Electricity storage and software provider Fluence (NASDAQ:FLNC) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 82.5% year on year to $1.23 billion. On the other hand, the company’s full-year revenue guidance of $4 billion at the midpoint came in 1.5% above analysts’ estimates. Its GAAP profit of $0.34 per share was 19.8% above analysts’ consensus estimates.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it’s free.

Fluence Energy (FLNC) Q3 CY2024 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.29 billion (82.5% year-on-year growth, 4.7% miss)

- Adjusted EPS: $0.34 vs analyst estimates of $0.28 (19.8% beat)

- Adjusted EBITDA: $86.87 million vs analyst estimates of $70.66 million (7.1% margin, 22.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $4 billion at the midpoint, beating analyst estimates by 1.5% and implying 48.2% growth (vs 19.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $180 million at the midpoint, below analyst estimates of $190.2 million

- Operating Margin: 5.7%, up from 1.8% in the same quarter last year

- Free Cash Flow Margin: 0.4%, down from 6.8% in the same quarter last year

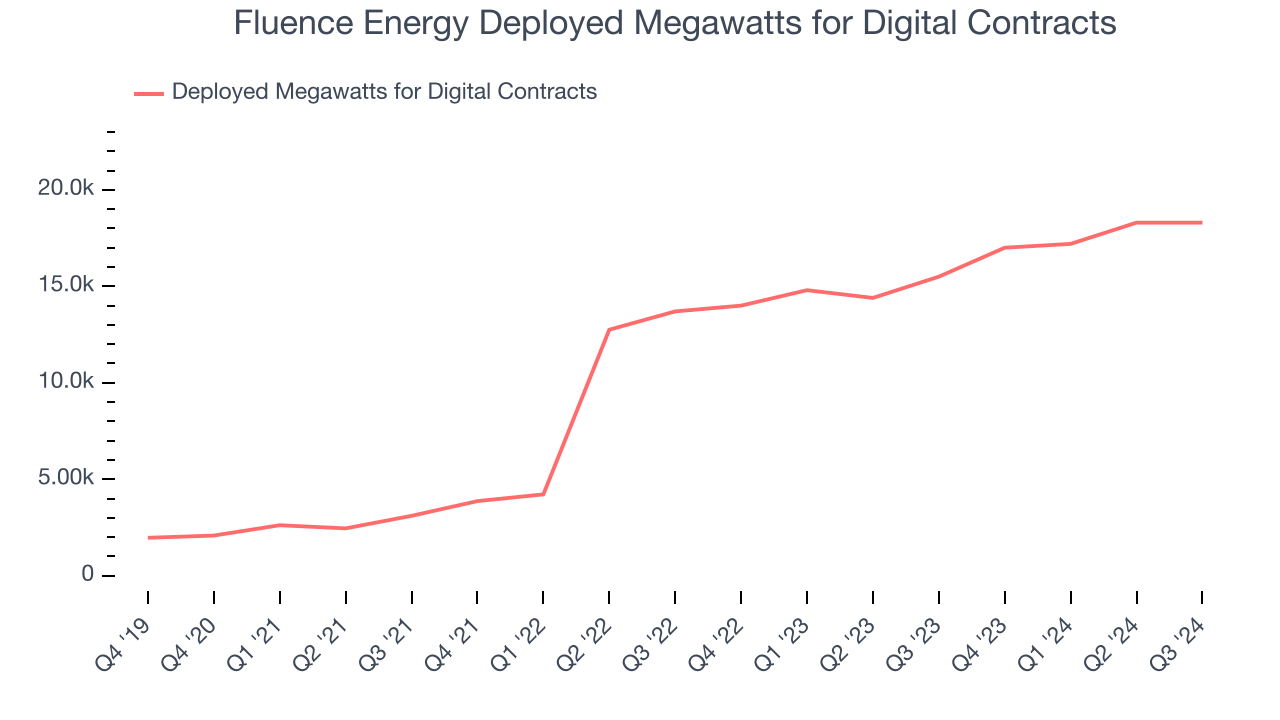

- Deployed Megawatts for Digital Contracts: 18,300, up 2,800 year on year

- Backlog: $4.5 billion at quarter end

- Market Capitalization: $2.97 billion

"Our record financial results for 2024 are a testament to our team's dedication, operational efficiency, and commitment to delivering value to our stakeholders as we achieved our highest ever revenue and profitability, marking a significant milestone in the Company's growth trajectory. Furthermore, we had our second consecutive quarter of signing more than $1 billion of new orders, which brought our backlog to $4.5 billion, underscoring the market's strong confidence in our energy storage solutions," said Julian Nebreda, the Company’s President and Chief Executive Officer.

