Heartland Express (NASDAQ:HTLD) Reports Sales Below Analyst Estimates In Q2 Earnings

Freight delivery company Heartland Express (NASDAQ: HTLD) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 23.4% year on year to $210.4 million. Its GAAP loss of $0.14 per share was 66.5% below analysts’ consensus estimates.

Is now the time to buy Heartland Express? Find out by accessing our full research report, it’s free.

Heartland Express (HTLD) Q2 CY2025 Highlights:

- Revenue: $210.4 million vs analyst estimates of $234.8 million (23.4% year-on-year decline, 10.4% miss)

- EPS (GAAP): -$0.14 vs analyst expectations of -$0.08 (66.5% miss)

- Adjusted EBITDA: $29.04 million vs analyst estimates of $36.87 million (13.8% margin, 21.2% miss)

- Operating Margin: -5.9%, down from 0.1% in the same quarter last year

- Market Capitalization: $681.1 million

Chief Executive Officer Mike Gerdin commented, "Our consolidated operating results for the three and six months ended June 30, 2025, reflect sequential improvement during a prolonged and challenged industry-wide operating environment where current capacity outpaces weak freight demand. These dynamics coupled with what we perceive as unsustainable pricing in many markets and rising operating costs, continue to be a significant headwind for us and all of those operating in our industry. Despite the operating loss during the quarter, we continue to have positive cash flows from operations. We remain confident in the future and our operating model and as a result we invested in our fleet ($5.8 million, net), reduced our debt and financing leases ($5.6 million paid), and repurchased 1 million shares of our common stock ($8.9 million paid) during the three months ended June 30, 2025."

