Higher Interest Rates, Ease of Moving Money Drive Higher Customer Satisfaction with Online-Only Banks, J.D. Power Finds

Charles Schwab Bank and Discover Bank Rank Highest in Respective Segments

If there is one silver lining to the constant forward march of inflation and rising interest rates, it can be found in the direct banking sector, in which customer satisfaction with online-only banks is climbing steadily. According to the J.D. Power 2023 U.S. Direct Banking Satisfaction Study,SM released today, customer satisfaction with direct banks is up 14 points (on a 1,000-point scale) this year, thanks largely to increases in satisfaction with deposit interest rates and the ease of managing accounts and transferring money using a mobile app.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230511005356/en/

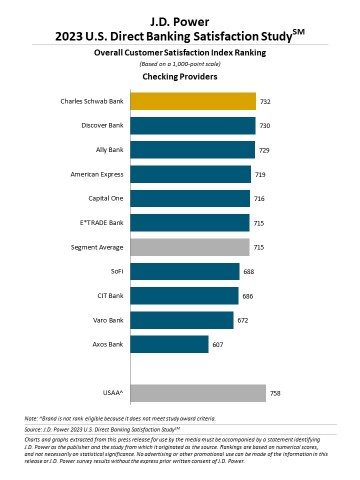

2023 U.S. Direct Banking Satisfaction Study (Graphic: Business Wire)

“Amid widespread volatility in the U.S. retail banking sector, direct banks—which offer branchless, digital alternatives to traditional retail banks—have been a bright spot that continues to drive exceptionally high levels of customer satisfaction,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “With their attractive fee structures and focus on seamless digital customer experience, direct banks have been able to offer even more competitive interest rates than their brick-and-mortar counterparts while also making it incredibly easy for customers to move money and manage their accounts. While satisfaction is high among existing customers, it is important to note that new customer growth has slowed 2% this year, suggesting that in addition to offering attractive deposit interest rates, direct banks may need to up the ante on generating word-of-mouth recommendations.”

Following are some key findings of the 2023 study:

-

New customer volume slows: Despite these significant gains in customer satisfaction, the number of new customers opening direct bank accounts declined 2% this year. The decline in new customer volume is most pronounced (-6%) among neobanks, a subset of the online banking sector that consists of fintech companies that offer online banking services through a partnership with an established bank.

-

New customer quality varies: The quality of customers opening new accounts with direct banks has improved in 2023, with increased volumes of affluent and mass affluent customers and those who bring deposit balances of $10,000 or more. The quality of new customers to neobanks weakened in this year’s study, with more being in financially vulnerable circumstances and having education levels less than a four-year college degree.

-

No branch, no problem: Direct banks also see significant gains in satisfaction with customer service provided via automated phone-based assistance and live phone operators. Customers cite the knowledge of representatives, timeliness of resolving inquiry, request, or problem, courtesy of the representative and ease of understanding the phone instructions as the key drivers of these improved satisfaction scores.

- Online chat losing ground: One area where direct bank customers report declines in satisfaction is assisted online servicing of checking accounts via chat and email. Online chat service interactions see a 1-point decline in customer satisfaction while email service satisfaction is down 4 points.

Study Rankings

Charles Schwab Bank ranks highest in overall satisfaction among checking providers with a score of 732, marking the fifth consecutive year of being top ranked in the study. Discover Bank (730) ranks second and Ally Bank (729) ranks third. The segment average is 715.

Discover Bank ranks highest in overall satisfaction among savings providers with a score of 748. Marcus by Goldman Sachs (736) ranks second and Ally Bank (731) ranks third. The segment average is 718.

The U.S. Direct Banking Satisfaction Study, now in its seventh year, measures overall satisfaction with direct bank and neobank checking and/or savings/money market products based on seven factors (in alphabetical order): customer service; ease of moving money; helps grow money; level of trust; managing account via mobile app; managing account via website; and reduce banking fees. The study defines direct banks as online/branchless institutions with federal banking charters, with either the Federal Reserve Board, the Office of the Comptroller of the Currency (OCC) or the Federal Deposit Insurance Corporation (FDIC) as their primary regulator.

To learn more about the U.S. Direct Banking Satisfaction Study, visit https://www.jdpower.com/business/us-direct-banking-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023042.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20230511005356/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.