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

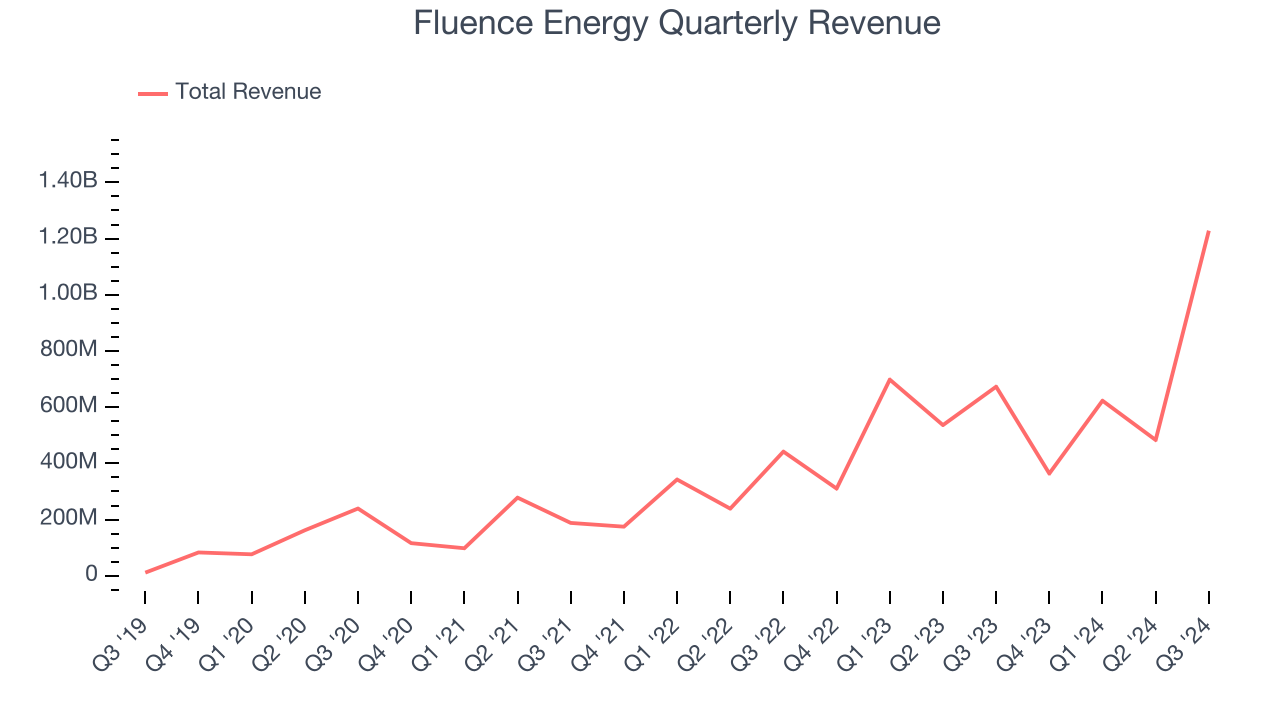

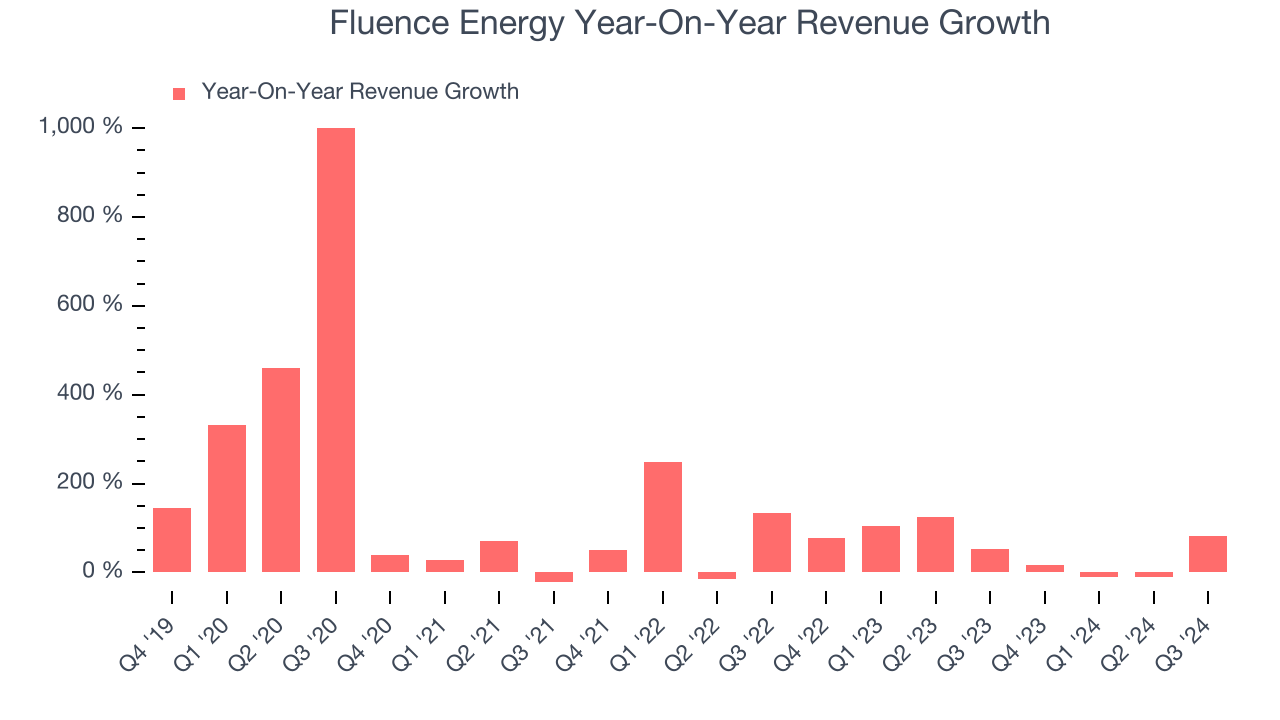

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Fluence Energy’s 96.5% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Fluence Energy’s annualized revenue growth of 50% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

We can better understand the company’s revenue dynamics by analyzing its number of deployed megawatts for digital contracts, which reached 18,300 in the latest quarter. Over the last two years, Fluence Energy’s deployed megawatts for digital contracts averaged 77.