Winners And Losers Of Q3: UFP Industries (NASDAQ:UFPI) Vs The Rest Of The Building Materials Stocks

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the building materials stocks, including UFP Industries (NASDAQ: UFPI) and its peers.

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

The 8 building materials stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.2% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.9% since the latest earnings results.

UFP Industries (NASDAQ: UFPI)

Beginning as a lumber supplier in the 1950s, UFP Industries (NASDAQ: UFPI) is a holding company making building materials for the construction, retail, and industrial sectors.

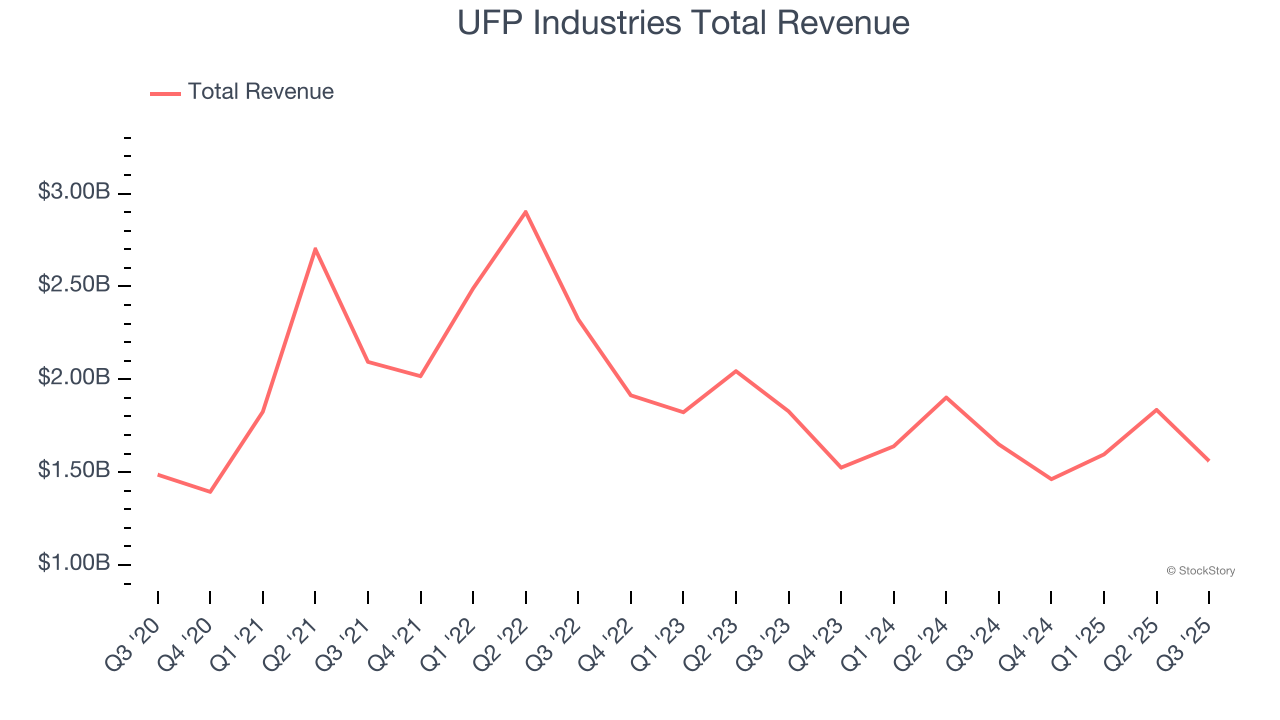

UFP Industries reported revenues of $1.56 billion, down 5.4% year on year. This print fell short of analysts’ expectations by 3.2%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ revenue and adjusted operating income estimates.

UFP Industries delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $89.57.

Read our full report on UFP Industries here, it’s free for active Edge members.

Best Q3: Carlisle (NYSE: CSL)

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE: CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Carlisle reported revenues of $1.35 billion, flat year on year, outperforming analysts’ expectations by 1.2%. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ organic revenue estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.8% since reporting. It currently trades at $305.25.

Is now the time to buy Carlisle? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Tecnoglass (NYSE: TGLS)

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE: TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

Tecnoglass reported revenues of $260.5 million, up 9.3% year on year, falling short of analysts’ expectations by 2.1%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 16.9% since the results and currently trades at $46.54.

Read our full analysis of Tecnoglass’s results here.

Armstrong World (NYSE: AWI)

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE: AWI) provides ceiling and wall products to commercial and residential spaces.

Armstrong World reported revenues of $425.2 million, up 10% year on year. This print beat analysts’ expectations by 0.8%. Aside from that, it was a mixed quarter as it also logged a narrow beat of analysts’ revenue estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 8.6% since reporting and currently trades at $185.27.

Read our full, actionable report on Armstrong World here, it’s free for active Edge members.

Vulcan Materials (NYSE: VMC)

Founded in 1909, Vulcan Materials (NYSE: VMC) is a producer of construction aggregates, primarily crushed stone, sand, and gravel.

Vulcan Materials reported revenues of $2.29 billion, up 14.4% year on year. This result topped analysts’ expectations by 0.8%. Taking a step back, it was a satisfactory quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but full-year EBITDA guidance slightly missing analysts’ expectations.

Vulcan Materials pulled off the fastest revenue growth among its peers. The stock is down 2.6% since reporting and currently trades at $287.19.

Read our full, actionable report on Vulcan Materials here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.