Q2 Earnings Highlights: Masimo (NASDAQ:MASI) Vs The Rest Of The Patient Monitoring Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how patient monitoring stocks fared in Q2, starting with Masimo (NASDAQ: MASI).

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

The 5 patient monitoring stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.6% while next quarter’s revenue guidance was 0.8% below.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

Masimo (NASDAQ: MASI)

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ: MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

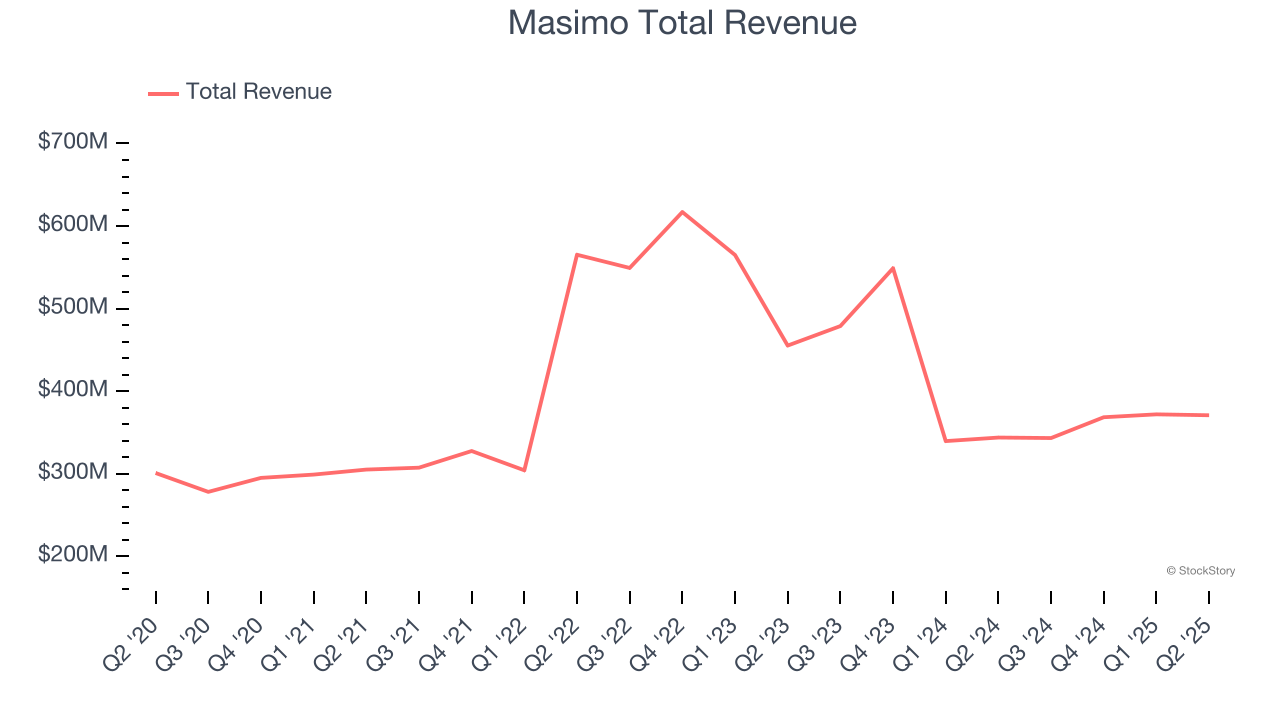

Masimo reported revenues of $370.9 million, up 7.9% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Katie Szyman, Chief Executive Officer of Masimo, said, “We once again delivered strong results in the second quarter as our core health care business continued to demonstrate strong growth and earnings. We are intensely focused on building our leading position in pulse oximetry to increase our market share in key global markets and advanced monitoring categories, and on driving commercial excellence throughout the organization. We have also expanded our leadership team to ensure that we have the right people and pillars in place to execute our growth strategy. Notably, our team has been highly effective in the implementation of tariff mitigation measures, allowing us to guide to a tariff impact that is 50% less than our original estimate. Each of these factors is contributing to our positive momentum and we are investing in our core healthcare business to achieve our goals and potentially accelerate our long-range revenue growth.”

Masimo delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 8.7% since reporting and currently trades at $150.

Is now the time to buy Masimo? Access our full analysis of the earnings results here, it’s free.

Best Q2: iRhythm (NASDAQ: IRTC)

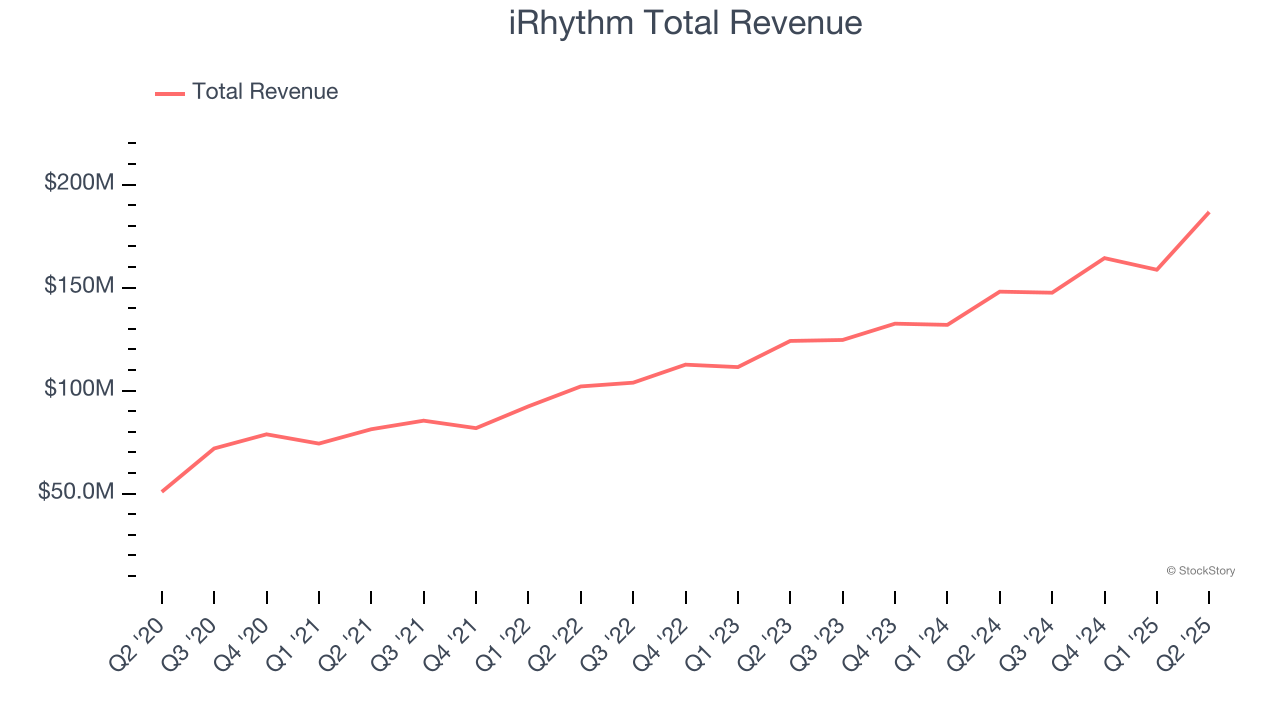

Pioneering the shift from bulky, short-term heart monitors to sleek, wire-free patches, iRhythm Technologies (NASDAQ: IRTC) provides wearable cardiac monitoring devices and AI-powered analysis services that help physicians detect and diagnose heart rhythm disorders.

iRhythm reported revenues of $186.7 million, up 26.1% year on year, outperforming analysts’ expectations by 7.3%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

iRhythm delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 15% since reporting. It currently trades at $161.20.

Is now the time to buy iRhythm? Access our full analysis of the earnings results here, it’s free.

ResMed (NYSE: RMD)

Founded in 1989 to address the then-underdiagnosed condition of sleep apnea, ResMed (NYSE: RMD) develops cloud-connected medical devices and software solutions that treat sleep apnea, COPD, and other respiratory disorders for home and clinical use.

ResMed reported revenues of $1.35 billion, up 10.2% year on year, exceeding analysts’ expectations by 1.3%. It was a satisfactory quarter as it also posted a narrow beat of analysts’ constant currency revenue estimates.

Interestingly, the stock is up 7% since the results and currently trades at $291.11.

Read our full analysis of ResMed’s results here.

Insulet (NASDAQ: PODD)

Revolutionizing diabetes care with its tubeless "Pod" technology, Insulet (NASDAQ: PODD) develops and manufactures innovative insulin delivery systems for people with diabetes, primarily through its Omnipod product line.

Insulet reported revenues of $649.1 million, up 32.9% year on year. This number beat analysts’ expectations by 5.8%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

Insulet achieved the fastest revenue growth among its peers. The stock is up 9.9% since reporting and currently trades at $304.84.

Read our full, actionable report on Insulet here, it’s free.

DexCom (NASDAQ: DXCM)

Founded in 1999 and receiving its first FDA approval in 2006, DexCom (NASDAQ: DXCM) develops and sells continuous glucose monitoring systems that allow people with diabetes to track their blood sugar levels without repeated finger pricks.

DexCom reported revenues of $1.16 billion, up 15.2% year on year. This print surpassed analysts’ expectations by 2.8%. It was a strong quarter as it also logged a solid beat of analysts’ organic revenue estimates and a decent beat of analysts’ EPS estimates.

DexCom had the weakest full-year guidance update among its peers. The stock is down 12.6% since reporting and currently trades at $77.86.

Read our full, actionable report on DexCom here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.