F5 (NASDAQ:FFIV) Beats Q4 Sales Targets, Stock Jumps 12.7%

Network application delivery and security specialist F5 (NASDAQ: FFIV) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 10.7% year on year to $766.5 million. Guidance for next quarter’s revenue was better than expected at $715 million at the midpoint, 1.7% above analysts’ estimates. Its non-GAAP profit of $3.84 per share was 13.7% above analysts’ consensus estimates.

Is now the time to buy F5? Find out by accessing our full research report, it’s free.

F5 (FFIV) Q4 CY2024 Highlights:

- Revenue: $766.5 million vs analyst estimates of $715.3 million (10.7% year-on-year growth, 7.2% beat)

- Adjusted EPS: $3.84 vs analyst estimates of $3.38 (13.7% beat)

- Revenue Guidance for Q1 CY2025 is $715 million at the midpoint, above analyst estimates of $703 million

- Adjusted EPS guidance for Q1 CY2025 is $3.08 at the midpoint, below analyst estimates of $3.22

- Operating Margin: 26.8%, up from 23.8% in the same quarter last year

- Free Cash Flow Margin: 25.4%, down from 32.2% in the previous quarter

- Billings: $914.8 million at quarter end, up 22.4% year on year

- Market Capitalization: $15.26 billion

“F5’s alignment with significant secular trends, a more stable IT spending environment, and our strong execution led to another record quarter,” said François Locoh-Donou, F5’s President and CEO.

Company Overview

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ: FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

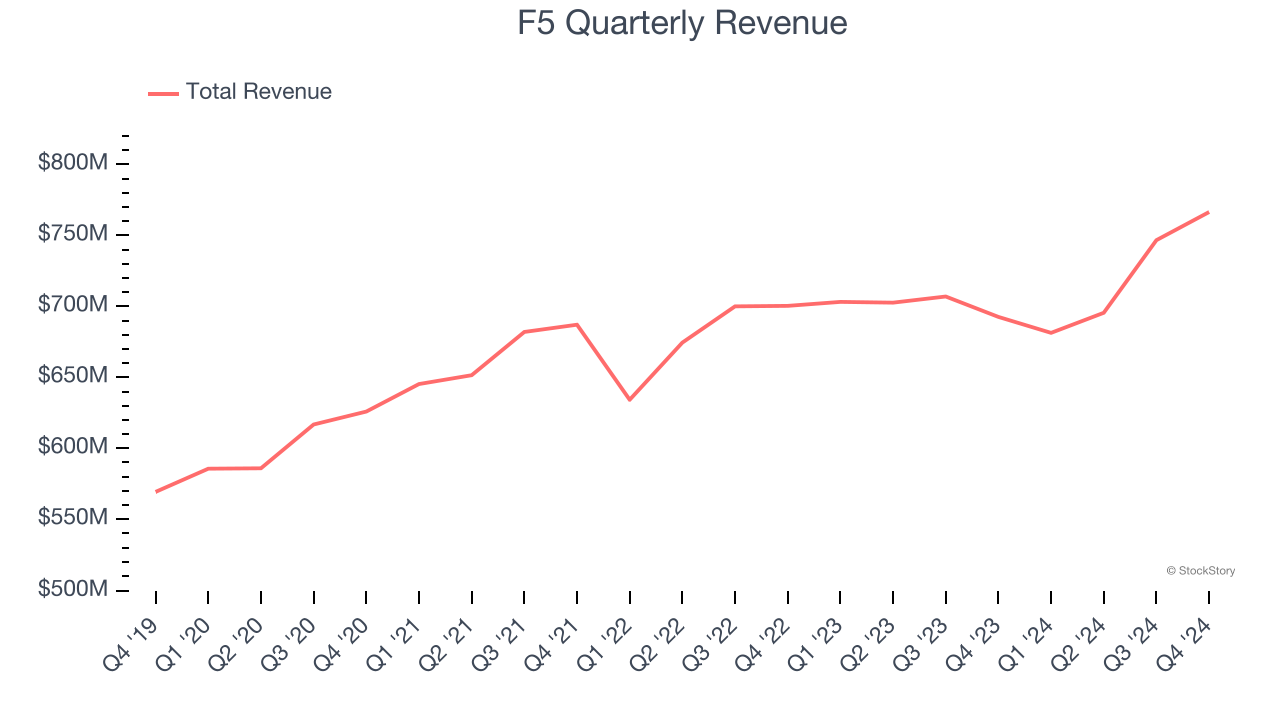

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, F5 grew its sales at a weak 2.7% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis.

