Semiconductors Stocks Q2 Results: Benchmarking Seagate Technology (NASDAQ:STX)

Looking back on semiconductors stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Seagate Technology (NASDAQ: STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.1% on average since the latest earnings results.

Seagate Technology (NASDAQ: STX)

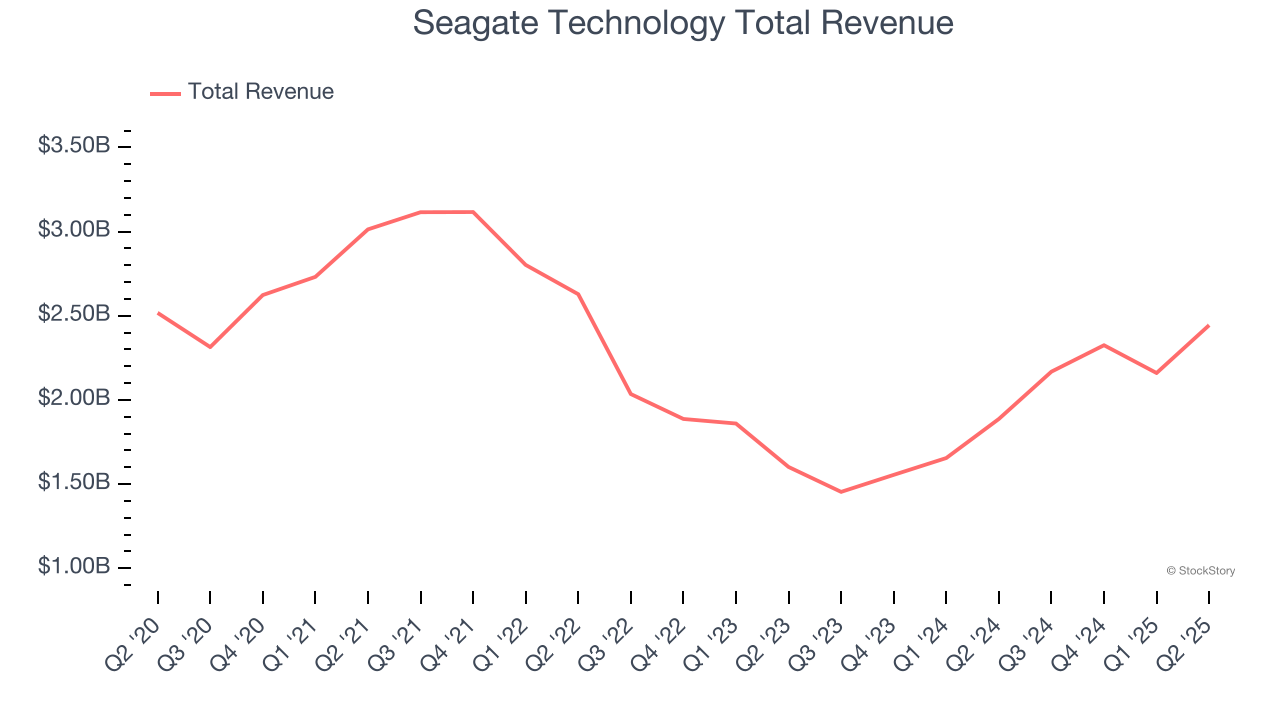

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ: STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.44 billion, up 29.5% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a satisfactory quarter for the company with a significant improvement in its inventory levels but revenue guidance for next quarter slightly missing analysts’ expectations.

"Seagate’s strong FQ4 performance underscores our commitment to profitable growth, marked by a 30% year-over-year revenue increase, record gross margin, and non-GAAP EPS expanding to the top of our guidance range. These achievements reflect the structural enhancements we’ve implemented in our business and ongoing demand strength from cloud customers for our high-capacity drives," said Dave Mosley, Seagate’s chief executive officer.

Interestingly, the stock is up 28.5% since reporting and currently trades at $196.52.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free.