Company Overview

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

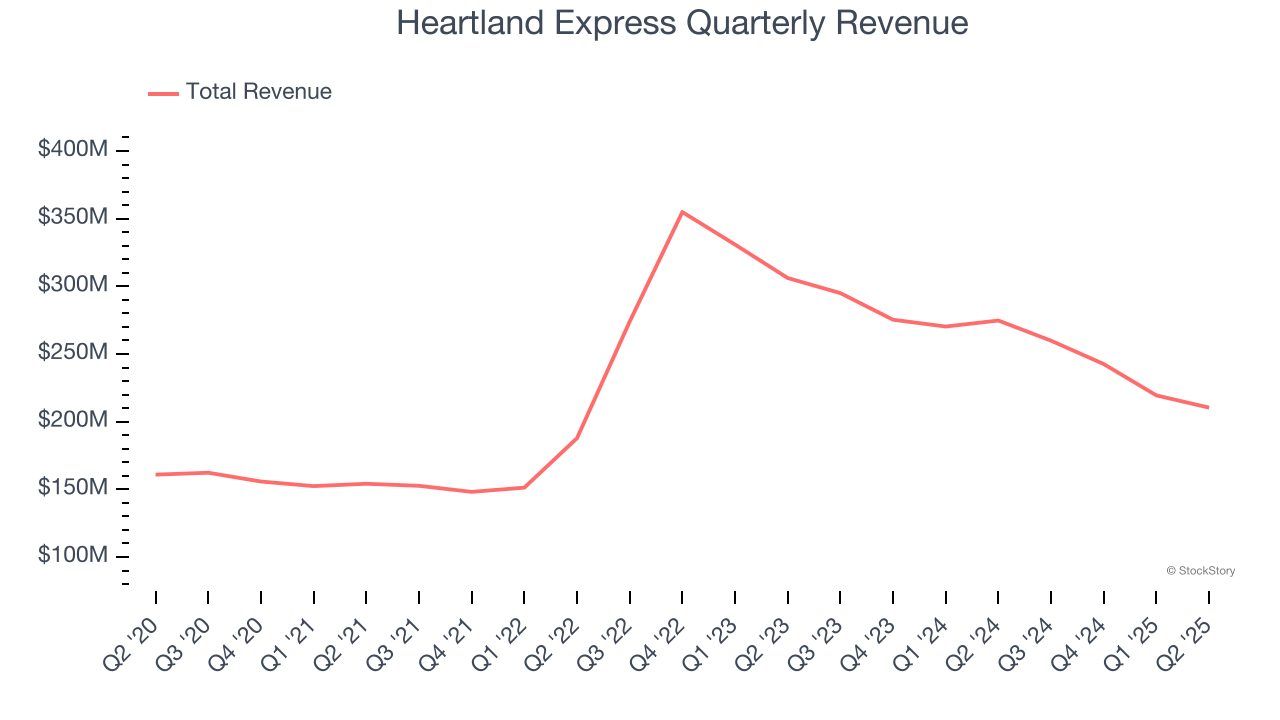

Revenue Growth

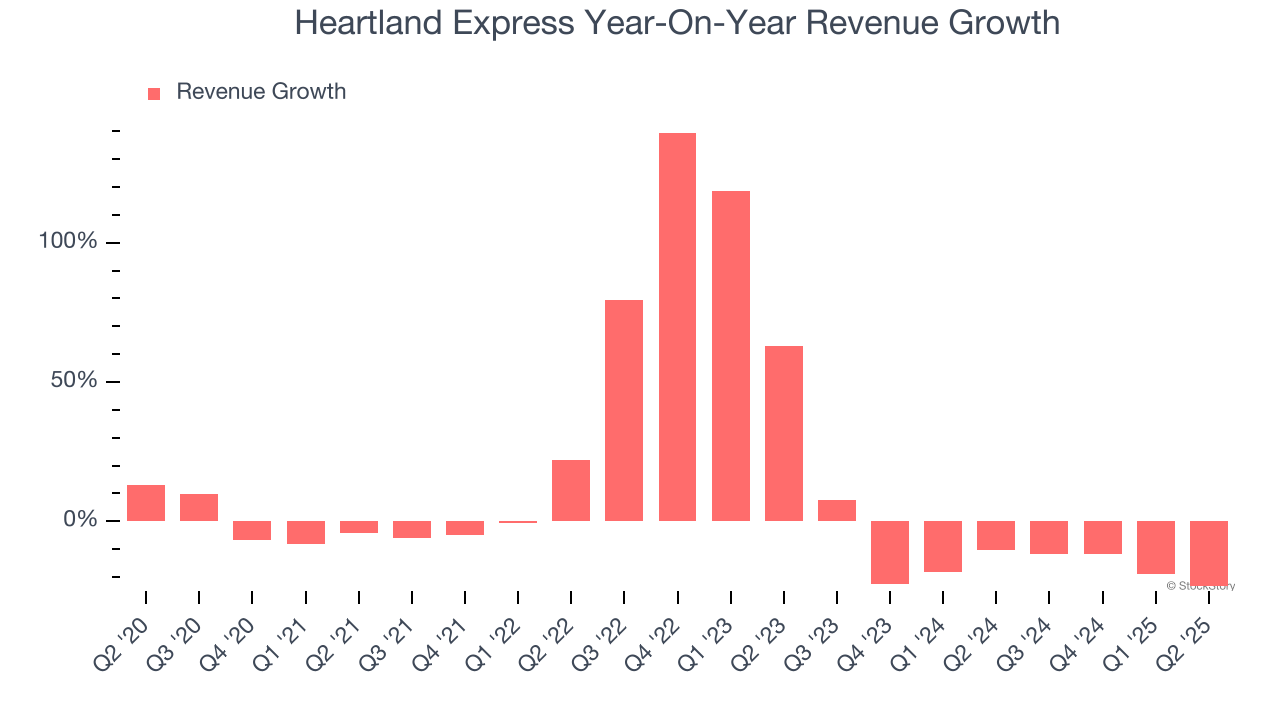

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Heartland Express’s sales grew at a decent 7.7% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Heartland Express’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 14.2% over the last two years. Heartland Express isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Heartland Express missed Wall Street’s estimates and reported a rather uninspiring 23.4% year-on-year revenue decline, generating $210.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 3.7% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

