Q2 Earnings Roundup: Byrna (NASDAQ:BYRN) And The Rest Of The Aerospace and Defense Segment

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Byrna (NASDAQ: BYRN) and its peers.

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 30 aerospace and defense stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

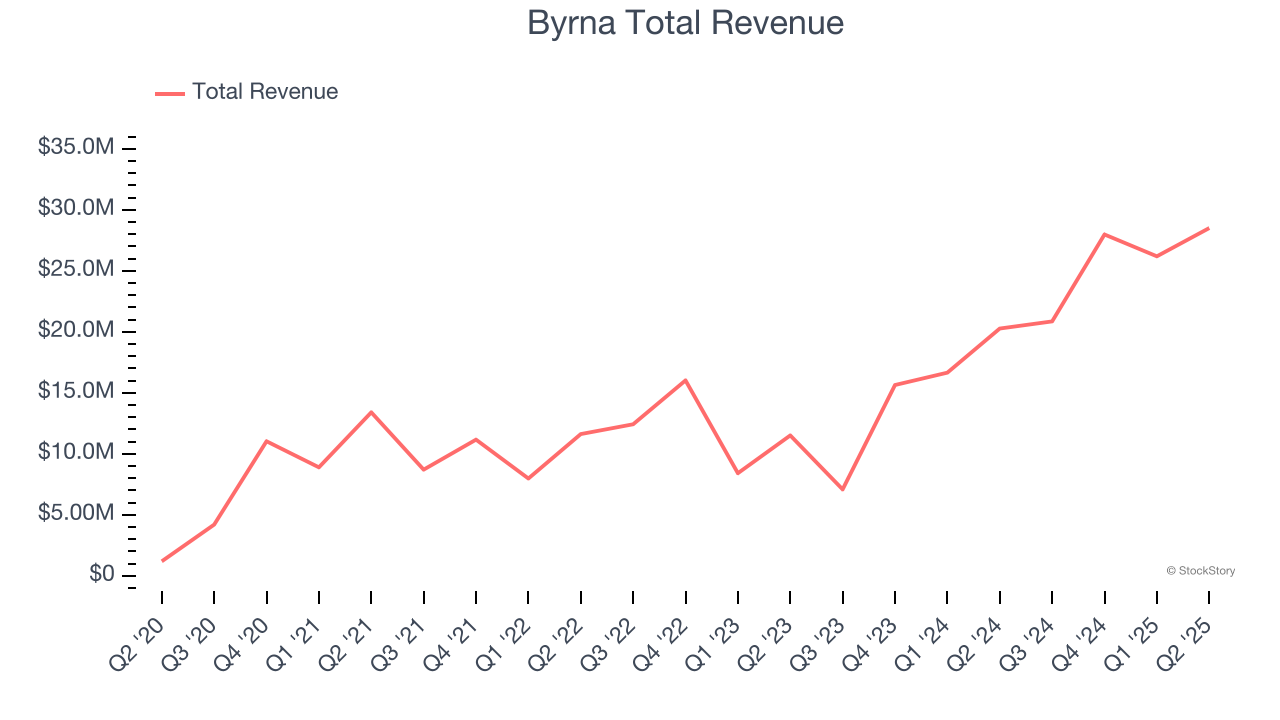

Byrna (NASDAQ: BYRN)

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ: BYRN) is a provider of non-lethal weapons.

Byrna reported revenues of $28.51 million, up 40.6% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Management CommentaryByrna CEO Bryan Ganz stated: “The launch of the Byrna CL in May helped us deliver a record $28.5 million in revenue for the second quarter. Despite overall softness in consumer spending, our focused marketing and retail expansion strategies allowed us to continue growing our total addressable market and reach new milestones. Looking ahead, we expect that the CL will be a larger part of our sales mix, especially now that it is available to customers on Amazon.

Byrna pulled off the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 34.7% since reporting and currently trades at $21.08.

We think Byrna is a good business, but is it a buy today? Read our full report here, it’s free.

