Life Insurance Stocks Q2 Recap: Benchmarking Unum Group (NYSE:UNM)

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Unum Group (NYSE: UNM) and its peers.

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

The 15 life insurance stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

Unum Group (NYSE: UNM)

Tracing its roots back to 1848 when financial security for workers was virtually non-existent, Unum Group (NYSE: UNM) provides workplace financial protection benefits including disability, life, accident, critical illness, dental and vision insurance primarily through employers.

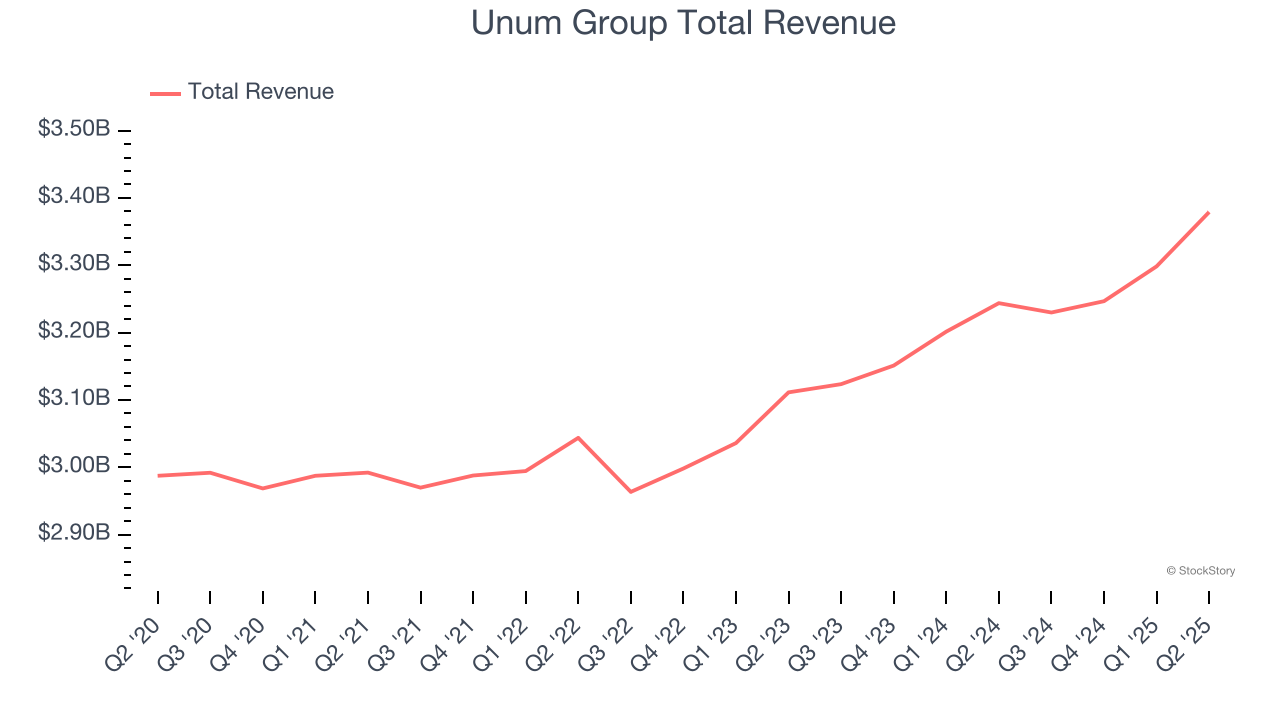

Unum Group reported revenues of $3.38 billion, up 4.2% year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a softer quarter for the company with a significant miss of analysts’ book value per share and EPS estimates.

“During the quarter we made meaningful progress against our strategic priorities, despite earnings results that did not meet our expectations,” said Richard P. McKenney, president and chief executive officer.

The stock is down 5.3% since reporting and currently trades at $76.70.

Read our full report on Unum Group here, it’s free.

Best Q2: Corebridge Financial (NYSE: CRBG)

Spun off from insurance giant AIG in 2022 to focus on the growing retirement market, Corebridge Financial (NYSE: CRBG) provides retirement solutions, annuities, life insurance, and institutional risk management products in the United States.

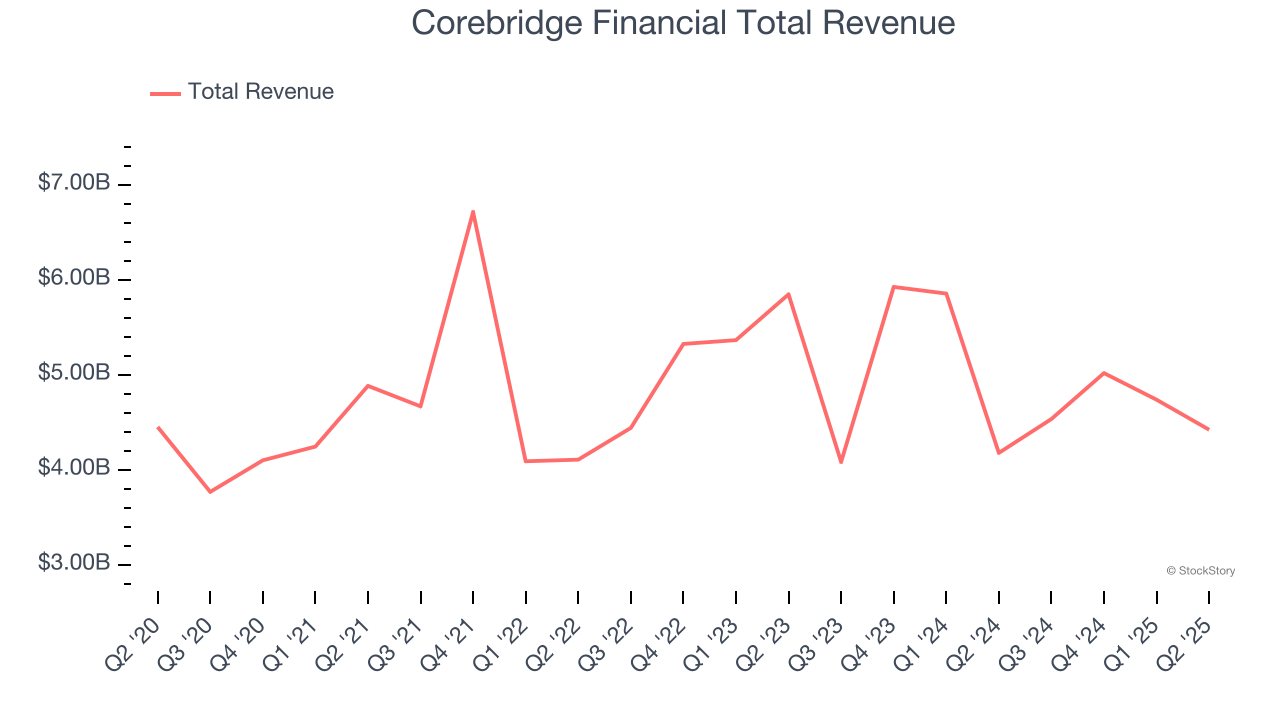

Corebridge Financial reported revenues of $4.42 billion, up 5.8% year on year, outperforming analysts’ expectations by 7.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.2% since reporting. It currently trades at $32.61.

Is now the time to buy Corebridge Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Equitable Holdings (NYSE: EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.80 billion, up 5.1% year on year, falling short of analysts’ expectations by 4.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 2% since the results and currently trades at $51.94.

Read our full analysis of Equitable Holdings’s results here.

Aflac (NYSE: AFL)

Known for its iconic duck mascot that has quacked "Aflac!" in commercials since 2000, Aflac (NYSE: AFL) provides supplemental health and life insurance policies that pay cash benefits directly to policyholders for expenses not covered by their primary insurance.

Aflac reported revenues of $4.54 billion, up 3.5% year on year. This print surpassed analysts’ expectations by 3.1%. Aside from that, it was a mixed quarter as it recorded a significant miss of analysts’ book value per share estimates and a narrow beat of analysts’ EPS estimates.

The stock is up 9.6% since reporting and currently trades at $108.43.

Read our full, actionable report on Aflac here, it’s free.

MetLife (NYSE: MET)

Founded in 1863 by a group of New York businessmen during the Civil War era, MetLife (NYSE: MET) is a global financial services company that provides insurance, annuities, employee benefits, and asset management services to individuals and businesses worldwide.

MetLife reported revenues of $17.92 billion, down 4.1% year on year. This result came in 3.9% below analysts' expectations. Overall, it was a softer quarter as it also logged a significant miss of analysts’ book value per share and EPS estimates.

The stock is up 5.6% since reporting and currently trades at $80.28.

Read our full, actionable report on MetLife here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.