Palomar Holdings (NASDAQ:PLMR) Reports Bullish Q2

Specialty insurance provider Palomar Holdings (NASDAQ: PLMR) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 55.1% year on year to $203.3 million. Its non-GAAP profit of $1.76 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Palomar Holdings? Find out by accessing our full research report, it’s free.

Palomar Holdings (PLMR) Q2 CY2025 Highlights:

- Net Premiums Earned: $180 million vs analyst estimates of $172.7 million (47.2% year-on-year growth, 4.2% beat)

- Revenue: $203.3 million vs analyst estimates of $186.1 million (55.1% year-on-year growth, 9.2% beat)

- Combined Ratio: 78.8% vs analyst estimates of 75.7% (3.1 percentage point miss)

- Adjusted EPS: $1.76 vs analyst estimates of $1.68 (4.5% beat)

- For the full year 2025, the Company expects to achieve adjusted net income of $198 million to $208 million, an increase from the previously announced range of $195 million to $205 million

- Market Capitalization: $3.47 billion

Mac Armstrong, Chairman and Chief Executive Officer, commented, “Our second quarter results highlight the sustained execution of our Palomar 2X strategic imperative. We achieved strong top and bottom-line growth in the quarter as gross written premium grew 29% across our diverse portfolio and adjusted net income increased 52%. This strong growth underscores the strength of our product set and the efficacy of our balanced book of property and casualty and residential and commercial products. Our financial metrics were equally stout as we generated an adjusted combined ratio of 73%, and a 24% adjusted return on equity.”

Company Overview

Founded in 2013 to fill gaps in catastrophe insurance markets, Palomar Holdings (NASDAQ: PLMR) is a specialty insurance provider that offers property and casualty insurance products in underserved markets, with a focus on earthquake coverage.

Revenue Growth

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third.

