Consumer-Focused Cyber Safety

As the world spends countless hours on their computers, tablets and phones, Gen Digital (NASDAQ: GEN) is doing its part to keep it safe.

A year removed from changing its name from NortonLifeLock, the Arizona-based company is one of the most prominent names in consumer cyber safety. Nearly 500 million people across 150 countries rely on Gen Digital products to protect their personal information and avoid destructive malware. Popular software brands like Norton, Avira and CCleaner quietly lurk in the background of electronic devices everywhere.

An afterthought for some who get the software as part of a Best Buy purchase, cybersecurity services are the lifeblood of Gen Digital. Built-in relationships with personal computer (PC) manufacturers and distributors as well as consumer aftermarket subscriptions drive revenue.

Work-from-home trends during the pandemic boosted the company’s financial results and stock. As businesses and a growing cadre of entrepreneurs scrambled to establish secure remote work setups, Gen Digital hauled in more than $2.5 billion in annual sales and enjoyed 60% profit growth in fiscal 2021. Its stock performance soon followed. By February 2022, Gen Digital shares had doubled off their March 2020 low and appeared destined to surpass their $34.20 record high.

But like other consumer-facing businesses, negative economic forces have taken a toll. Inflation and rising interest rates have caused people to slow spending on expensive laptops and the latest smartphones. Anti-virus protection shifted from a necessity to a luxury. Subscriptions were canceled for the sake of the budget.

Meanwhile, Gen Digital spent over $8 billion to acquire Avast, PLC, a consumer cybersecurity firm based in the Czech Republic. Although this bolstered the company’s market position, it also increased its debt burden. The combination of higher interest expenses and softer demand led to just 3% profit growth in fiscal 2023.

Discouraged by the sharp contrast to 60% growth, bears have been largely in control of Gen Digital stock since it crossed the $30.00 mark early last year. On Friday, it closed at $17.16, not far from its Covid crash low — and almost 50% off its all-time high.

Has the market gone too far?

Customer Losses May Be at a Turning Point

The Avast acquisition was probably ill-timed and came at a steep price. But it also pushed the company closer to its goal of becoming the dominant player in consumer cybersecurity.

Despite the near-term macro headwinds, the need for malware protection isn’t going away — especially with the increasing occurrence of high-profile consumer data breaches. As developing economies like India and China gain greater Internet access, buy more electronic devices and undergo digital transformations, demand for safe work, e-commerce and digital entertainment experiences will only grow.

Granted, it will take time for Gen Digital to get to the light at the other end of the tunnel. In its most recently reported quarter, the company lost 29,000 direct customers and grew revenue by just 2%. This is significant progress, however, after it lost 180,000 and 219,000 customers, respectively, in the previous two quarters. If management announces lower attrition or, better yet, a return to customer growth during its November 7th update, bulls could be energized.

Adding Value for Subscribers…

Investors may be encouraged by the fiscal 2024 second-quarter results next month, but it's the longer-term growth opportunity that matters more. With Gen Digital and Avast having a stranglehold on anti-malware firewall software, the company should be able to expand into adjacent product areas such as consumer identity and privacy software.

Spending on these ‘trust-based’ solutions is expected to grow at a faster pace than Gen Digital’s core cybersecurity market. Management estimates that the trust-based software market will grow at a 10% to 15% rate over the next three years compared to 5% to 10% for anti-malware. Traction in the identity and privacy arena would allow Gen Digital to build off its estimated 26% anti-malware market share and further distance itself from rivals like McAfee and Trend Micro.

With product launches a key theme to watch in the coming years, Gen Digital hasn’t been shy about broadening its offerings in a weak IT spending environment. Part of the reason has been to capitalize on the artificial intelligence (AI) boom.

In July 2023, the company introduced an AI-powered scam detector called Norton Genie AI. It helps identify fraudulent emails, social media messages and website links and gives users real-time guidance on how to manage them. While the tool is free, it could help with subscriber retention and acquisition — and serve as the basis for future cybersecurity innovations.

