Taboola (TBLA): Buy, Sell, or Hold Post Q4 Earnings?

Over the past six months, Taboola’s stock price fell to $2.98. Shareholders have lost 7.2% of their capital, disappointing when considering the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is now the time to buy Taboola, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're cautious about Taboola. Here are three reasons why TBLA doesn't excite us and a stock we'd rather own.

Why Is Taboola Not Exciting?

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ: TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

1. EPS Trending Down

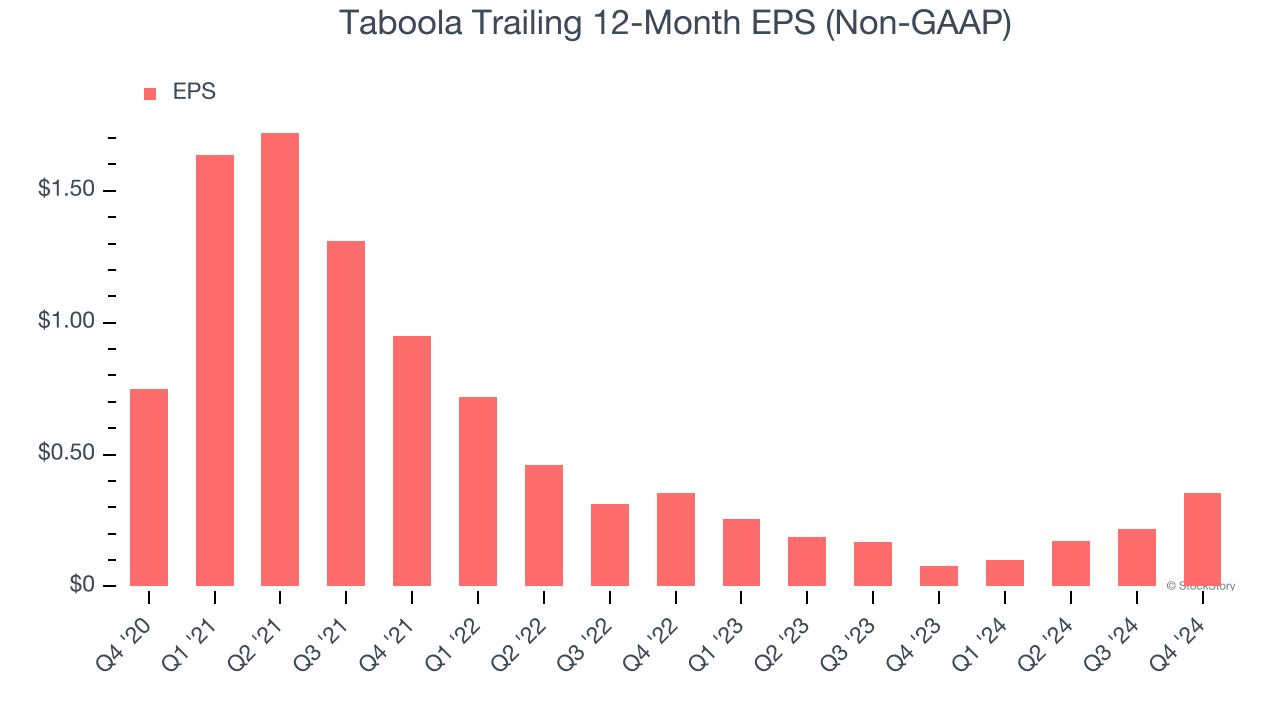

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Taboola’s full-year EPS dropped 88.4%, or 17.2% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Taboola’s low margin of safety could leave its stock price susceptible to large downswings.

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Taboola’s margin dropped meaningfully over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Taboola’s free cash flow margin for the trailing 12 months was 22.1%.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Taboola’s five-year average ROIC was negative 3.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Taboola’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 8.3× forward price-to-earnings (or $2.98 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Taboola

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.