Once positioned to be a “killer” in the electric vehicle industry, Rivian (RIVN), has been lagging the likes of Tesla (TSLA) and Google’s (GOOG) (GOOGL) Waymo both in terms of adoption and sales. Moreover, the company’s stock is down more than 80% from its IPO levels in 2021. For context, Tesla’s stock has more than doubled in this period.

But Tesla has its hands full in other domains like artificial intelligence, and it seems like Rivian is making a strategic bet to drive future growth from AI as well.

Autonomy and AI Day

Rivian hosted its first Autonomy & AI Day on Dec. 11. The event was designed to showcase Rivian’s autonomous driving and artificial intelligence strategy, including its technology roadmap for future vehicle autonomy.

At the event, Rivian showcased a major push into self-driving technology, unveiling a custom chip, an in-house vehicle computer, and new AI models built for its next-generation lineup. The company says these advances will lay the foundation for hands-free driving and eventually higher levels of autonomy.

Beginning in early 2026, Rivian plans to offer an Autonomy+ package for its new vehicles, available either as a one-time fee or a monthly subscription. Executives say a coming software update will introduce “Universal Hands-Free,” allowing drivers to go hands-free across millions of miles of mapped roads in North America.

Rivian’s autonomy roadmap also opens the door to future robotaxi services, expanding beyond personal vehicles once its technology matures. The company’s new AI-powered voice assistant and its high-bandwidth chip, scheduled for release in 2026, are meant to bolster its reputation as an innovator at a time when U.S. EV demand has softened.

Although shares are up more than 20% in the year to date, they are in the red for the past month, and are negative on Thursday despite the AI and autonomy announcements.

Rivian’s Financials in Review

Rivian is yet to turn a profit, and that makes it an arduous task for it to compete with deep-pocketed players in the domestic and international EV arena.

However, Q3 2025 showed some hope for improvement.

The company reported a beat on both the top line and bottom line. Total revenues of $1.56 billion represented a substantial year-over-year growth of 78.3%. Automotive revenues grew almost 4x to $2.9 billion from just $776 million in the year-ago period, and revenues from the software and services segment saw a leap to $416 million from a mere $98 million in the prior year.

Losses came in at $0.66 per share, lower than last year’s figure of $0.97 as well as the consensus estimate for a loss of $0.74 per share.

The company also reported net cash from operating activities of $26 million in Q3 2025, compared to an outflow of $876 million in the year-ago period. However slight it might be, a positive turn in the cash flow from operations is a significant development, and the company must now build on it.

Overall, Rivian closed the September quarter with a cash balance of $4.44 billion, much higher than its short-term debt levels of $1.48 billion.

With losses narrowing, the cash position remaining robust, and sales multiplying, on an absolute basis, Rivian is doing well. However, to compete with larger players like Tesla and Google, it requires a lot more heft and growth, along with sustainable profits that are steadily increasing.

What Aids and Ails Rivian

Rivian’s near-term outlook and overall valuation hinge almost entirely on the R2 midsize SUV. That vehicle is the company’s first real attempt to move from a high-price niche into the core of the auto market, with a planned sticker price well below current average transaction prices.

Management keeps pointing to the R2, followed by the smaller R3, as the triggers that will finally lift deliveries far above the 13,201 units shipped in Q3 2025, which itself was 31.8% ahead of the year-ago figure.

Meanwhile, the $5.8 billion Volkswagen partnership is already producing cash. Close to half of Rivian’s software and services revenue last quarter came directly from VW, proof that licensing its architecture and software stack is starting to contribute. On the infrastructure front, Rivian ended September with 95 service centers, 35 retail sites, and more than 850 fast chargers spread across 131 locations in 38 states, with 90% of those chargers now open to any EV.

Outside the auto business, Rivian has quietly placed two side bets. Its industrial robotics arm, Mind Robotics, recently closed a $115 million seed round. The company also retains a 40.6% stake in micromobility offshoot ALSO, which is working on electric bikes, scooters, and light utility vehicles.

Still, the numbers tell a sobering story. Full-year 2025 delivery guidance now sits at 41,500-43,500 vehicles. The low end was raised by 1,500 units, but the high end was cut by 2,500, leaving the midpoint 500 vehicles below the prior forecast. More importantly, the absolute level remains under the 50,000-plus units delivered back in 2023, even after several new variants were added this year. The bottleneck is clearly demand, not production capacity.

Additionally, when the R2 finally arrives, it will face a far more crowded field than originally expected. Tesla’s refreshed Model Y already offers 330 miles of range from around $47,000 with unmatched scale and efficiency. On top of that, BYD’s Tang EV comes in cheaper in most markets, while Hyundai’s Ioniq 5, Kia’s EV6, and the Chevrolet Equinox EV will all be in full swing through 2026.