Norton Genie has been followed by a spree of new products and features designed to give cash-strapped subscribers more bang for their buck. Over the past month alone, Gen Digital has rolled out:

- Norton Secure Browser – an advanced web browser with customizable, built-in security and privacy tools;

- Norton Small Business – an all-in-one cybersecurity solution for small businesses and entrepreneurs that protects against scams and phishing (which account for 85% of small business online threats); and

- Norton Enhanced Password Manager and Anti-Track features help customers protect their privacy and get ahead of threats (an early entry into the privacy and identity market).

Collectively, these launches could drive customer count outperformance and set the stage for a stronger-than-expected fiscal 2024.

…And Value for Shareholders

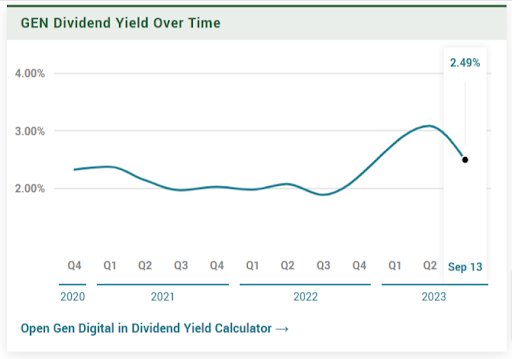

As Gen Digital’s recovery and growth story unfolds, investors have an opportunity to collect a nice dividend in addition to whatever share price appreciation happens. The stock pays a $0.125 per share quarterly dividend that equates to a 2.9% annualized forward yield. This is an unusually high payout for a technology company but shouldn’t be interpreted as a substitute for a lack of growth prospects.

Most systems software large caps don’t pay a dividend. Microsoft (0.9% yield) and Oracle (1.6% yield) are the exceptions. Remarkably, Gen Digital has stronger dividend coverage ratios than both of its much larger peers. Based on trailing 12 months earnings per share (EPS), the dividend coverage of 4.2x comfortably exceeds that of Microsoft (3.5x) and Oracle (2.0x).

Gen Digital also offers shareholder value in the form of an active share repurchase program. The company bought back $41 million of its own stock in the first quarter of fiscal 2024 (ended June 30th, 2023) after repurchasing $904 million in fiscal 2023.

A Cheap Cybersecurity Pure-Play

The Avast deal has understandably been met with much criticism. It added to an already high debt burden (in a rising interest rate environment) and caused the share count to go up by about 10%. Leverage and dilution are valid reasons to exit any stock, especially when the macro backdrop is less than supportive.

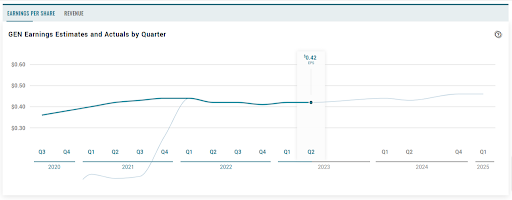

What is a reason to enter the stock though, is that Avast is slated to go from having a negative to a positive impact on earnings. After it reduced fiscal 2024 Q1 EPS by $0.20, management said that it expects that the acquisition will increase the bottom line within the first 12 months of the closing. Since this brings us to September 2023, Avast groans could soon turn into Avast cheers.

The consensus EPS projection for the current fiscal year is $1.98. This gives Gen Digital a price-to-earnings (P/E) ratio of only 9x. The stock looks even less expensive when we look to next year, when profits are forecast to grow 20% to $2.28 per share. At 7x next year’s earnings, Gen Digital is by far the cheapest stock in the large-cap systems software space. Peers like Zscaler (60x), CrowdStrike (52x) and Fortinet (33x) represent far pricier ways to gain exposure to cybersecurity growth.

Wall Street price targets also suggest the recent Gen Digital selloff has gone too far. While the $11 billion market cap stock is thinly followed, the average analyst target is $22.00 — which implies nearly 30% upside from Friday’s close. Add in the dividend, and the potential total return over the next 12 months looks even better.

Bottom Line

Gen Digital has been hampered by customer losses tied to economic weakness rather than product quality. With demand likely to pick up as inflation and rate pressures ease, the company should benefit from an increasing global need for cybersecurity solutions and hybrid workforce trends. Its potential to expand into the faster-growing trust-based software space is an underappreciated catalyst.

Given the low valuation and the substantial dividend payout, buy-and-hold investors appear to have a favorable margin of ‘safety’ when it comes to this consumer cybersecurity leader.