Winners And Losers Of Q3: Restaurant Brands (NYSE:QSR) Vs The Rest Of The Traditional Fast Food Stocks

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the traditional fast food industry, including Restaurant Brands (NYSE: QSR) and its peers.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

While some traditional fast food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.6% since the latest earnings results.

Restaurant Brands (NYSE: QSR)

Formed through a strategic merger, Restaurant Brands International (NYSE: QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

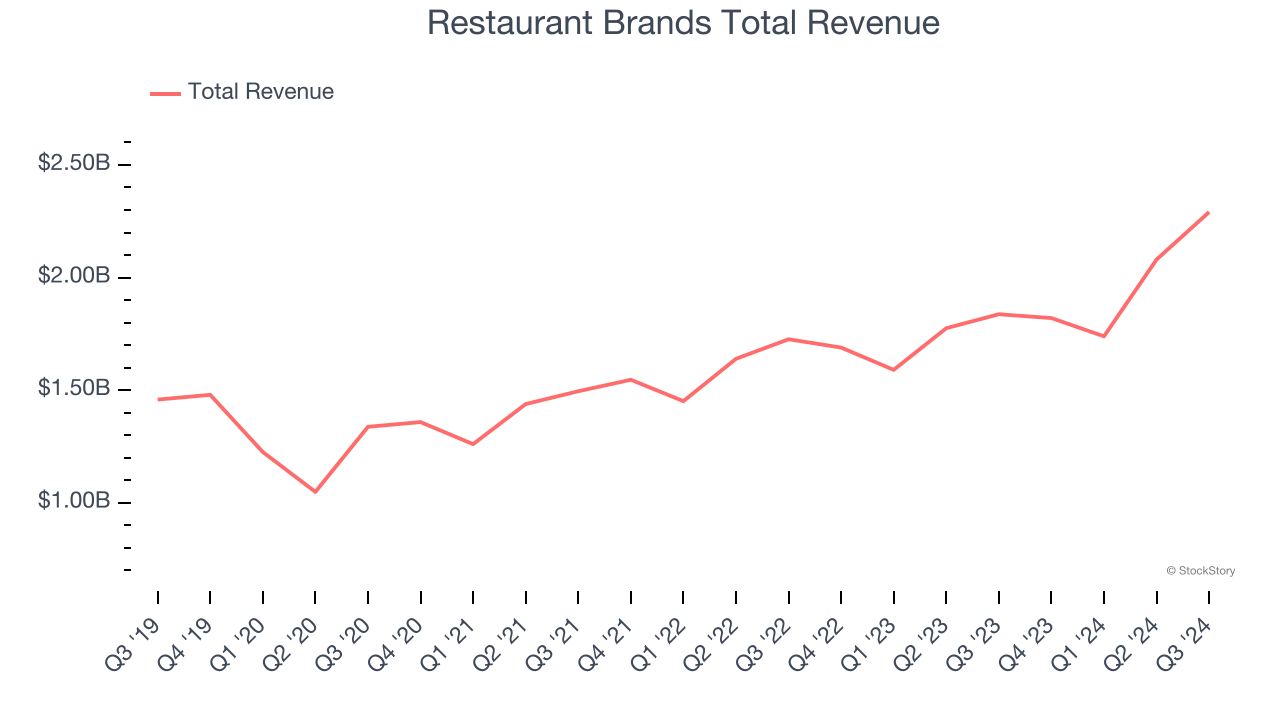

Restaurant Brands reported revenues of $2.29 billion, up 24.7% year on year. This print fell short of analysts’ expectations by 2.7%. Overall, it was a slower quarter for the company with a miss of analysts’ EBITDA and EPS estimates.

Unsurprisingly, the stock is down 6.9% since reporting and currently trades at $65.20.

Is now the time to buy Restaurant Brands? Access our full analysis of the earnings results here, it’s free.