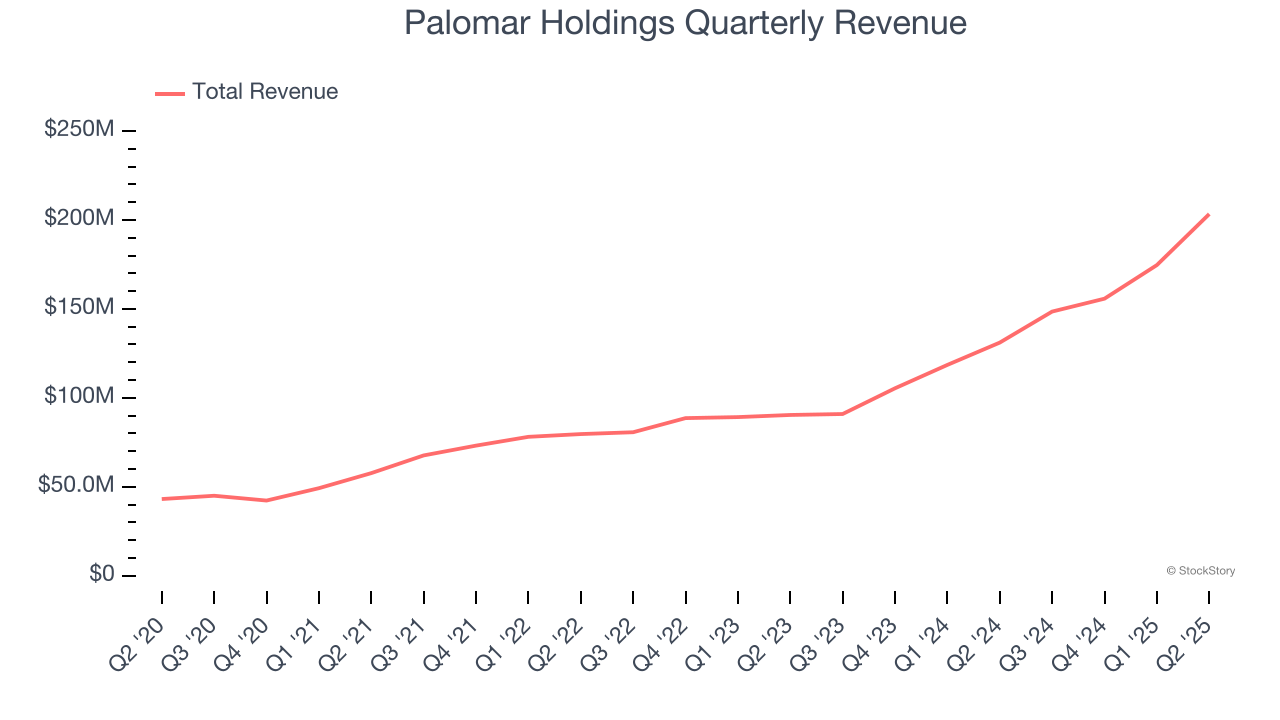

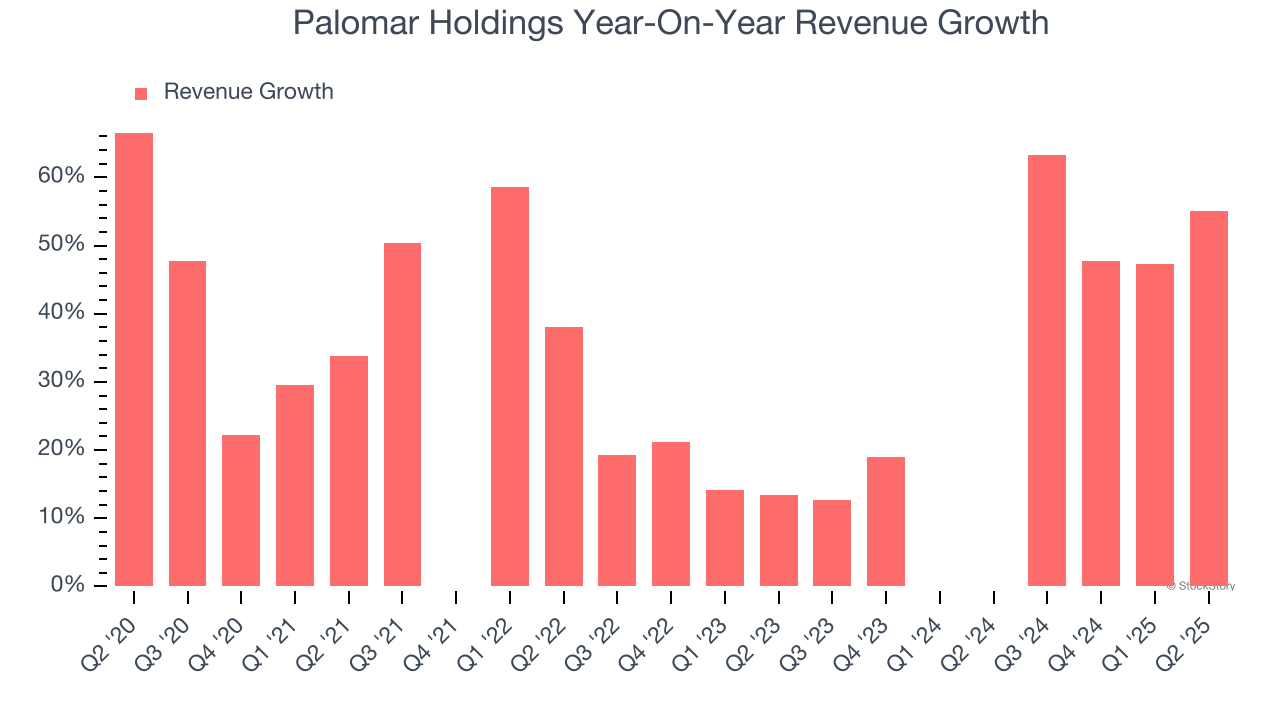

Over the last five years, Palomar Holdings grew its revenue at an incredible 36.1% compounded annual growth rate. Its growth surpassed the average insurance company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Palomar Holdings’s annualized revenue growth of 39.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Palomar Holdings reported magnificent year-on-year revenue growth of 55.1%, and its $203.3 million of revenue beat Wall Street’s estimates by 9.2%.

