VANCOUVER, BC / ACCESSWIRE / April 17, 2024 / Usha Resources Ltd. ("USHA" or the "Company") (TSXV:USHA)(OTCQB:USHAF)(FSE:JO0), a North American mineral acquisition and exploration company, is pleased to announce that, subject to the approval of the TSX Venture (the "Exchange"), the Company has executed an option (the "Option Agreement") for the right to purchase an undivided 100% interest in the Abiwin lithium pegmatite property (the "Property") comprised of 38 mineral claims to the northeast of its flagship White Willow Lithium Pegmatite Project ("White Willow" or the "Project") located 170 km west of Thunder Bay, Ontario.

Abiwin Property highlights:

- Preliminary prospecting resulted in the discovery of 29 pegmatite dykes

- Muscovite geochemistry in these pegmatites indicates a highly fractionated signature

- LIBS[i] analyses return up to 6,700 ppm rubidium (Rb) and a K/Rb ~13 (potassium/rubidium ratios); indicative of spodumene-subtype pegmatites

- Extends strike length of the White Willow LCT pegmatite field to ~44 kilometres

- Adds additional target pegmatites to the existing 10 targets identified for Usha's planned maiden drill program

- Hosts ultramafic "Quetico intrusions" from which historic assessment work reports up to 33 g/t Pt+Pd and 3% Cu in grab samples and up to 0.72% Zn over 2 metres in chip samples.

Deepak Varshney, CEO of Usha Resources, commented: "The Abiwin claims are an exciting addition to our growing portfolio of critical metal assets in Ontario, and the preliminary results from the pegmatites highlight the potential for new discoveries within this rapidly expanding White Willow LCT pegmatite district. The claims are located within an excellent setting for spodumene-type pegmatites, situated within the metasedimentary rocks of the Quetico subprovince and only 3 kilometres from the district-scale Quetico Fault and have a tremendous exploration upside for not only lithium, but a wide range of critical metals."

Mr. Varshney continued: "With almost 22,000 hectares now secured, Usha controls a significant portion of a new lithium district where we and many others have continued to find success. With Phase 4 of our field program underway, we look forward to sharing updates as we build-up to our maiden drill program at White Willow."

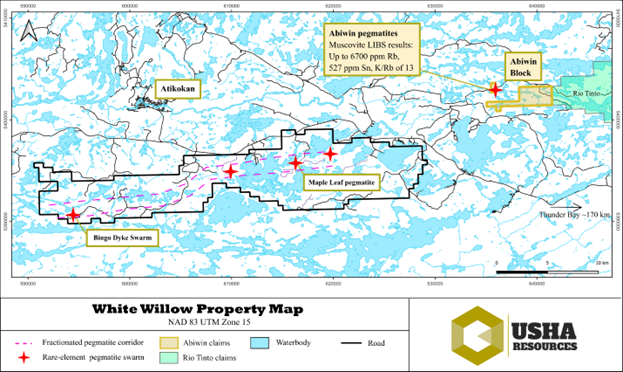

The Abiwin mining claims are geologically similar to the White Willow property and situated along trend from the Maple Leaf pegmatite, as well as the corridor of fractionated pegmatite identified on the White Willow property (Fig. 1; Usha Resources Press Release, Apr. 1, 2024). Preliminary mapping on the Abiwin claims documented 29 pegmatites dykes, and LIBS analyses of muscovite from these dykes returned up to 6,700 ppm Rb, 527 ppm Sn, and K/Rb ratios as low as 13, indicating a high degree of fractionation in the pegmatites[ii]. K/Rb is a key tool in identifying potentially spodumene-bearing dykes. Values below 30 are indicative of rare-earth pegmatites, 20 of spodumene-subtype pegmatites, and those below 10 are often associated with economic spodumene pegmatites.

The fractionated pegmatites of the Abiwin claims are ~44 kilometres from the western-most rare-element pegmatites identified to date on the White Willow property, (the Bingo pegmatite swarm) and extend the already immense strike length of the pegmatite field. (Fig. 1). The Abiwin claims are accessible via Crooked Pine Lake Road.

Figure 1 - Location Map for the White Willow Project. The Abiwin Block extends the LCT-pegmatite corridor to ~44 km.

The Abiwin claims are also host to the ultramafic "Quetico Intrusions", which are the target of Ni-Cu-PGE exploration efforts on Rio Tinto's adjacent JR property (Fig. 1). Historic grab samples from these intrusions on the Abiwin claims are reported to return up to 33 g/t Pt+Pd*, 3% Cu* and historic surface trenching yielded chip strings of up to 0.72% Zn over 2m (Puumula, 1992)*. The company intends to prioritize expenditures on the exploration for spodumene-bearing pegmatites, however the claims remain highly prospective for base and precious metal mineralization.

Pursuant to the Option Agreement, the Company may acquire a 100% interest in the Property by paying the Vendors a total of $100,000 and issuing an aggregate of 600,000 common shares ("Shares") in the capital of the Company as indicated in the table below:

Payment |

Cash |

Shares |

Signing |

$15,000 1 |

250,000 1 |

November 16, 2024 |

$20,000 |

250,000 2 |

November 16, 2025 |

$25,000 |

250,000 2 |

November 16, 2026 |

$40,000 |

250,000 2 |

Total |

$100,000 |

1,000,000 |

Notes |

|

|

The Company has granted a 2% net-smelter returns royalty (the "NSR") to the Vendor. The Company may purchase one-half of the net-smelter returns royalty (the "NSR") from the Vendor at any time for consideration of $1,000,000.

The transaction contemplated, including the issuance of the Shares, are subject to the final approval of the Exchange. The Shares will be subject to the applicable hold periods in accordance with securities laws in Canada and the Exchange policies.

The Company is also pleased to announce that it has made the first anniversary payments for the 8 mineral claims ("Nym") that comprise part of the White Willow Project. A total of $20,000 and 150,000 shares have been issued to the Vendors. The shares are subject to a hold period of four months and one day from the date of issuance.

The Company announces that, further to its news release of March 25, 2024, it has issued 15,000,000 common shares of the Company to the vendors of the option agreements entered into on March 23, 2024, with respect to the Bingo East and Bingo West properties. The shares are subject to a hold period of four months and one day from the date of issuance.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Adrian Smith, P.Geo., a qualified person as defined by National Instrument 43-101. Historical reports provided by the Optionors of the Mineral Claims were reviewed by the qualified person. The information provided has not been verified and is being treated as historic non-compliant intercepts.

About Usha Resources Ltd.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality lithium metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha's portfolio of strategic properties provides target-rich diversification and includes Jackpot Lake, a lithium brine project in Nevada and White Willow, a lithium pegmatite project in Ontario that is the flagship among its growing portfolio of hard-rock lithium assets. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

USHA RESOURCES LTD.

For more information, please call email info@usharesources.com or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements

[i] A LIBS analyzer is a portable device that provides semi-quantitative assessments of geochemical concentrations in real-time. These readings should not be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. LIBS readings are not representative of the whole core and represent purely a concentration measured at a single point.

[ii] Selway, J. et al. 2005. A Review of Rare-Element (Li-Cs-Ta) Pegmatite Exploration Techniques for the Superior Province, Canada, and Large Worldwide Tantalum Deposits. Exploration and Mining Geology, Vol. 14, Nos. 1-4, pp. 1-30.

SOURCE: Usha Resources Ltd.

View the original press release on accesswire.com