Q2 Rundown: The Ensign Group (NASDAQ:ENSG) Vs Other Healthcare Providers & Services Stocks

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the healthcare providers & services industry, including The Ensign Group (NASDAQ: ENSG) and its peers.

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.4% on average since the latest earnings results.

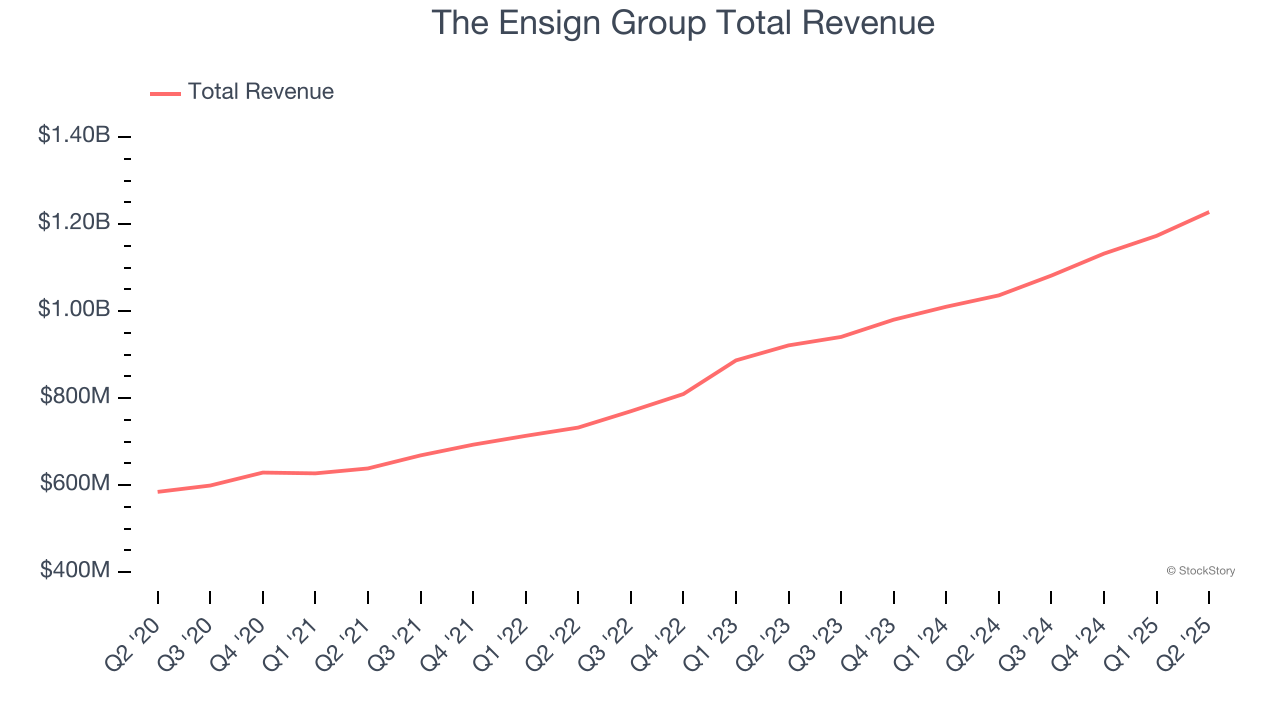

The Ensign Group (NASDAQ: ENSG)

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ: ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

The Ensign Group reported revenues of $1.23 billion, up 18.5% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a strong quarter for the company with full-year revenue guidance beating analysts’ expectations and a narrow beat of analysts’ full-year EPS guidance estimates.

“Our local teams achieved another outstanding quarter, raising the bar again for what is possible, even in a quarter where we historically have experienced more seasonality. The clinical results they achieved continue to be the primary driver of our success. As our teams work tirelessly to gain the trust of the communities they serve, our operations continue to earn the reputation as the facility of choice for thousands of patients. This trust is apparent from the strong trends in occupancy and skilled mix, which we believe is only achievable, over time, through consistent quality care and the dedication of amazing local leaders,” said Barry Port, Ensign’s Chief Executive Officer.

Interestingly, the stock is up 23.2% since reporting and currently trades at $170.

Is now the time to buy The Ensign Group? Access our full analysis of the earnings results here, it’s free.

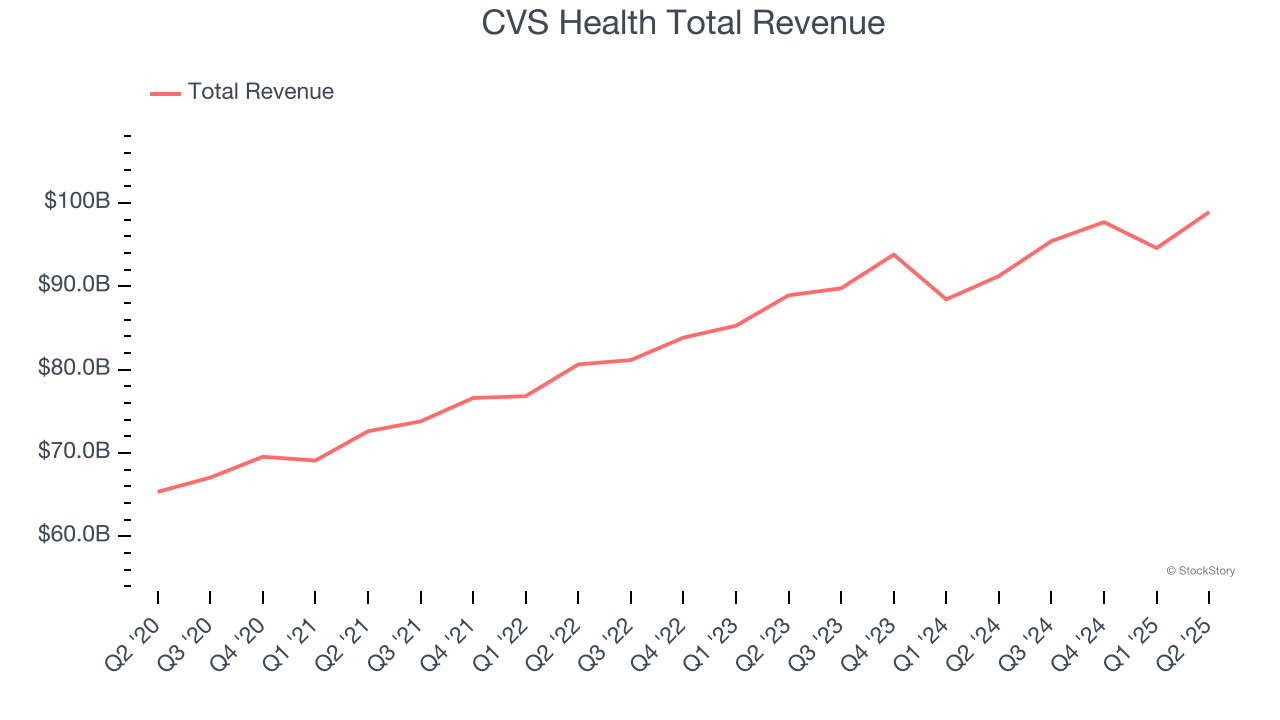

Best Q2: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $98.92 billion, up 8.4% year on year, outperforming analysts’ expectations by 5.1%. The business had a stunning quarter with an impressive beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 14.9% since reporting. It currently trades at $71.59.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Oscar Health (NYSE: OSCR)

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health reported revenues of $2.86 billion, up 29% year on year, falling short of analysts’ expectations by 3.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 10.1% since the results and currently trades at $15.22.

Read our full analysis of Oscar Health’s results here.

Pediatrix Medical Group (NYSE: MD)

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE: MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Pediatrix Medical Group reported revenues of $468.8 million, down 7% year on year. This number surpassed analysts’ expectations by 1%. It was an exceptional quarter as it also put up a solid beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The stock is up 31.3% since reporting and currently trades at $16.15.

Read our full, actionable report on Pediatrix Medical Group here, it’s free.

Humana (NYSE: HUM)

With over 80% of its revenue derived from federal government contracts, Humana (NYSE: HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

Humana reported revenues of $32.39 billion, up 9.6% year on year. This print topped analysts’ expectations by 1.7%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ full-year EPS guidance estimates and full-year revenue guidance slightly topping analysts’ expectations.

The company added 3,200 customers to reach a total of 14.84 million. The stock is up 27% since reporting and currently trades at $295.75.

Read our full, actionable report on Humana here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.