Atomic's PayLink Manage outshines other solutions by enabling users to both monitor their recurring payments and make real-time changes within the banking app.

Atomic, the leader in payroll connectivity, has launched PayLink Manage, a subscription management technology designed to help account holders seamlessly view, update and optimize all their recurring payments directly within their financial institution’s app, helping them to take action to cut unnecessary spending and be better with their money. Banks will experience more frequent, meaningful interactions, deepening the overall customer relationship and confirming their position as the primary financial relationship.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240521291385/en/

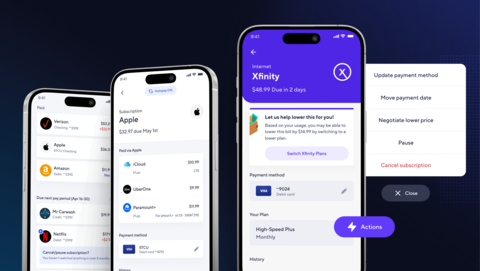

Atomic’s PayLink Manage surpasses other solutions by allowing users to not only view all of their recurring payments, but also to take real-time actions on them without ever having to leave the banking app. With Atomic's direct connectivity, insights into usage data, plan details, itemized receipts, and other critical subscription information are accessible, providing deeper analysis and facilitating precise actions that help consumers save money. (Graphic: Business Wire)

PayLink Manage addresses the growing complexity consumers face with managing recurring payments by centralizing and automating oversight and control. This feature provides a unified experience where consumers can go to connect, view and track all of their recurring payments, including subscriptions and bills such as streaming services, phone and internet plans, auto-insurance, rent, and mortgage payments.

Atomic’s PayLink Manage surpasses other solutions by allowing users to not only view all of their recurring payments, but also to take real-time actions on them without ever having to leave the banking app. With Atomic's direct connectivity, insights into usage data, plan details, itemized receipts, and other critical subscription information are accessible, providing deeper analysis and facilitating precise actions that help consumers save money.

"The new products Atomic chooses to invest in and build are determined after thoughtful conversations with clients and extensive market research. We’re confident that within a few years subscription management will become a must-have feature in any leading consumer banking application," said Jordan Wright, Co-Founder and CEO of Atomic. "By integrating PayLink Manage, banks can not only improve their service offerings and increase engagement, but also can solidify themselves as the primary banking relationship. When banks help their account holders with innovative insights that are actionable, everybody wins.”

PayLink Manage is more than just a tool; it's a strategic advantage for financial institutions aiming to meet the evolving needs of their customers, all while helping to solidify their position as the primary banking relationship:

- Enhanced Service Offering: Integrating subscription management capabilities into banking apps enriches the suite of services offered to consumers and gives them a powerful tool to help them take control of their finances.

- Deepen Relationships: Serving as the mission control for account holders' financial activities allows financial institutions to be their go-to resource for monitoring spending, identifying opportunities to cut costs, and finding ways to save money.

- Competitive Edge: Providing a unique solution that differentiates financial institutions in the market.

- Customer Retention: Providing a subscription management tool enhances customer satisfaction by empowering users with greater control and delivering actionable advice to improve their financial lives. This increased value, driven by meaningful guidance and actions that help to alleviate financial stress, could lead to stronger customer loyalty and reduced churn.

- Cross-Selling Opportunities: Providing banks with data on customer spending habits and financial needs to enable more targeted and timely offers for related financial products like loans, insurance, and savings accounts. This may increase revenue through successful cross-selling.

"PayLink leverages Atomic’s proven technology, which has already facilitated millions of secure connections across financial platforms," said Andrea Martone, Chief Product Officer of Atomic. "With this launch, we are extending our trusted, robust connectivity framework to subscription management, providing financial institutions with a tool to enhance customer engagement and improve retention by helping people take action to improve their financial outcomes."

This innovative approach is aligned with market demand and regulatory shifts towards greater consumer control over financial data. PayLink's adoption represents a crucial step in the future of consumer banking, where convenience and security converge to help put financial control back in the hands of consumers.

For more information about PayLink Manage, or to request a demo, visit atomic.financial.

About Atomic

Atomic is a leading financial connectivity platform trusted by over 195 financial institutions and fintech firms, including 13 of the industry's largest digital-first neobanks and 5 of the top 10 financial institutions. Atomic serves as the essential bridge between consumer data and financial solutions by allowing unparalleled access to payroll, HRIS, and merchant systems, facilitating a range of financial services by offering solutions for direct deposit switching, income and employment verification, payment method updating and subscription management.

With over $70 million in backing from trusted investors like Mercato Partners, Core Innovation Capital, Portage, ATX Venture Partners, and Greylock, Atomic is well-positioned to accelerate its vision of services that benefit both consumers and financial institutions. As open banking continues to shape the U.S. financial landscape, Atomic remains committed to empowering consumers to have better control of their personal data, offering a more transparent and equitable banking experience for all. To learn more visit atomic.financial.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240521291385/en/

Contacts

Press Contacts

Atomic

Becky Ross

Head of Marketing

Becky@atomicfi.com

Avenue Z

Bristol Jones

Bristol.Jones@AvenueZ.com