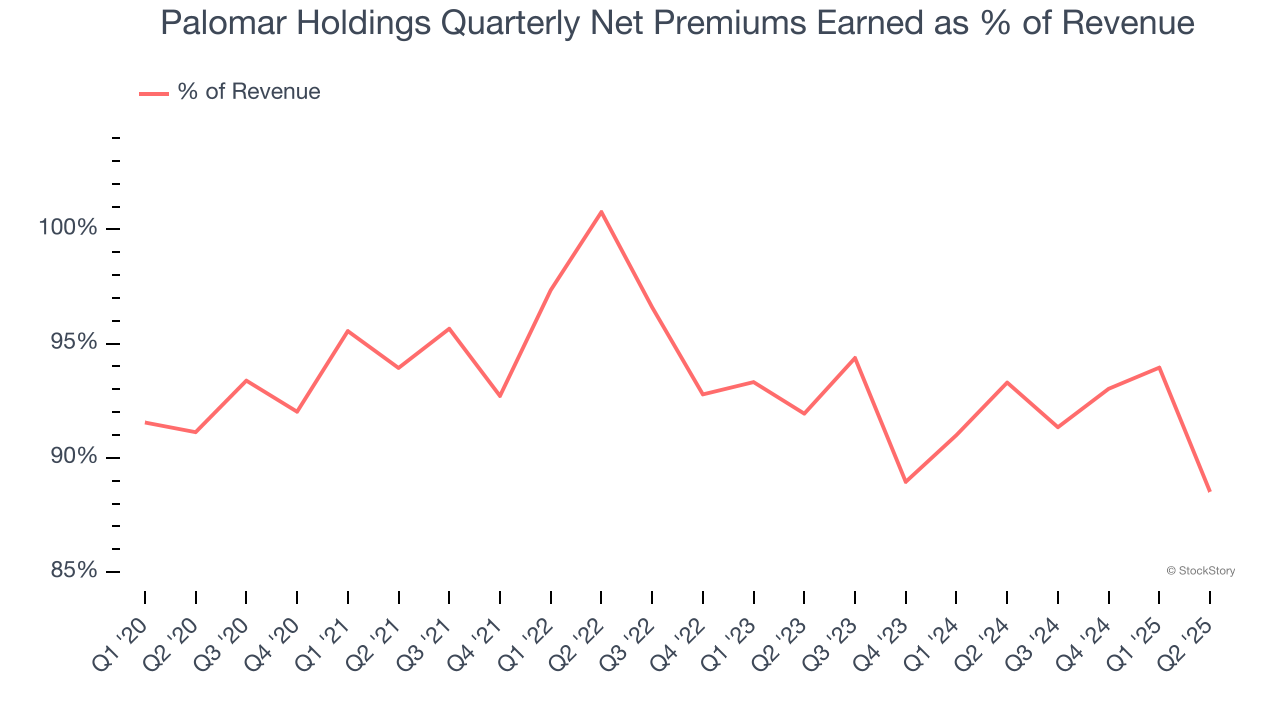

Net premiums earned made up 93% of the company’s total revenue during the last five years, meaning Palomar Holdings lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

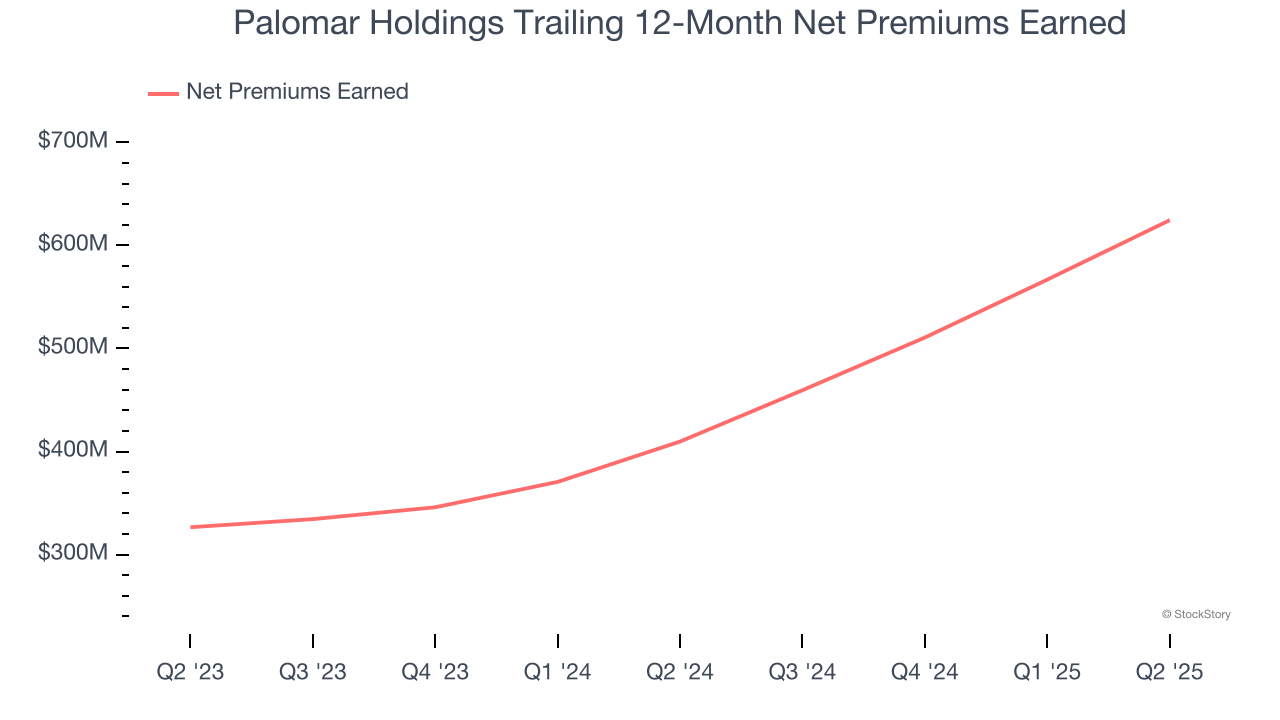

Palomar Holdings’s net premiums earned has grown at a 35.9% annualized rate over the last five years, much better than the broader insurance industry and in line with its total revenue.

When analyzing Palomar Holdings’s net premiums earned over the last two years, we can see that growth accelerated to 38.3% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these additional streams certainly contribute to the bottom line, their impact can vary. Some firms have shown greater success and long-term consistency in investing their float compared to peers. However, sharp fluctuations in the fixed income and equity markets can significantly affect short-term performance.

This quarter, Palomar Holdings’s net premiums earned was $180 million, up a hearty 47.2% year on year and topping Wall Street Consensus estimates by 4.2%.

Key Takeaways from Palomar Holdings’s Q2 Results

We liked that Palomar Holdings's net premiums earned and EPS beat expectations this quarter. On the other hand, efficiency ratio missed. The company also raised its full-year guidance for adjusted net income. Zooming out, this was a solid quarter. The market seemed to be hoping for more, and the stock traded down 1.4% to $130 immediately after reporting.

So should you invest in Palomar Holdings right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.