This quarter, F5 reported year-on-year revenue growth of 10.7%, and its $766.5 million of revenue exceeded Wall Street’s estimates by 7.2%. Company management is currently guiding for a 4.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

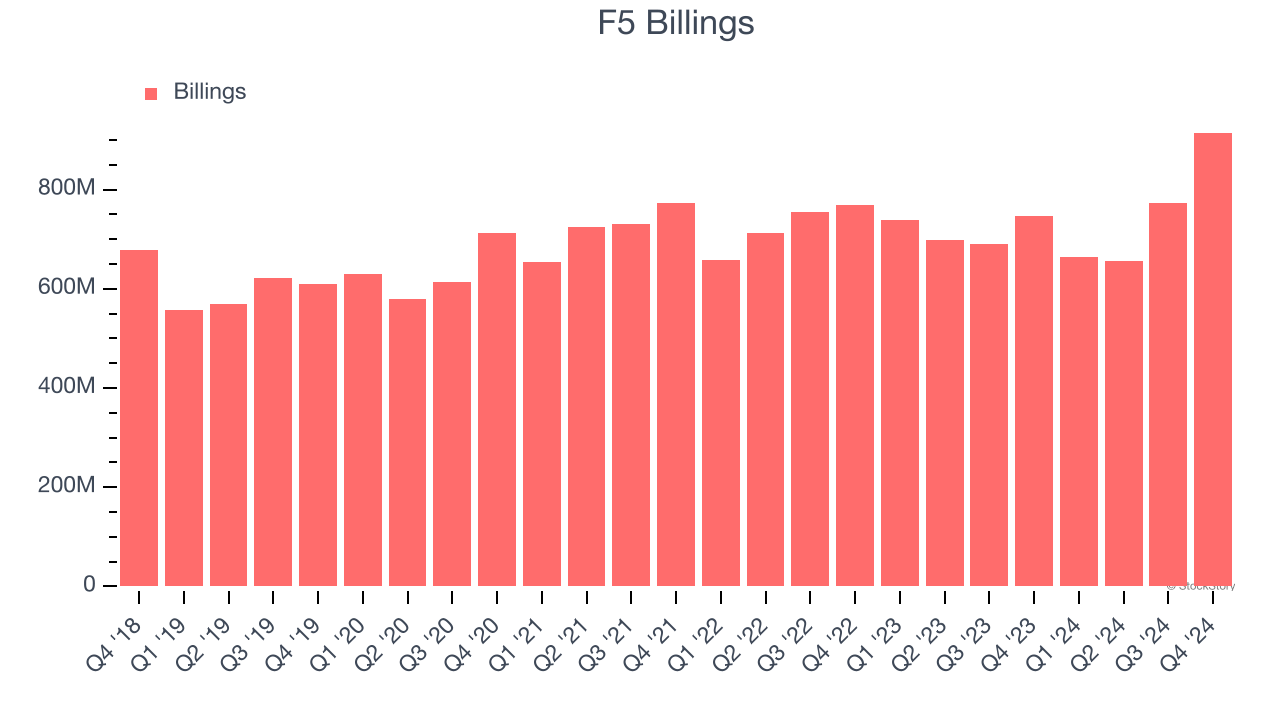

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

F5’s billings came in at $914.8 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 4.5% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

F5 is extremely efficient at acquiring new customers, and its CAC payback period checked in at 11 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from F5’s Q4 Results

We were impressed by how significantly F5 blew past analysts’ revenue, billings, and EPS expectations this quarter. We were also glad its revenue forecast for next quarter outperformed Wall Street’s estimates, though its EPS guidance missed. Still, this quarter had some key positives. The stock traded up 12.7% to $304.04 immediately following the results.

Indeed, F5 had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.