Consumer Retail Stocks Q4 Recap: Benchmarking Walgreens (NASDAQ:WBA)

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer retail industry, including Walgreens (NASDAQ: WBA) and its peers.

Consumer retail companies operate the brick-and-mortar stores where consumers have shopped for centuries. The way people shop is changing with increased penetration of technology, but these retailers are adapting and still very much a part of the consumer fabric.

The 62 consumer retail stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 3% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.1% since the latest earnings results.

Walgreens (NASDAQ: WBA)

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ: WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

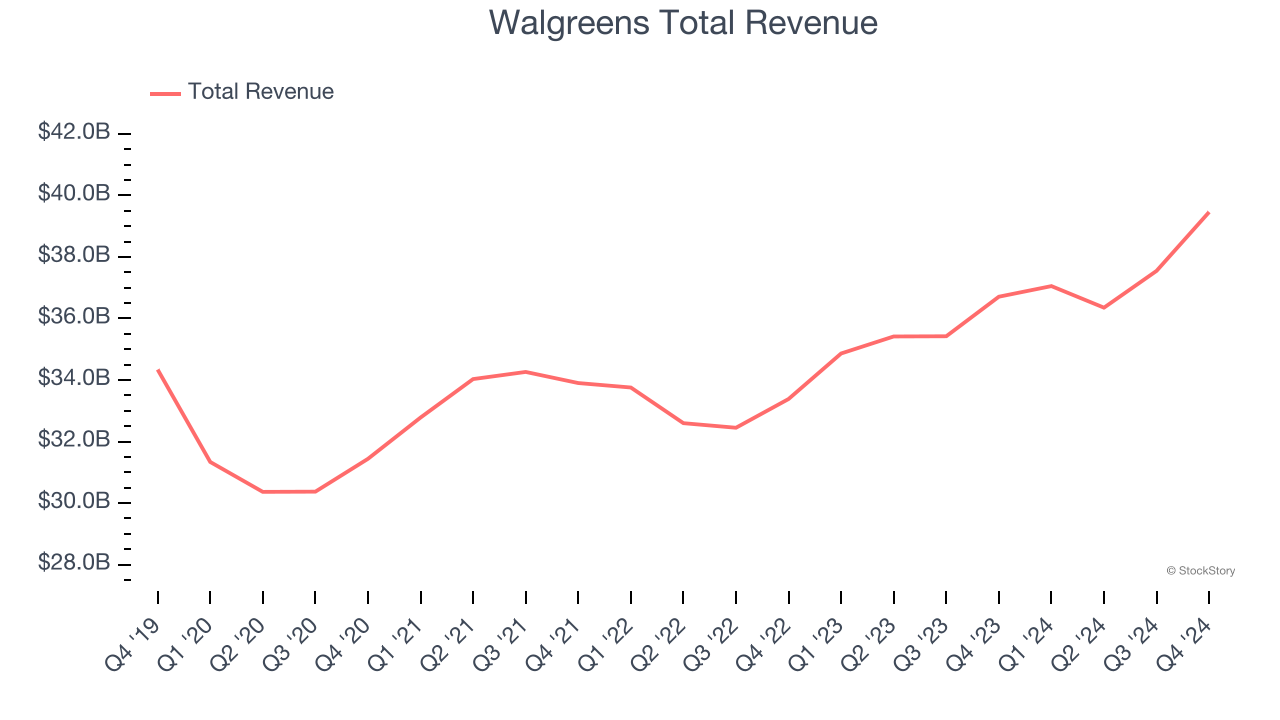

Walgreens reported revenues of $39.46 billion, up 7.5% year on year. This print exceeded analysts’ expectations by 5.7%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“Our first quarter results reflect our disciplined execution against our 2025 priorities: stabilizing the retail pharmacy by optimizing our footprint, controlling operating costs, improving cash flow and continuing to address reimbursement models”Post this Chief Executive Officer Tim Wentworth said:

The stock is up 20.4% since reporting and currently trades at $11.09.

Is now the time to buy Walgreens? Access our full analysis of the earnings results here, it’s free.

Best Q4: America's Car-Mart (NASDAQ: CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ: CRMT) sells used cars to budget-conscious consumers.

