Alphabet (GOOGL) delivered stronger-than-expected third-quarter financials, sending GOOGL stock soaring more than 7% in pre-market trading. Notably, Alphabet delivered its first-ever $100 billion revenue quarter, as artificial intelligence (AI) has become the engine driving growth across nearly every part of the company’s business. From search and advertising to cloud computing, YouTube, and subscriptions, the company’s deep integration of AI technologies is paying off in a big way.

Alphabet’s search business is benefiting from consumers’ growing reliance on AI-powered experiences in their daily digital interactions. Further, YouTube is seeing growth in ad revenue. The company’s cloud division also delivered another strong performance, driven by demand for AI-led services. At the same time, the cloud segment’s backlog climbed 46% quarter-over-quarter to $155 billion, providing a solid base for future growth.

In addition, Alphabet’s subscription business continues to expand, surpassing 300 million paid users thanks to the growing popularity of Google One and YouTube Premium.

With AI powering growth across Alphabet’s businesses, is GOOGL stock a buy now?

Alphabet to Sustain Momentum

Alphabet’s third-quarter results highlight how AI is positioning its business for solid long-term growth. The company’s search and other revenue rose 15% year-over-year to $56.6 billion in the third quarter as AI-driven experiences are propelling user engagement and monetization.

Alphabet’s introduction of new AI features, such as AI Overviews and AI Mode, is improving the quality of search results and enhancing commercial intent, connecting users and businesses more effectively. These tools are deepening user interaction, particularly within commercial queries, and opening new monetization pathways that could support long-term advertising growth.

Beyond search, the company’s cloud business is seeing solid growth driven by the rising adoption of enterprise AI tools. Cloud revenue surged 34% to $15.2 billion in Q3. Within that, Google Cloud Platform (GCP) continues to perform well, driven by enterprise AI products that now generate billions in quarterly revenue. Demand is surging, with the number of new GCP customers climbing nearly 34% year-over-year. Notably, Google signed more billion-dollar deals through Q3 this year than it did in the previous two years combined, signaling solid growth ahead.

Further, over 70% of Alphabet’s cloud customers are using Google’s AI offerings, highlighting a deepening ecosystem. The company now boasts 13 product lines, each generating over $1 billion in annual revenue. Further, the segment’s operating margins are improving as Alphabet continues to scale differentiated products built on its proprietary AI infrastructure. Moreover, revenue from generative AI products rose more than 200% year-over-year, a signal of accelerating adoption across industries.

The recent launch of Gemini Enterprise, Alphabet’s AI platform for the workplace, marks another important step. Designed to integrate AI agents into professional workflows, Gemini Enterprise is already seeing rapid traction, with over 2 million subscribers across 700 companies. This positions Alphabet as a leading provider of AI-powered productivity tools, a market expected to grow significantly in the coming years.

Meanwhile, YouTube continues to deliver steady growth, with ad revenue up 15% to $10.3 billion. Direct response advertising remains a key driver, supported by the AI-driven recommendation systems that enhance engagement on Shorts and living-room devices. YouTube’s use of Gemini models is further enhancing content discovery, while AI-powered tools are empowering creators to generate and monetize content more effectively, which is an important tailwind for future revenue growth.

Looking ahead, Alphabet’s momentum appears resilient. Though its services segment faces tough year-over-year advertising comparisons due to last year’s U.S. election cycle, the underlying fundamentals remain robust. Cloud demand continues to accelerate, with enterprise AI infrastructure and data analytics solutions driving sustained interest. The rollout of Gemini 2.5 and ongoing investment in AI hardware such as TPUs and GPUs suggest further upside in 2025.

Is Alphabet Stock a Buy?

Alphabet’s record-breaking $100 billion quarter reflects how AI has become the company’s key growth catalyst. With AI enhancing its every major business line and its growing capex, Alphabet is positioned for long-term growth. Its cloud backlog, rising enterprise adoption, and expanding ecosystem of AI-driven products suggest a strong runway ahead.

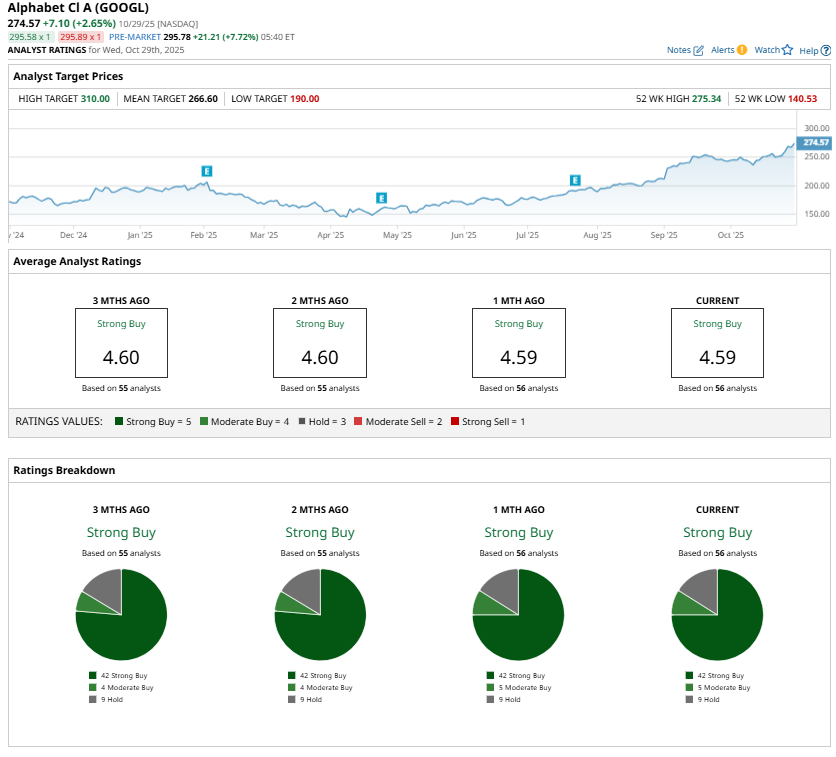

Analysts are bullish about GOOGL stock and have a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart