Newark, New Jersey-based Prudential Financial, Inc. (PRU) is a global financial services company that provides life insurance, retirement solutions, asset management, and annuities for individuals and institutional clients. Valued at a market cap of $37.7 billion, the company offers products that support long-term financial protection, income planning, and wealth accumulation.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and PRU fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the insurance - life industry. The company generates steady cash flow through recurring premiums, long-term customer relationships, and strong brand trust. At the same time, it is reshaping its business to focus more on faster-growing and less capital-intensive areas, which is expected to support better long-term profitability.

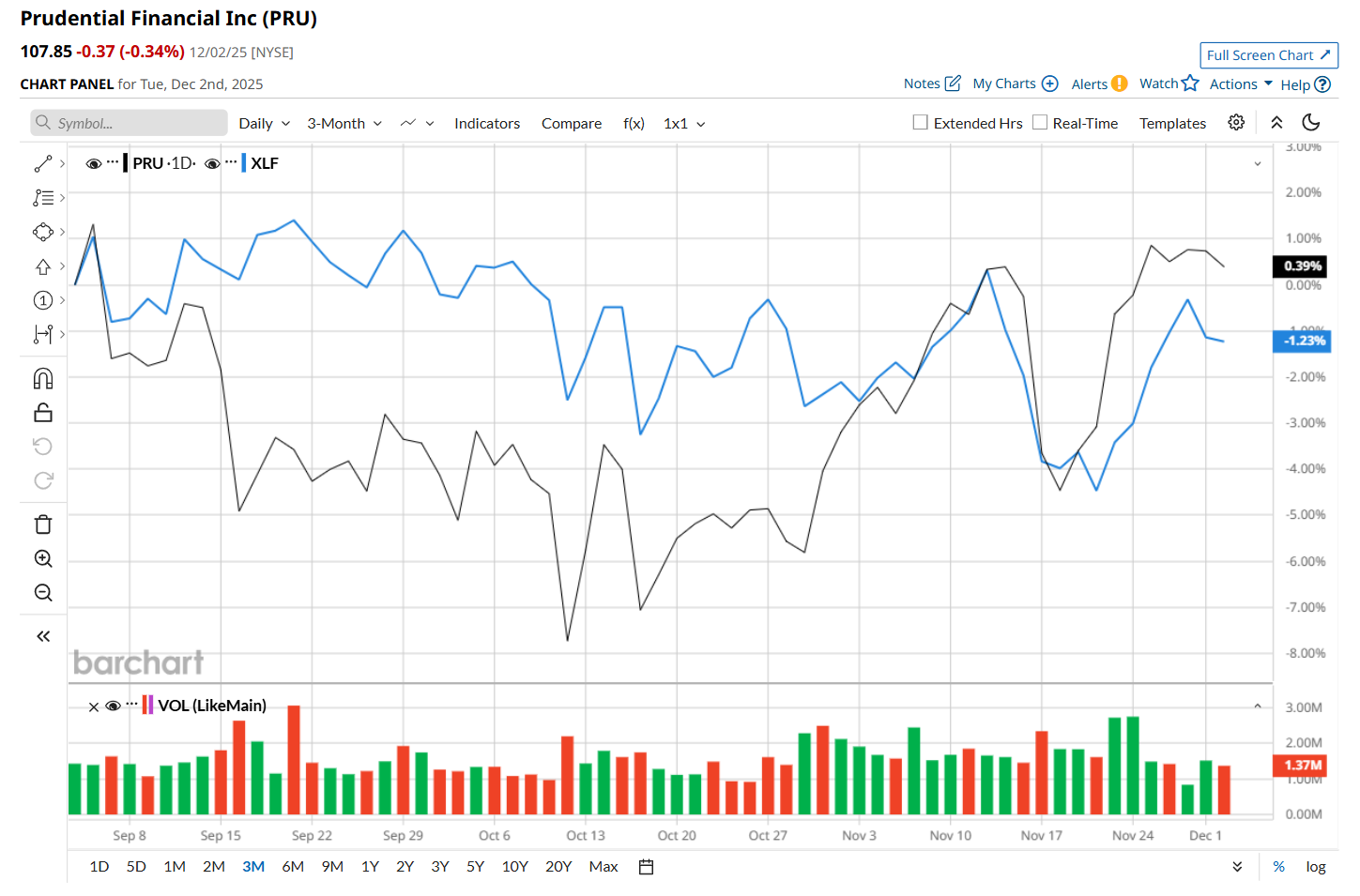

This insurance company is currently trading 16.2% below its 52-week high of $128.72, reached on Dec. 3, 2024. Shares of PRU have gained marginally over the past three months, outperforming the Financial Select Sector SPDR Fund’s (XLF) 1.4% drop during the same time frame.

However, on a YTD basis, shares of PRU are down 9%, trailing behind XLF’s 9.3% return. Moreover, in the longer term, PRU has declined 16% over the past 52 weeks, considerably lagging behind XLF’s 4% uptick over the same time frame.

To confirm its recent bullish trend, PRU has been trading above its 200-day moving average since late November and has remained above its 50-day moving average since late October, with minor fluctuations.

On Oct. 29, Prudential Financial released better-than-expected Q3 results, and its shares surged 1.9% in the following trading session. Due to strong growth in adjusted operating income across all its business segments, the company’s adjusted EPS increased 27.9% year-over-year to $4.26, surpassing consensus estimates by a notable margin of 16.4%. Additionally, its assets under management grew 3.5% year over year to $1.6 trillion.

PRU has also underperformed its rival, MetLife, Inc. (MET), which declined 12.2% over the past 52 weeks and 6.9% on a YTD basis.

Despite PRU’s recent outperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 19 analysts covering it, and the mean price target of $117.07 suggests an 8.5% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear AVGO Stock Fans, Mark Your Calendars for December 11

- Small-Cap Investment Firm Slumps to 52-Week Low: Opportunity or Red Flag?

- IonQ Wants to Bring Quantum Computing to Medicine. Should You Buy IONQ Stock Here?

- Jamie Dimon Once Called Bitcoin a ‘Fraud.’ Now, JPMorgan Is Quietly Making Blockchain History and Betting This ‘Crypto Winter’ Will Be Short-Lived.