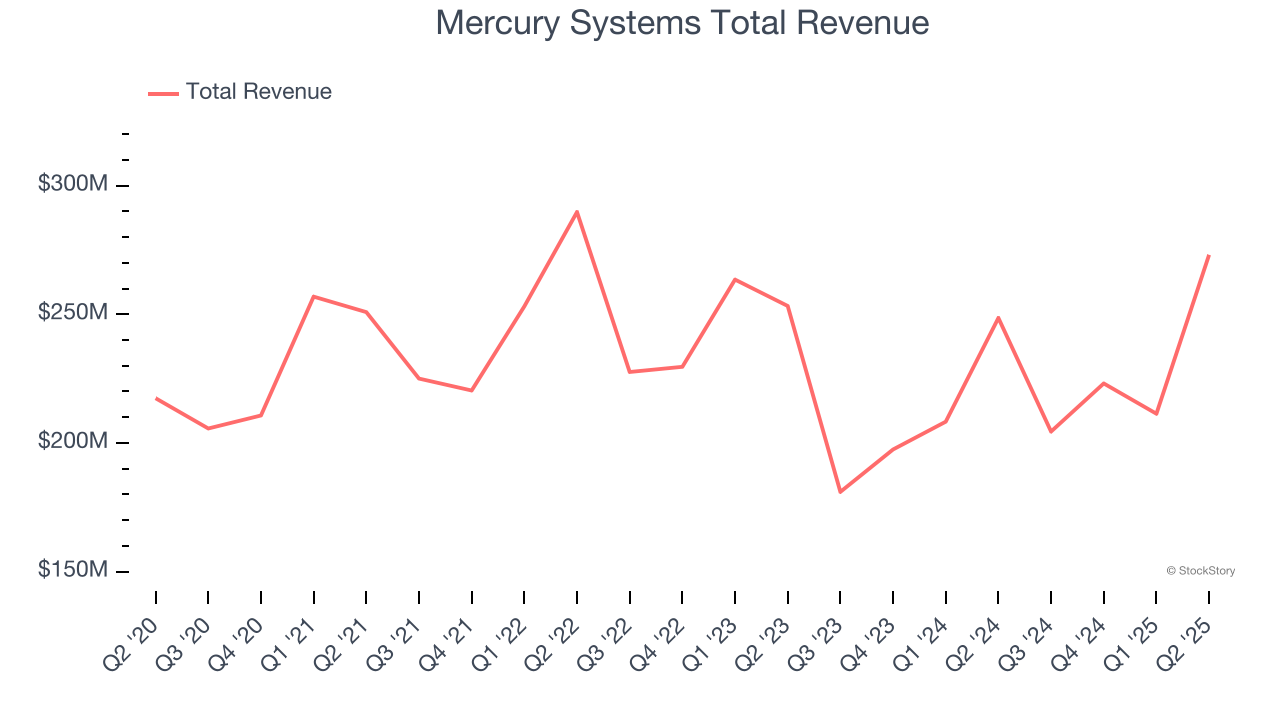

Best Q2: Mercury Systems (NASDAQ: MRCY)

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $273.1 million, up 9.9% year on year, outperforming analysts’ expectations by 11.9%. The business had an incredible quarter with a solid beat of analysts’ organic revenue estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 27% since reporting. It currently trades at $68.22.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lockheed Martin (NYSE: LMT)

Headquartered in Maryland, Famous for the F-35 aircraft, Lockheed Martin (NYSE: LMT) specializes in defense, space, homeland security, and information technology products.

Lockheed Martin reported revenues of $18.16 billion, flat year on year, falling short of analysts’ expectations by 2.3%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 3% since the results and currently trades at $447.50.

Read our full analysis of Lockheed Martin’s results here.

Astronics (NASDAQ: ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ: ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $204.7 million, up 3.3% year on year. This number lagged analysts' expectations by 1.7%. Overall, it was a slower quarter as it also recorded a significant miss of analysts’ EBITDA estimates.

The stock is up 3.5% since reporting and currently trades at $36.62.

Read our full, actionable report on Astronics here, it’s free.

Axon (NASDAQ: AXON)

Providing body cameras and tasers for first responders, AXON (NASDAQ: AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Axon reported revenues of $668.5 million, up 32.8% year on year. This print beat analysts’ expectations by 4.3%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ ARR estimates and a beat of analysts’ EPS estimates.

The stock is up 2.8% since reporting and currently trades at $763.37.

Read our full, actionable report on Axon here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.