Three Reasons Why HON is Risky and One Stock to Buy Instead

Honeywell has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed 11.1% to $226 per share while the index has gained 10.8%.

Is now the time to buy Honeywell, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We're cautious about Honeywell. Here are three reasons why you should be careful with HON and one stock we like more.

Why Is Honeywell Not Exciting?

Originally founded in 1906 as a thermostat company, Honeywell (NASDAQ: HON) is a multinational conglomerate known for its aerospace systems, building technologies, performance materials, and safety and productivity solutions.

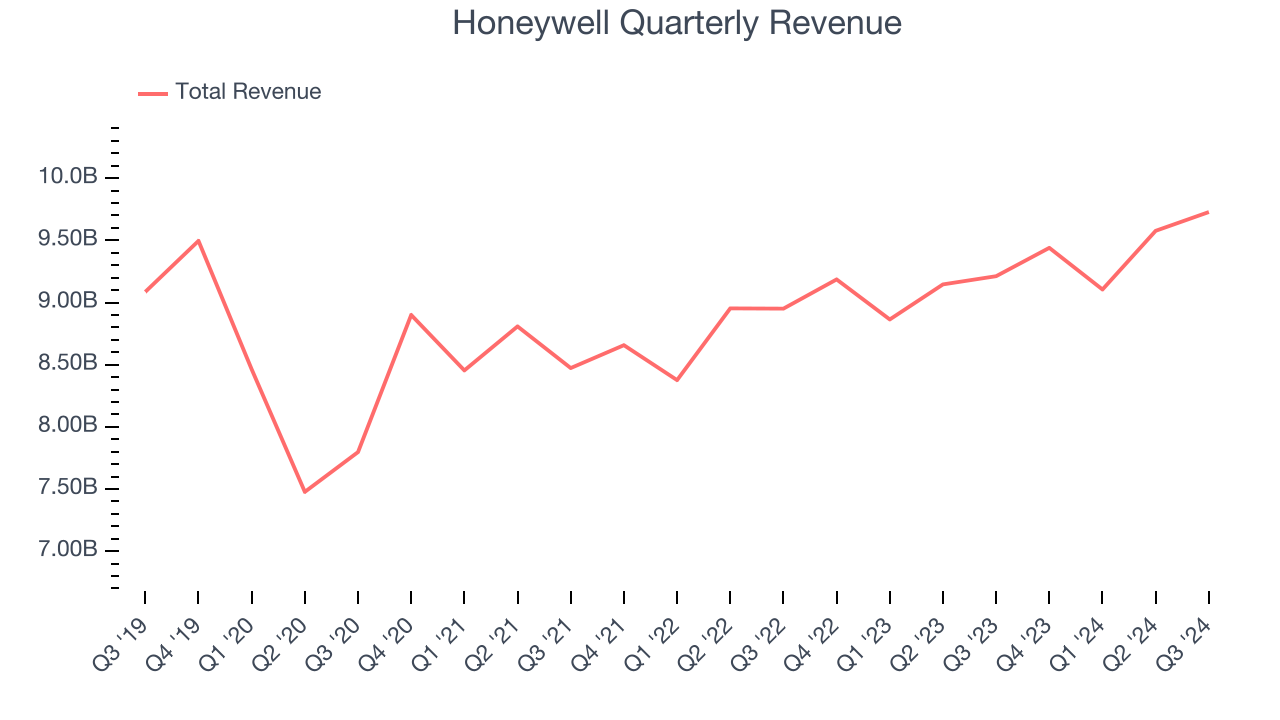

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Honeywell struggled to consistently increase demand as its $37.85 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business.

