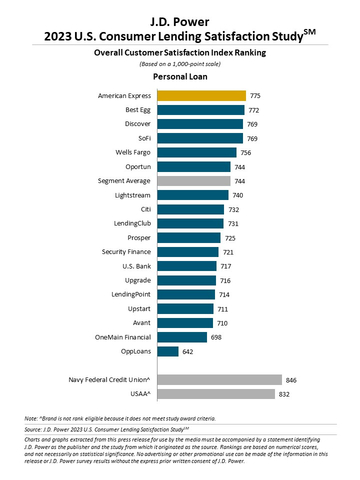

2023 U.S. Consumer Lending Satisfaction Study (Graphic: Business Wire)

“Fintechs are having increased success in the lending space because they are effectively delivering what customers want: a quick, transactional approach to lending,“ said Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power. “As the lending process becomes increasingly digital and significantly faster, brands need to focus on effective engagement to build loyalty.”

Following are some key findings of the 2023 study:

- Fintechs gain ground on legacy lending brands: Overall customer satisfaction scores for fintech brands evaluated in the study rise 16 points (on a 1,000-point scale) year over year. That compares with a 12-point increase in customer satisfaction across all non-fintech brands in the study. The gains made by fintechs have been driven by several key factors that include meeting the customer’s borrowing needs; managing loans once closed; and keeping customers informed during the process. Problem avoidance is also a strength for fintechs, as 83% of customers indicate never having a problem with their loan compared with 74% for non-fintech borrowers.

- Role of all digital vs. human interaction: Just 31% of applicants said they interacted with someone during the process. Of that group, 70% said it was necessary to obtain approval. Even though the market is digitally dominated, there is no difference in satisfaction when humans are involved. This reinforces the key idea regarding satisfaction that meeting the customer needs is more important than the way it is achieved.

- Younger and well-qualified buyers are informed: Younger customers, specifically those from Gen Z1, and prime credit borrowers are diligently gathering information about lenders and their products. More than half (51%) of respondents from Gen Z “strongly agree” that a borrower should gather as much info as possible before taking a loan compared with 39% of Pre-Boomers/Boomers and 40% of Gen X respondents. Half of customers with a credit score of 740 or higher “strongly agree” about gathering as much information as possible compared with 35% of customers with a score of less than 670.

- Fintech brand awareness gets big bump: Fintech brand awareness increases by as much as 15 percentage points in this year’s study. This increased awareness has resulted in multiple fintech brands breaking the milestone of 50% of respondents having heard of them.

“Although applications are done online, and customers are coming to view person-to-person interactions as more of an obstacle to a transaction than a benefit, lenders still need to get the basics of the customer relationship right to build a strong foundation for a successful lending experience,” said Bruce Gehrke, senior director of wealth and lending intelligence at J.D. Power. “Today’s personal loan customers are looking for a secure application process, fast approval processes and easy-to-understand applications—those basics are unchanged. The key now is to consistently deliver on those core values in a more streamlined, digital user experience for all customers. Currently, only 56% of customers said their lender delivered on all these basic elements.”

Study Ranking

American Express (775) ranks highest among personal loan lenders in overall customer satisfaction, while BestEgg (772) ranks second. Discover (769) an SoFi (769) each rank third in a tie.

The U.S. Consumer Lending Satisfaction Study measures overall customer satisfaction based on performance in five factors (in alphabetical order): customer service for loan; experience managing loan; experience obtaining loan; kept informed about loan; and loan met borrowing needs. The study is based on responses from 4,525 personal loan customers and was fielded from January through March 2023.

For more information about the U.S. Consumer Lending Satisfaction study, visit https://www.jdpower.com/business/consumer-lending-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023048.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines Pre-Boomers as born before 1946; Boomers (1946-1964); Gen X (1965- 1976); Gen Y (1977-1994); Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230510005027/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.