Best Q2: IPG Photonics (NASDAQ: IPGP)

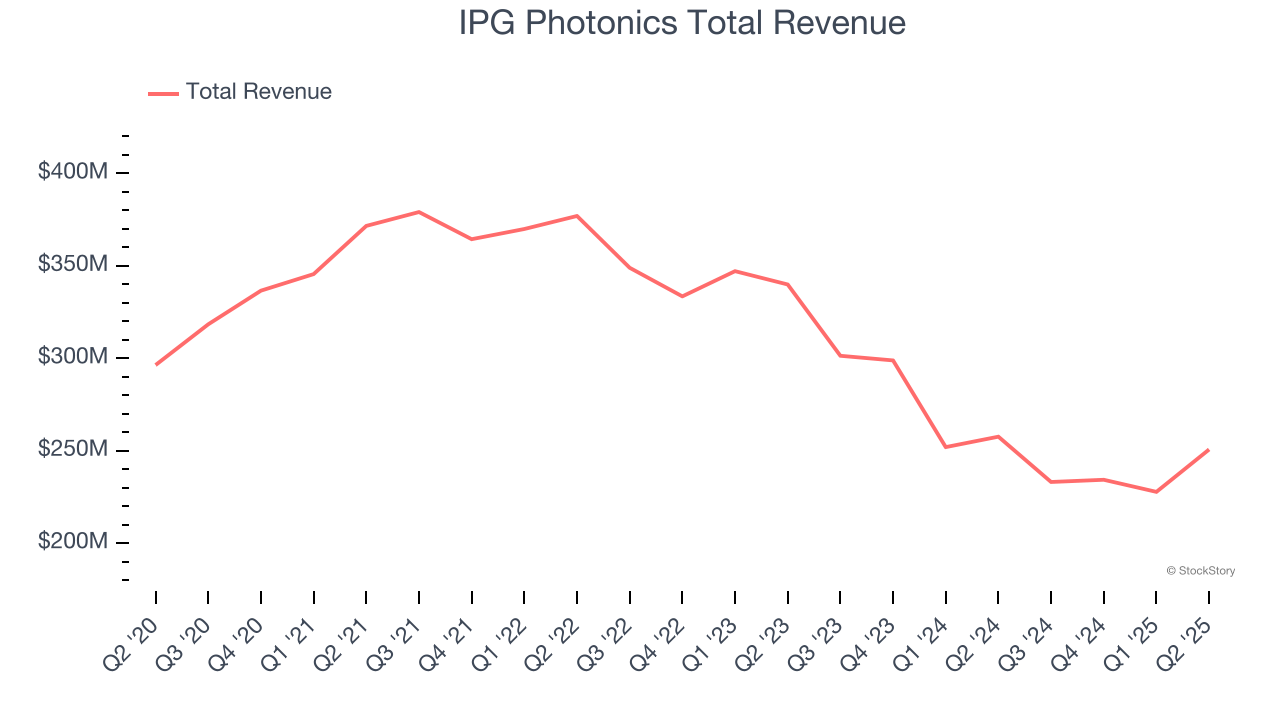

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $250.7 million, down 2.7% year on year, outperforming analysts’ expectations by 9.4%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems content with the results as the stock is up 2.4% since reporting. It currently trades at $79.47.

Is now the time to buy IPG Photonics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $214.8 million, down 10.4% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a softer quarter as it posted EPS in line with analysts’ estimates and an increase in its inventory levels.

As expected, the stock is down 3.2% since the results and currently trades at $8.36.

Read our full analysis of Himax’s results here.

Amtech (NASDAQ: ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ: ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $19.56 million, down 23.1% year on year. This number topped analysts’ expectations by 15%. Zooming out, it was a satisfactory quarter as it also produced a beat of analysts’ EPS estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Amtech scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 108% since reporting and currently trades at $9.33.

Read our full, actionable report on Amtech here, it’s free.

Impinj (NASDAQ: PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ: PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $97.89 million, down 4.5% year on year. This result surpassed analysts’ expectations by 4.3%. It was an exceptional quarter as it also put up a significant improvement in its inventory levels and a beat of analysts’ EPS estimates.

The stock is up 45.5% since reporting and currently trades at $178.20.

Read our full, actionable report on Impinj here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.