Papa John's (NASDAQ:PZZA) Posts Better-Than-Expected Sales In Q1

Fast-food pizza chain Papa John’s (NASDAQ: PZZA) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $518.3 million. Its non-GAAP profit of $0.36 per share was 4.1% above analysts’ consensus estimates.

Is now the time to buy Papa John's? Find out by accessing our full research report, it’s free.

Papa John's (PZZA) Q1 CY2025 Highlights:

- Revenue: $518.3 million vs analyst estimates of $515.1 million (flat year on year, 0.6% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.35 (4.1% beat)

- Adjusted EBITDA: $49.62 million vs analyst estimates of $50.17 million (9.6% margin, 1.1% miss)

- EBITDA guidance for the full year is $210 million at the midpoint, above analyst estimates of $207.2 million

- Operating Margin: 4.6%, down from 6.6% in the same quarter last year

- Free Cash Flow was $19.11 million, up from -$1.07 million in the same quarter last year

- Locations: 6,019 at quarter end, up from 5,914 in the same quarter last year

- Same-Store Sales fell 1.3% year on year, in line with the same quarter last year

- Market Capitalization: $1.09 billion

Company Overview

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

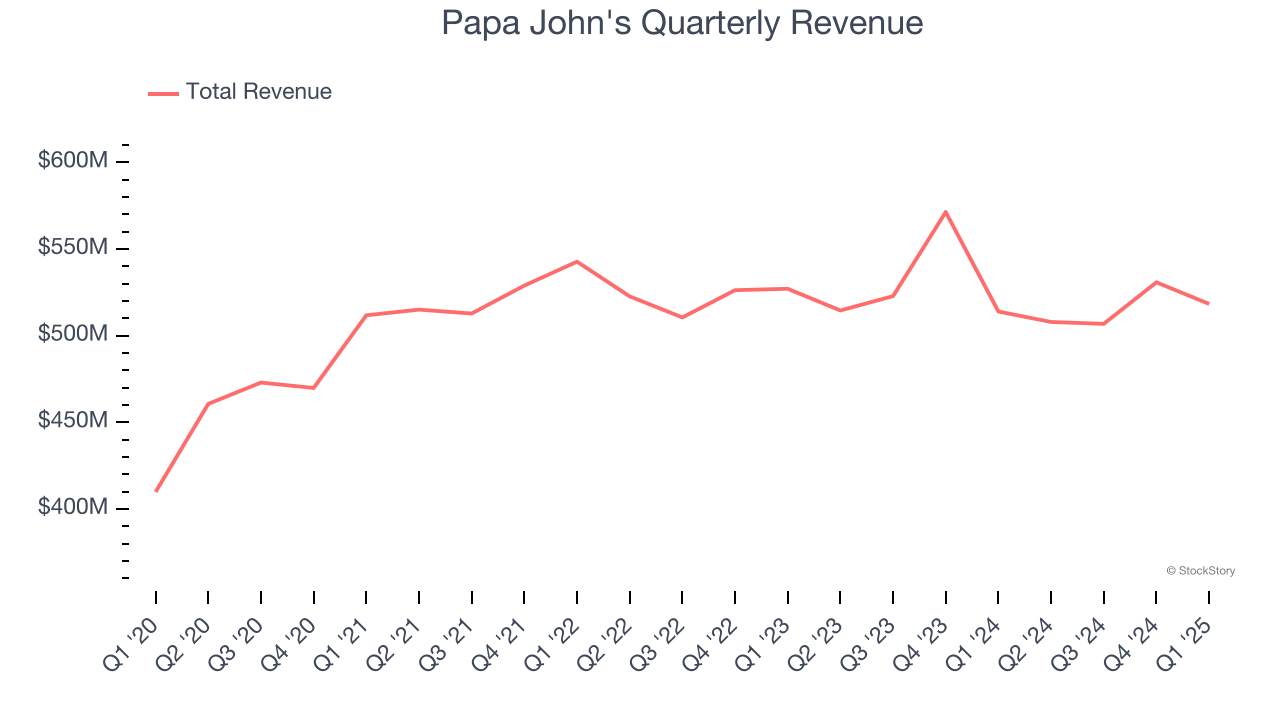

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.06 billion in revenue over the past 12 months, Papa John's is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Papa John's grew its sales at a sluggish 4.5% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Papa John’s $518.3 million of revenue was flat year on year but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, a slight deceleration versus the last six years. This projection doesn't excite us and implies its menu offerings will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