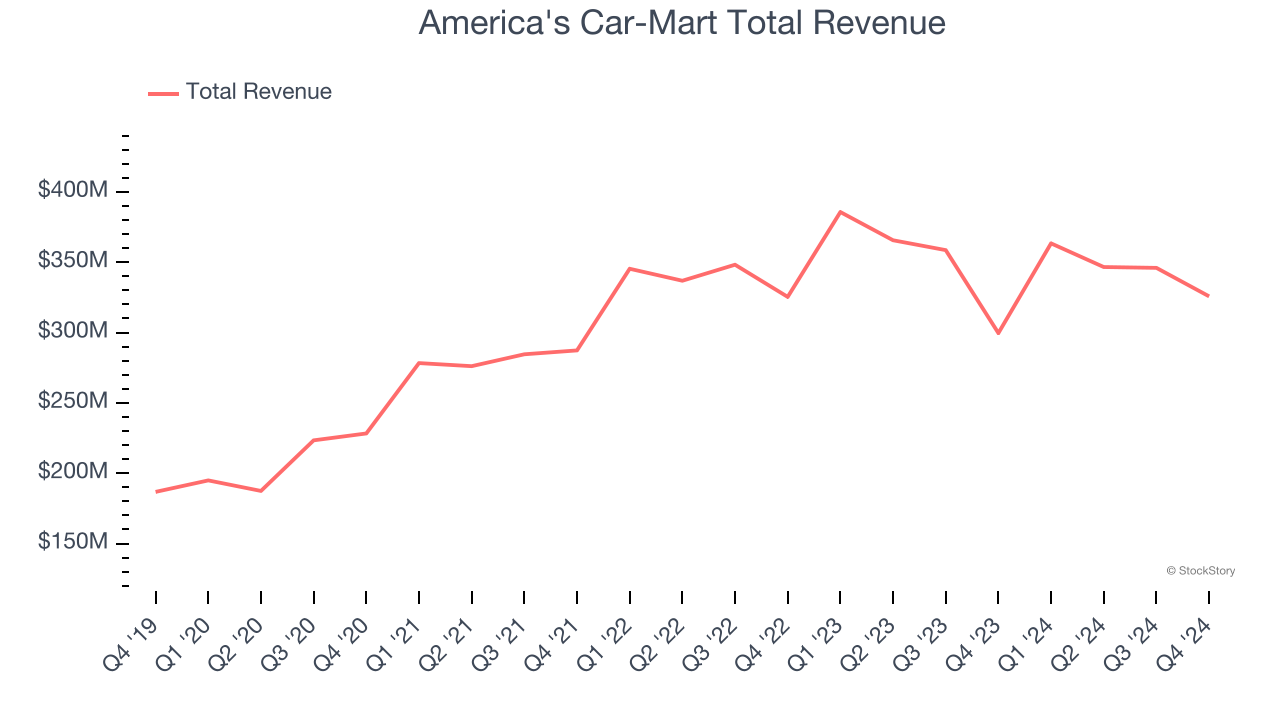

America's Car-Mart reported revenues of $325.7 million, up 8.7% year on year, outperforming analysts’ expectations by 15.2%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ gross margin estimates.

America's Car-Mart pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 18.3% since reporting. It currently trades at $45.47.

Is now the time to buy America's Car-Mart? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Monro (NASDAQ: MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ: MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $305.8 million, down 3.7% year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 35.8% since the results and currently trades at $14.12.

Read our full analysis of Monro’s results here.

Abercrombie and Fitch (NYSE: ANF)

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE: ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Abercrombie and Fitch reported revenues of $1.58 billion, up 9.1% year on year. This number topped analysts’ expectations by 1.2%. Zooming out, it was a slower quarter as it recorded EPS guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ gross margin estimates.

The stock is down 18.5% since reporting and currently trades at $78.35.

Read our full, actionable report on Abercrombie and Fitch here, it’s free.

Arhaus (NASDAQ: ARHS)

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ: ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Arhaus reported revenues of $347 million, flat year on year. This print was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a solid beat of analysts’ gross margin estimates but full-year EBITDA guidance missing analysts’ expectations.

The stock is down 39.6% since reporting and currently trades at $7.21.

Read our full, actionable report on Arhaus here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.