General Industrial Machinery Stocks Q3 In Review: Dover (NYSE:DOV) Vs Peers

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at general industrial machinery stocks, starting with Dover (NYSE: DOV).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 15 general industrial machinery stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 5.5% below.

Thankfully, share prices of the companies have been resilient as they are up 9.5% on average since the latest earnings results.

Dover (NYSE: DOV)

A company who manufactured critical equipment for the United States military during World War II, Dover (NYSE: DOV) manufactures engineered components and specialized equipment for numerous industries.

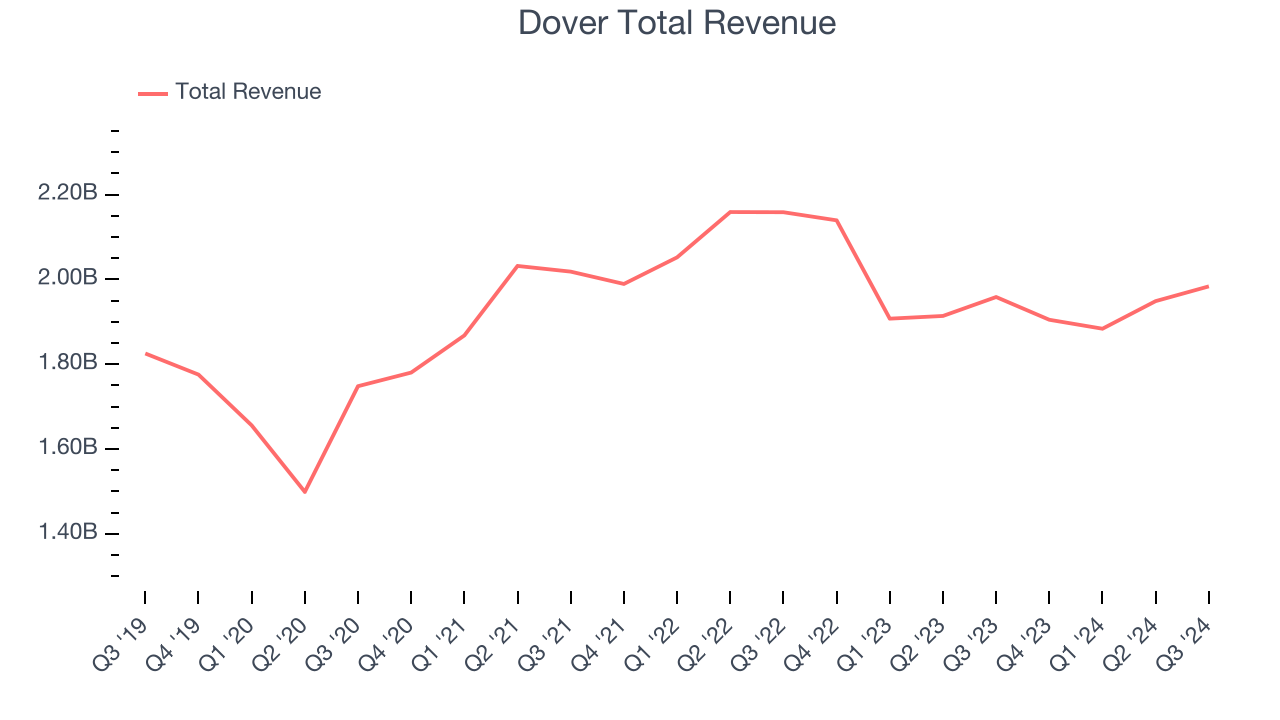

Dover reported revenues of $1.98 billion, up 1.3% year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a slower quarter for the company with a miss of analysts’ organic revenue and EBITDA estimates.

Dover's President and Chief Executive Officer, Richard J. Tobin, said, "Dover's third quarter results were in line with our expectations, driven by excellent production performance and positive margin mix from our growth platforms in clean energy, biopharma components, thermal connectors, and CO2 refrigeration systems. Top line performance was broad-based across the majority of the portfolio, more than offsetting near-term headwinds in polymer processing, beverage can-making, and heat exchangers for European heat pumps. Consolidated bookings continued their positive trajectory, with robust order rates in our secular-growth-exposed markets.

Interestingly, the stock is up 5.7% since reporting and currently trades at $202.49.

Read our full report on Dover here, it’s free.

Best Q3: Luxfer (NYSE: LXFR)

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE: LXFR) offers specialized materials, components, and gas containment devices to various industries.

Luxfer reported revenues of $99.4 million, up 2.1% year on year, outperforming analysts’ expectations by 15.9%. The business had an incredible quarter with a solid beat of analysts’ EPS and EBITDA estimates.

Luxfer achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 9.6% since reporting. It currently trades at $13.98.

Is now the time to buy Luxfer? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Icahn Enterprises (NASDAQ: IEP)

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Icahn Enterprises reported revenues of $2.22 billion, down 25.7% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Icahn Enterprises delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 14.5% since the results and currently trades at $11.02.

Read our full analysis of Icahn Enterprises’s results here.

Honeywell (NASDAQ: HON)

Originally founded in 1906 as a thermostat company, Honeywell (NASDAQ: HON) is a multinational conglomerate known for its aerospace systems, building technologies, performance materials, and safety and productivity solutions.

Honeywell reported revenues of $9.73 billion, up 5.6% year on year. This print missed analysts’ expectations by 1.8%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but a miss of analysts’ organic revenue estimates.

The stock is up 2.6% since reporting and currently trades at $226.08.

Read our full, actionable report on Honeywell here, it’s free.

Kadant (NYSE: KAI)

Headquartered in Massachusetts, Kadant (NYSE: KAI) is a global supplier of high-value, critical components and engineered systems used in process industries worldwide.

Kadant reported revenues of $271.6 million, up 11.2% year on year. This number topped analysts’ expectations by 2%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

The stock is up 27.3% since reporting and currently trades at $408.42.

Read our full, actionable report on Kadant here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.