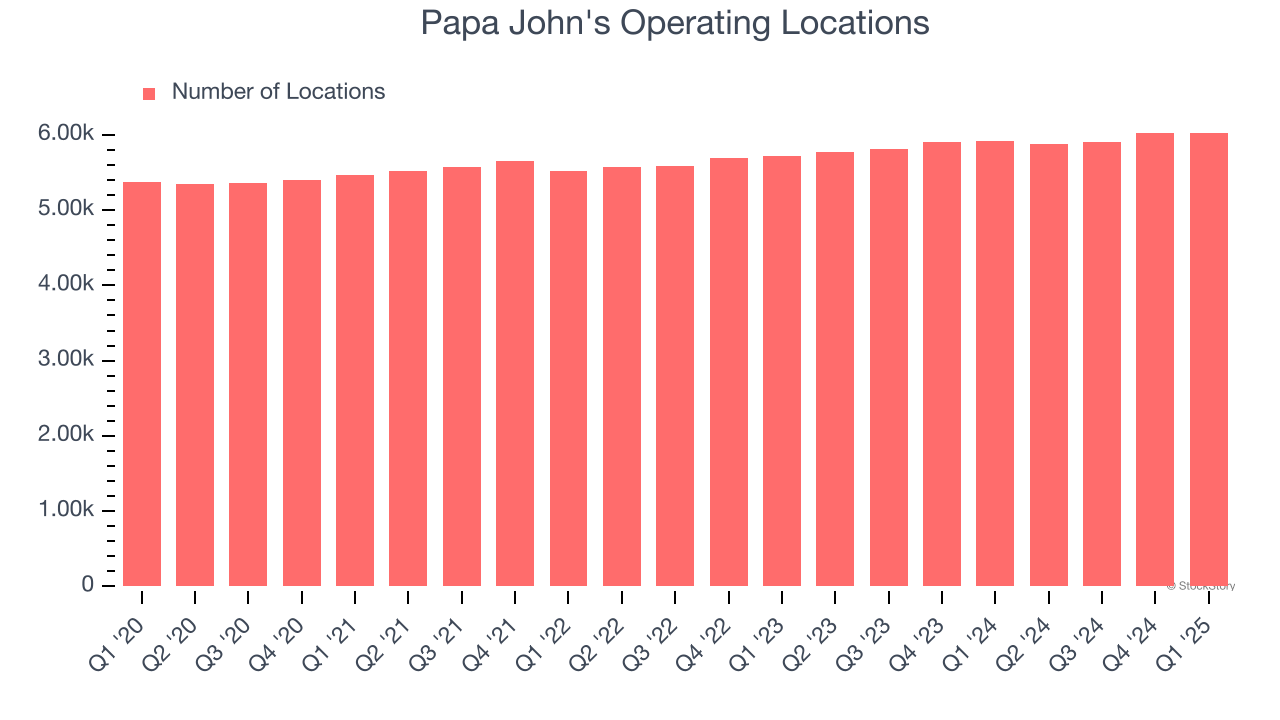

Number of Restaurants

Papa John's operated 6,019 locations in the latest quarter. It has opened new restaurants quickly over the last two years, averaging 2.8% annual growth, faster than the broader restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Papa John's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

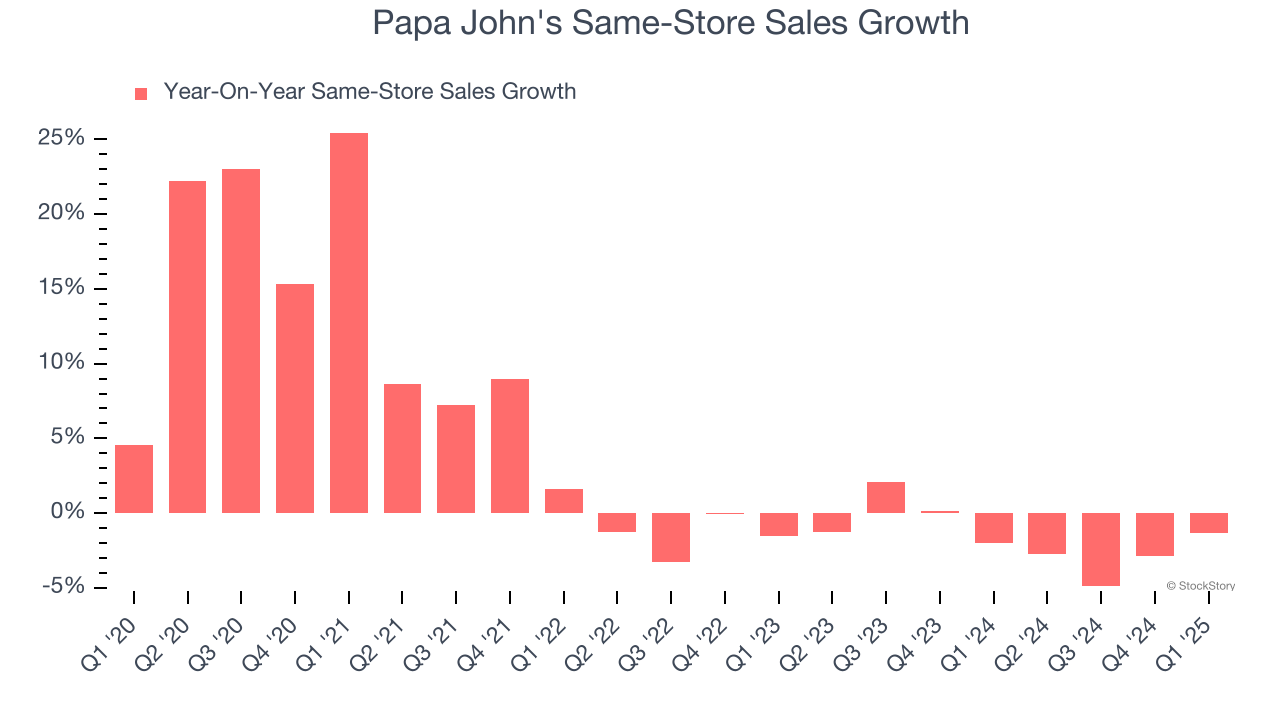

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Papa John’s demand has been shrinking over the last two years as its same-store sales have averaged 1.6% annual declines. This performance is concerning - it shows Papa John's artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, Papa John’s same-store sales fell by 1.3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Papa John’s Q1 Results

It was good to see Papa John's narrowly top analysts’ same-store sales expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, its EBITDA slightly missed. Overall, this print had some key positives. The stock traded up 3.5% to $34.50 immediately following the results.

Is Papa John's an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.