Best Q3: Dutch Bros (NYSE: BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

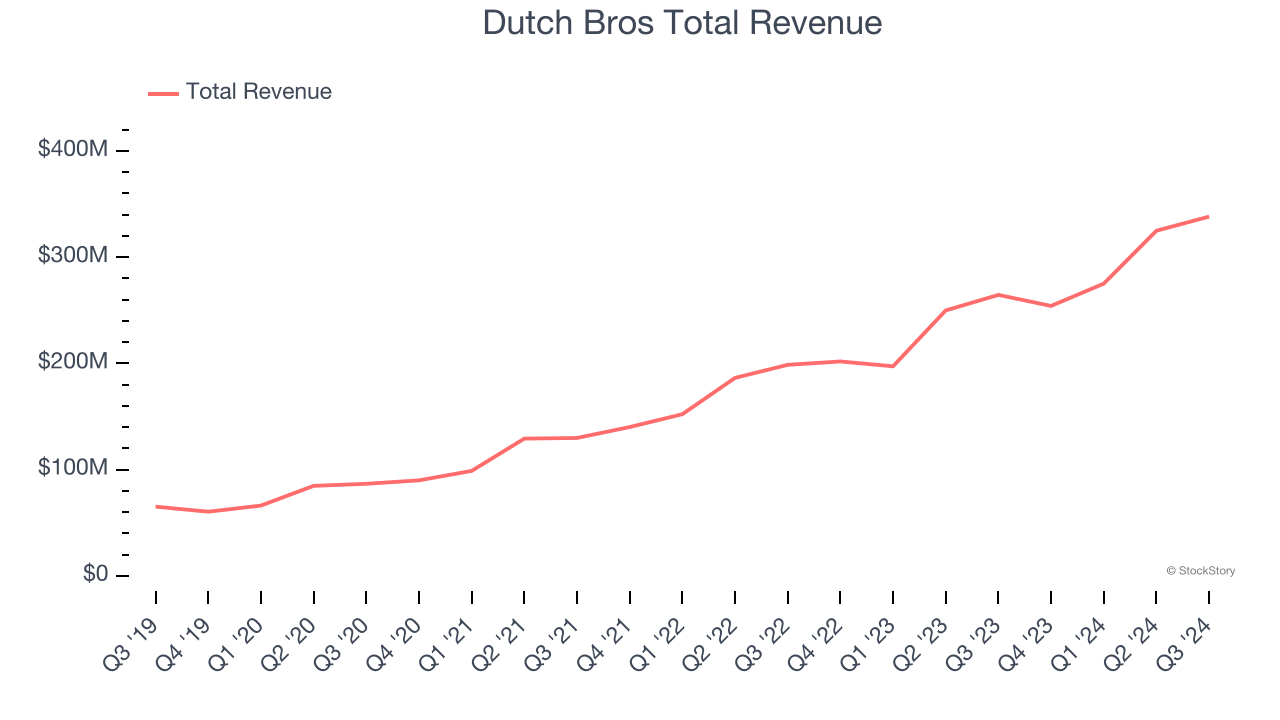

Dutch Bros reported revenues of $338.2 million, up 27.9% year on year, outperforming analysts’ expectations by 4.1%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ same-store sales estimates.

Dutch Bros delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 66.2% since reporting. It currently trades at $58.02.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Krispy Kreme (NASDAQ: DNUT)

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ: DNUT) is one of the most beloved and well-known fast-food chains in the world.

Krispy Kreme reported revenues of $379.9 million, down 6.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Krispy Kreme delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 20.3% since the results and currently trades at $9.90.

Read our full analysis of Krispy Kreme’s results here.

Portillo's (NASDAQ: PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ: PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $178.3 million, up 6.9% year on year. This result came in 2.1% below analysts' expectations. Taking a step back, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EPS estimates but a miss of analysts’ same-store sales estimates.

The stock is down 29.7% since reporting and currently trades at $9.59.

Read our full, actionable report on Portillo's here, it’s free.

El Pollo Loco (NASDAQ: LOCO)

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ: LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

El Pollo Loco reported revenues of $120.4 million, flat year on year. This number came in 0.5% below analysts' expectations. Aside from that, it was a strong quarter as it logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

The stock is down 6.7% since reporting and currently trades at $11.37.

Read our full, actionable report on El Pollo Loco here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.