Thus, Rivian will need to lean hard on the Volkswagen cash, its budding software revenue stream, and any cost savings the R2 platform can deliver to turn current momentum into a genuine volume breakout and a credible path to gross-margin profitability.

Analyst Opinion

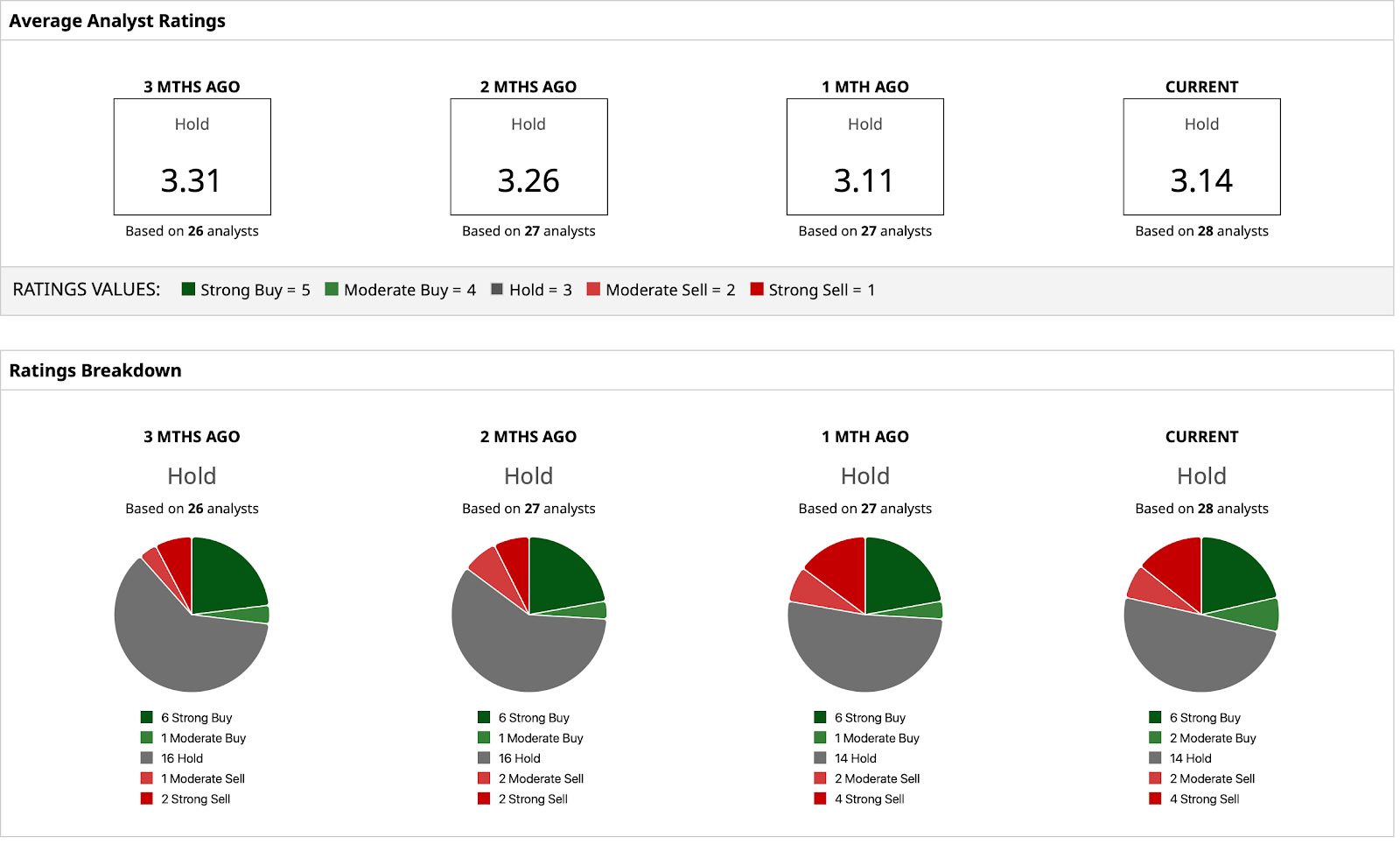

Overall, analysts continue to maintain a “Hold” rating on the stock, with a mean target price that has already been surpassed. The high target price of $25 indicates upside potential of about 43% from current levels.

Out of 28 analysts covering the stock, six have a “Strong Buy” rating, two have a “Moderate Buy” rating, 14 have a “Hold” rating, two have a “Moderate Sell” rating, and four have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?

- Rivian’s Autonomy & AI Day Failed to Move the Needle for RIVN Stock. How Should You Play It Here?