San Francisco, California-based Wells Fargo & Company (WFC) is a leading financial services firm with a broad footprint across consumer and commercial banking, lending, and wealth and investment management. With a market cap of $292 billion, the bank serves millions of customers through its extensive branch network and digital platforms, with core businesses spanning retail banking, mortgages, credit cards, corporate banking, and advisory services.

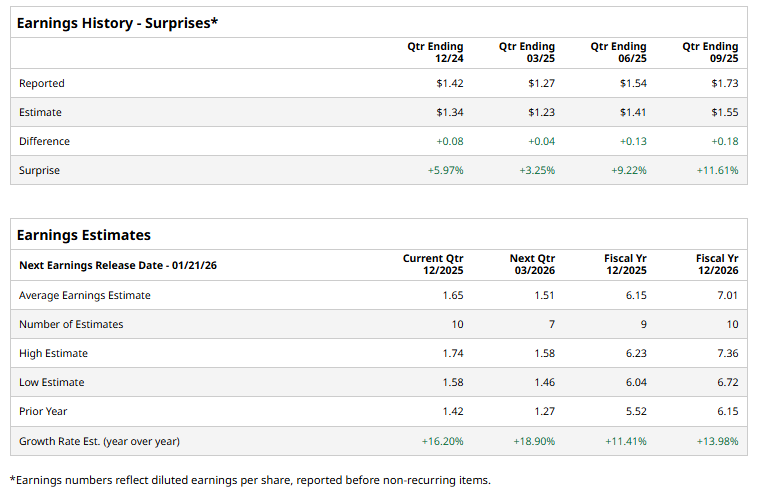

The financial sector giant is expected to release its fourth-quarter results soon. Ahead of the event, analysts expect WFC to deliver a profit of $1.65 per share, up 16.2% from $1.42 per share reported in the year-ago quarter. Additionally, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the current year, its EPS is expected to reach $6.15, up 11.4% year over year from $5.52 reported in fiscal 2024. In fiscal 2026, its earnings are expected to surge 14% year over year to $7.01 per share.

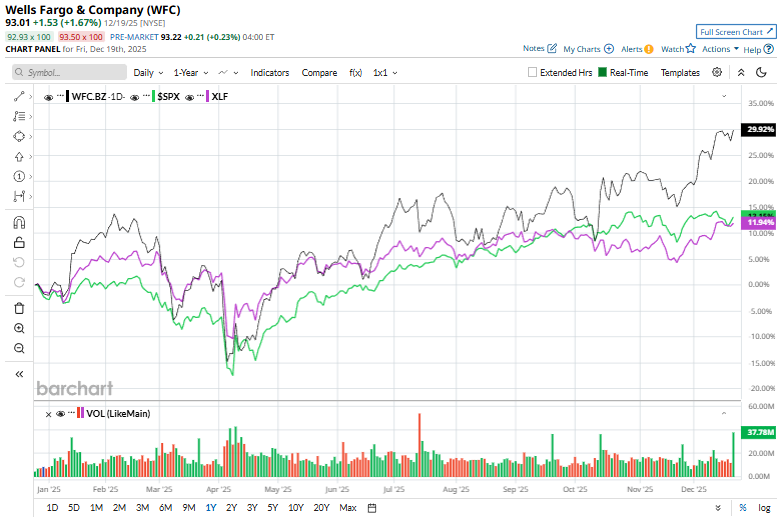

WFC’s stock prices have surged 35.1% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 16.5% gains and the Financial Select Sector SPDR Fund’s (XLF) 14.7% returns during the same time frame.

On Dec. 10, Wells Fargo Bank announced it would lower its prime rate to 6.75% from 7%. Following the announcement, Wells Fargo’s shares jumped more than 2%, reflecting a positive market reaction to the rate cut.

Analysts remain optimistic about WFC’s prospects, and the stock has a consensus “Moderate Buy” rating overall. Out of the 26 analysts covering WFC, 13 recommend “Strong Buy,” four advocate “Moderate Buy,” and nine recommend “Hold” ratings. Its mean price target of $97.79 suggests a modest 5.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Google Launches Gemini 3 Flash, Should You Buy, Sell, or Hold GOOGL Stock?

- Amazon Could Invest $10 Billion in OpenAI. Should You Invest in AMZN Stock First?

- Holiday Trading, Inflation Data and Other Key Things to Watch this Week

- Analysts Are Hot on the Foldable iPhone. Should You Buy AAPL Stock Before Apple’s Next Big Product Launch?