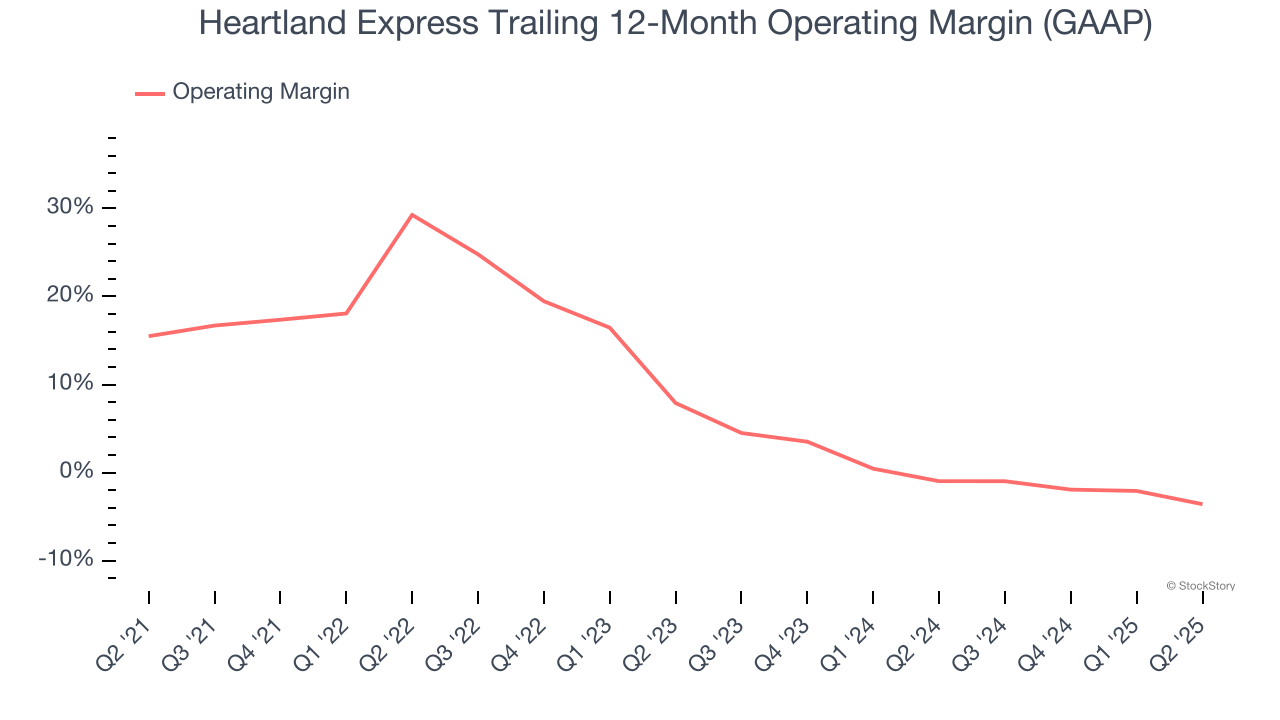

Operating Margin

Heartland Express was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.4% was weak for an industrials business.

Looking at the trend in its profitability, Heartland Express’s operating margin decreased by 19.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but Heartland Express’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Heartland Express generated an operating margin profit margin of negative 5.9%, down 6 percentage points year on year. The contraction shows it was less efficient because its expenses increased relative to its revenue.

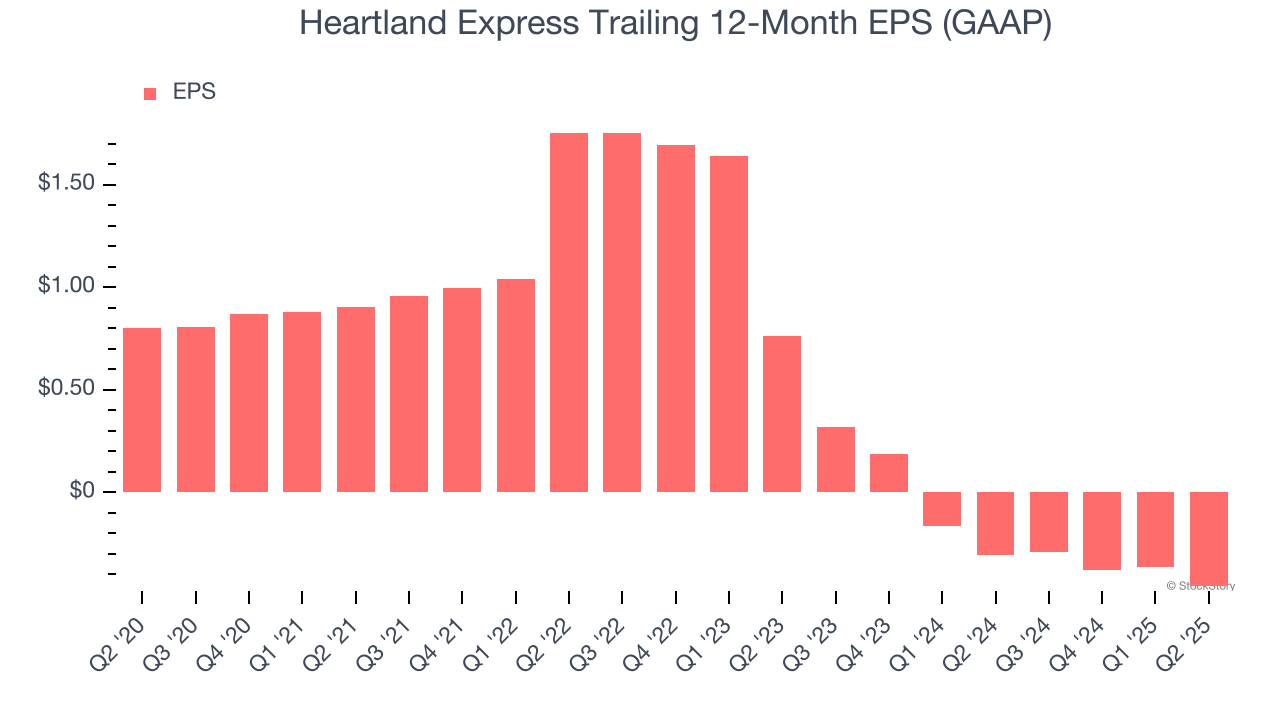

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Heartland Express, its EPS declined by 20.8% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Heartland Express’s earnings can give us a better understanding of its performance. As we mentioned earlier, Heartland Express’s operating margin declined by 19.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Heartland Express, its two-year annual EPS declines of 61.3% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, Heartland Express reported EPS at negative $0.14, down from negative $0.04 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Heartland Express’s full-year EPS of negative $0.46 will reach break even.

Key Takeaways from Heartland Express’s Q2 Results

We struggled to find many positives in these results as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.5% to $8.28 immediately following the results.

Heartland Express may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.