Dallas, Texas-based Invitation Homes Inc. (INVH) operates as a leading single-family home leasing and management company in the United States. With a market cap of $16.8 billion, Invitation Homes focuses on providing high-quality, updated homes in desirable neighborhoods, catering to modern lifestyle demands.

The REIT has underperformed the broader market over the past year and in 2025. INVH stock prices have dropped 11.1% in 2025 and 14.5% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16% gains on a YTD basis and 17.4% returns over the past year.

Narrowing the focus, Invitation Homes has also underperformed the industry-focused Residential REIT ETF’s (HAUS) 9.8% decline in 2025 and 12.3% drop over the past 52 weeks.

Invitation Homes’ stock prices gained 3.4% in the trading session following the release of its solid Q3 results on Oct. 29. Q3 was marked with robust same-store renewal rate growth and sustained momentum in funds from operations (FFO). The company has notably benefitted from its operational strategy and reported a robust 4.2% year-over-year growth in revenues to $688.2 million, beating the consensus estimates by 1.3%.

Its EPS for the quarter surged 46.7% year-over-year to $0.22, while core FFO remained flat at $0.47 per share, beating the consensus estimates by 2.2%.

For the full fiscal 2025, ending in December, analysts expect INVH to deliver a core FFO of $1.87, marginally down from $1.88 reported in 2024. However, the company has a solid FFO surprise history. It has surpassed the Street’s FFO estimates in each of the past four quarters.

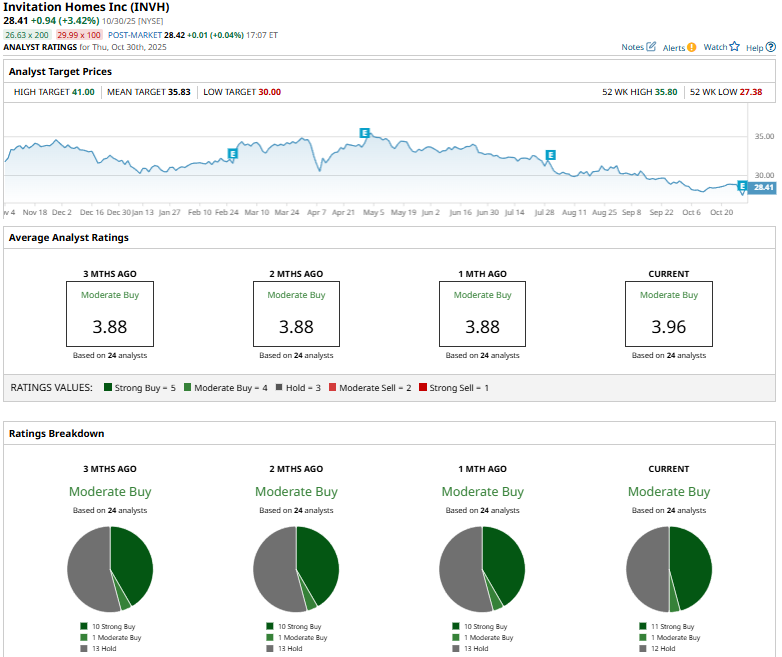

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buys,” one “Moderate Buy,” and 12 “Holds.”

This configuration is marginally more optimistic than a month ago, when 10 analysts gave “Strong Buy” recommendations.

On Oct. 21, Mizuho analyst Haendel St. Juste maintained an “Outperform” rating on INVH, but reduced the price target from $32 to $30.

INVH’s mean price target of $35.83 suggests a 26.1% upside potential. Meanwhile, the street-high target of $41 represents a 44.3% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever