3 Reasons ACGL Has Explosive Upside Potential

Arch Capital Group currently trades at $88.38 per share and has shown little upside over the past six months, posting a small loss of 3.3%. The stock also fell short of the S&P 500’s 4.8% gain during that period.

Given the weaker price action, is now a good time to buy ACGL? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Are We Positive On Arch Capital Group?

With roots dating back to 1995 and now operating across insurance markets on six continents, Arch Capital Group (NASDAQ: ACGL) provides specialty insurance, reinsurance, and mortgage insurance services worldwide through its three main business segments.

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Arch Capital Group’s net premiums earned has grown at a 23.3% annualized rate over the last two years, much better than the broader insurance industry.

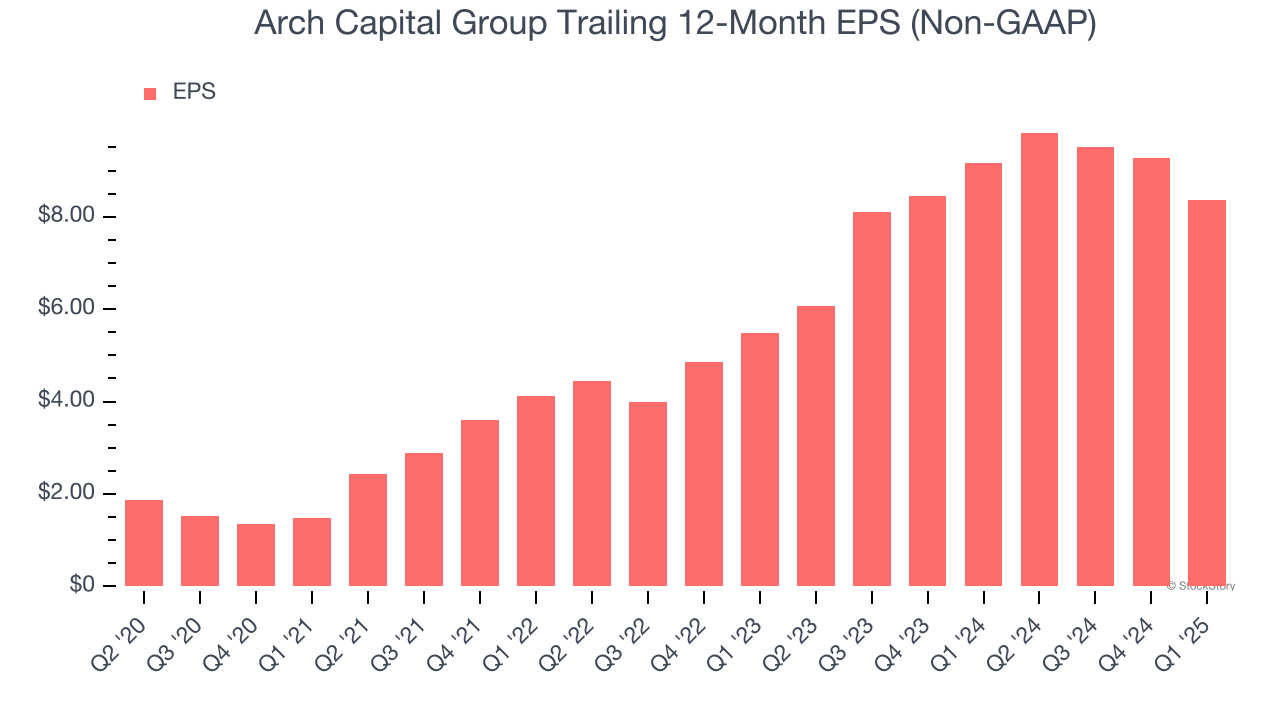

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Arch Capital Group’s EPS grew at an astounding 25.9% compounded annual growth rate over the last five years, higher than its 22% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

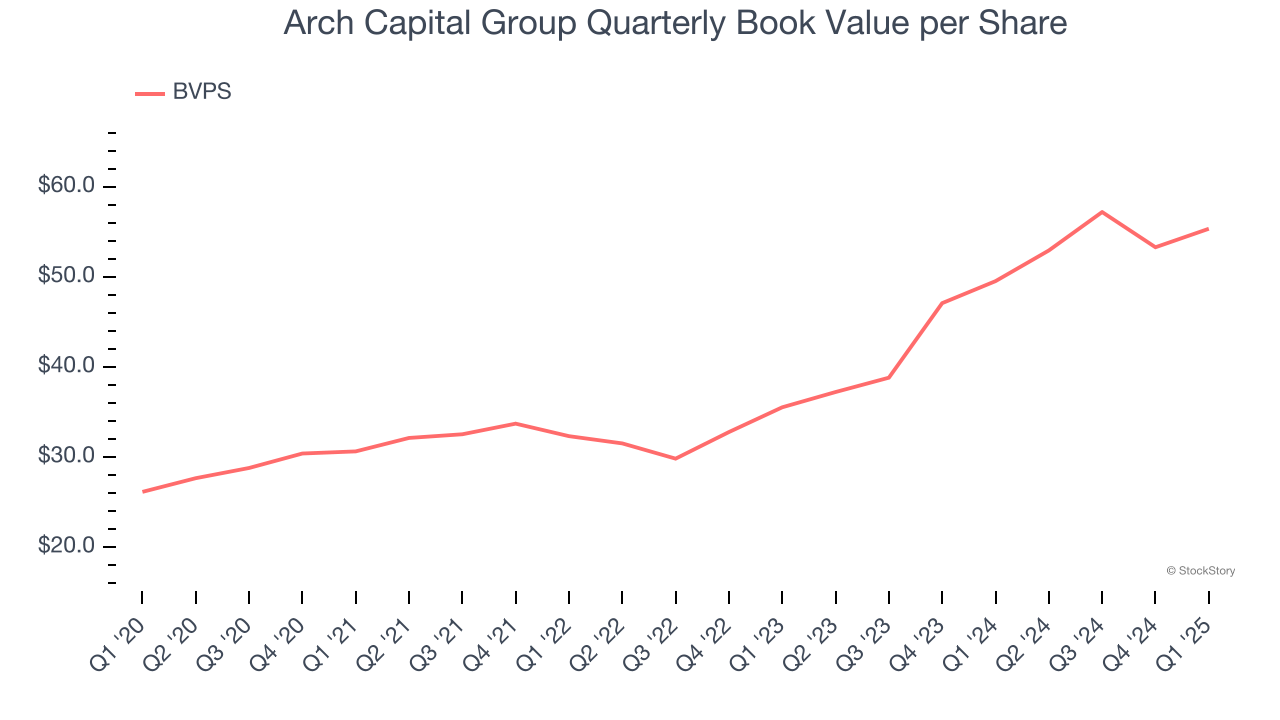

3. Growing BVPS Reflects Strong Asset Base

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Arch Capital Group’s BVPS increased by 16.2% annually over the last five years, and growth has recently accelerated as BVPS grew at an exceptional 24.8% annual clip over the past two years (from $35.56 to $55.38 per share).

Final Judgment

These are just a few reasons why Arch Capital Group is one of the best insurance companies out there. With its shares trailing the market in recent months, the stock trades at 1.5× forward P/B (or $88.38 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Arch Capital Group

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.