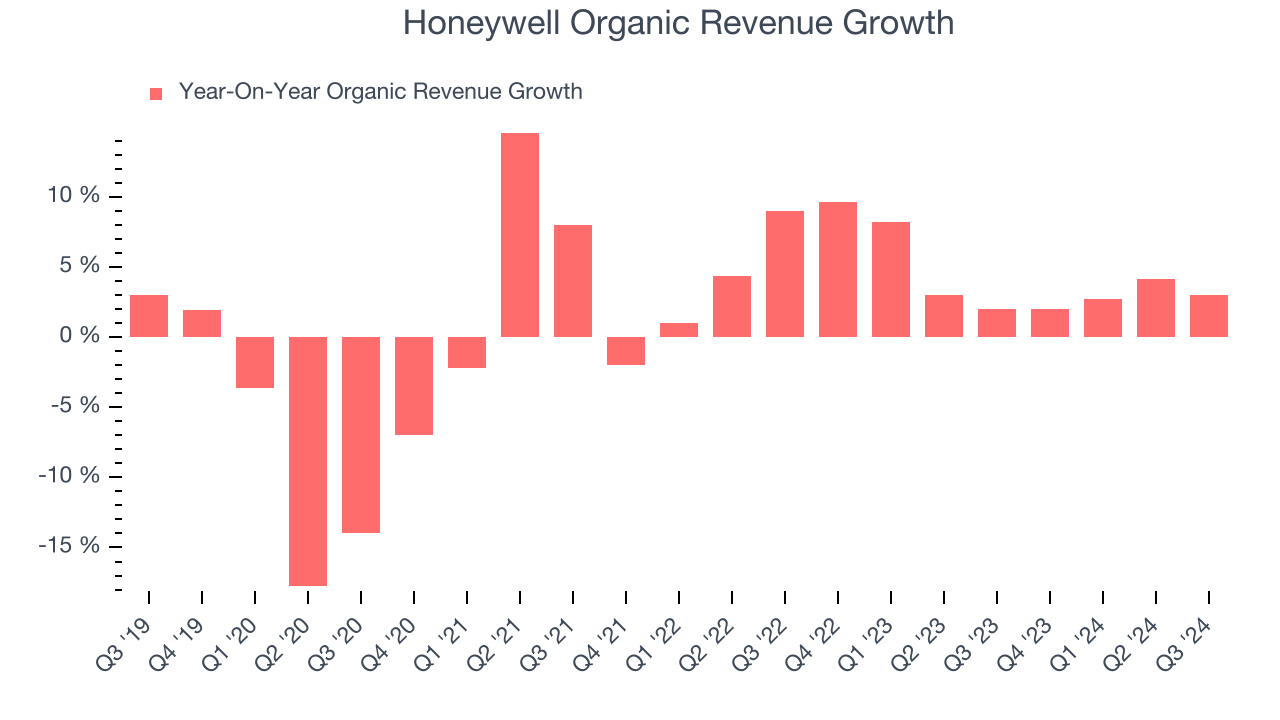

2. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand General Industrial Machinery companies by analyzing their organic revenue. This metric gives visibility into Honeywell’s core business as it excludes one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Over the last two years, Honeywell’s organic revenue averaged 4.3% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

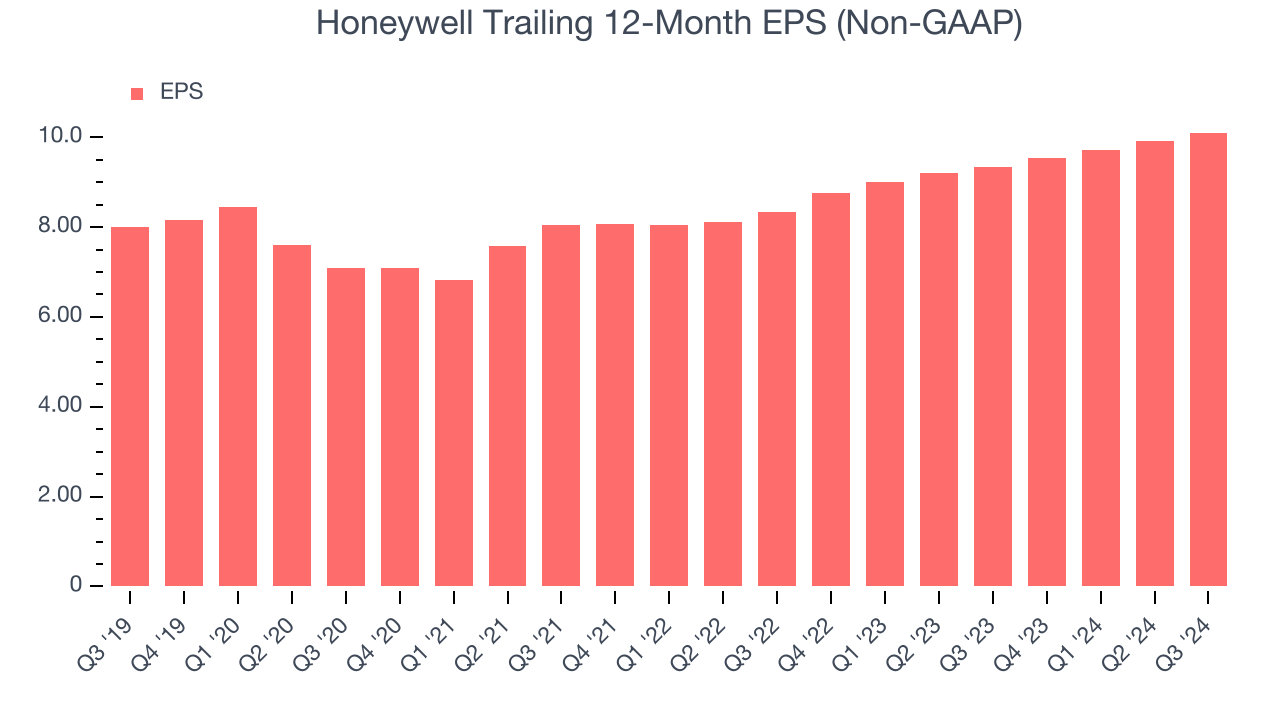

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Honeywell’s EPS grew at an unimpressive 4.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Final Judgment

Honeywell isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 21.1x forward price-to-earnings (or $226 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward Deere, the leading supplier of autonomous agriculture equipment.

Stocks We Like More Than Honeywell

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.