2 Reasons to Like ALHC and 1 to Stay Skeptical

What a time it’s been for Alignment Healthcare. In the past six months alone, the company’s stock price has increased by a massive 64.1%, setting a new 52-week high of $18.13 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy ALHC? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Alignment Healthcare Spark Debate?

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Two Positive Attributes:

1. Customer Base Skyrockets, Fueling Growth Opportunities

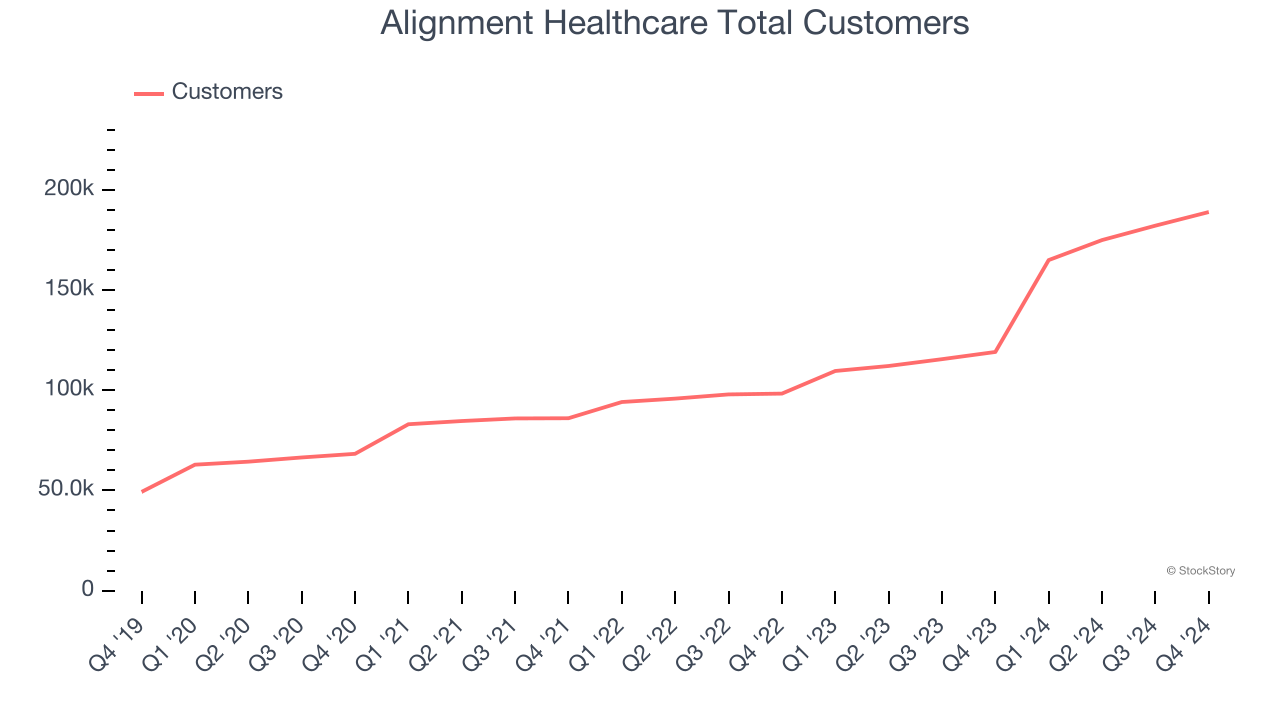

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Alignment Healthcare’s total customers punched in at 189,100 in the latest quarter, and over the last two years, their count averaged 36.9% year-on-year growth. This performance was fantastic, reflecting its ability to "land" new contracts and potentially "expand" them later - a powerful one-two punch for sales.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Alignment Healthcare’s revenue to rise by 38.7%, close to its 37.3% annualized growth for the past two years. This projection is eye-popping and indicates the market sees success for its products and services.

One Reason to be Careful:

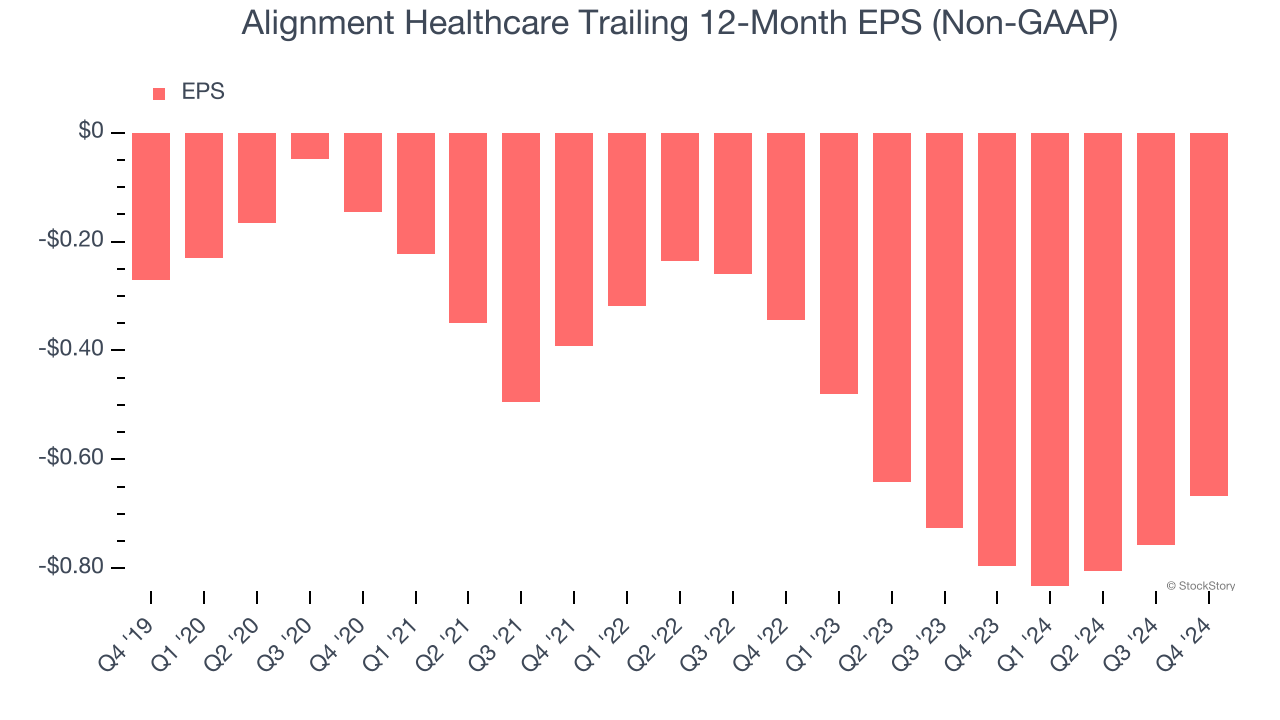

EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Alignment Healthcare’s earnings losses deepened over the last five years as its EPS dropped 19.7% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Final Judgment

Alignment Healthcare’s positive characteristics outweigh the negatives, and with the recent rally, the stock trades at 80.3× forward EV-to-EBITDA (or $18.13 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Alignment Healthcare

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.