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Fluence Energy achieved a magnificent 82.5% year-on-year revenue growth rate, but its $1.23 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 42.8% over the next 12 months, a deceleration versus the last two years. This projection is still commendable and implies the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

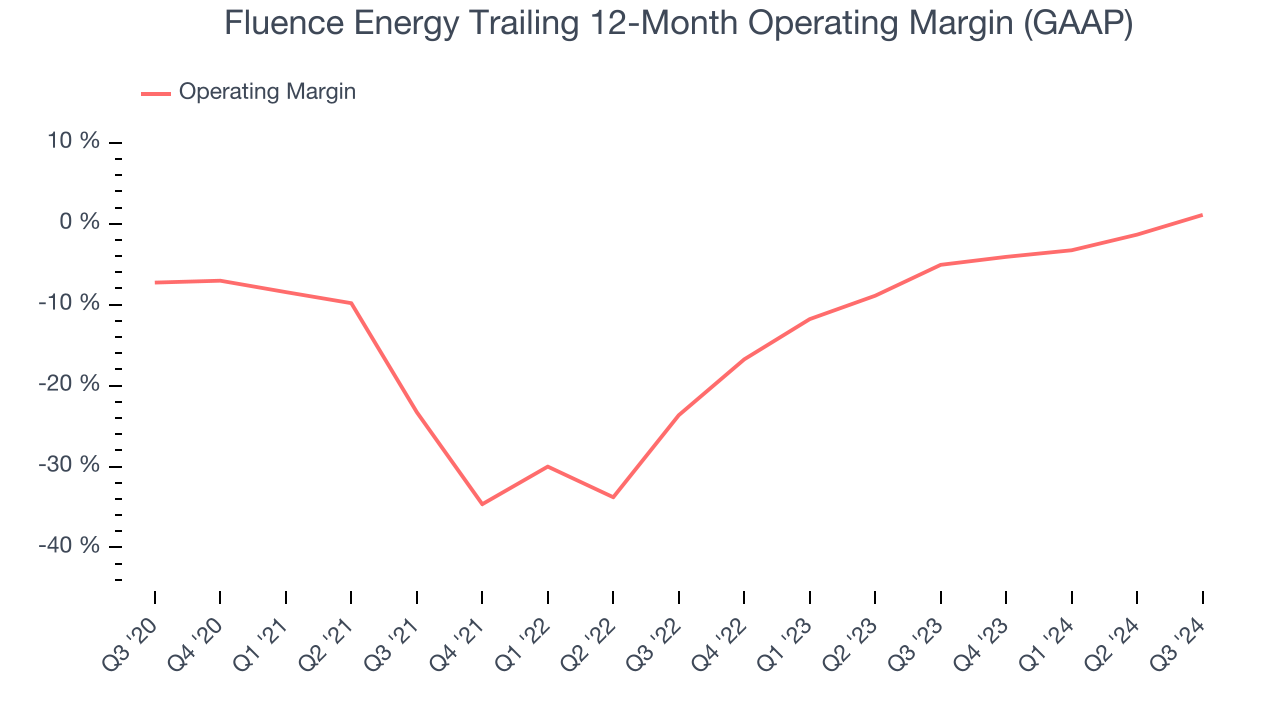

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Fluence Energy was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 7.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Fluence Energy’s annual operating margin rose by 8.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Fluence Energy generated an operating profit margin of 5.7%, up 3.9 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

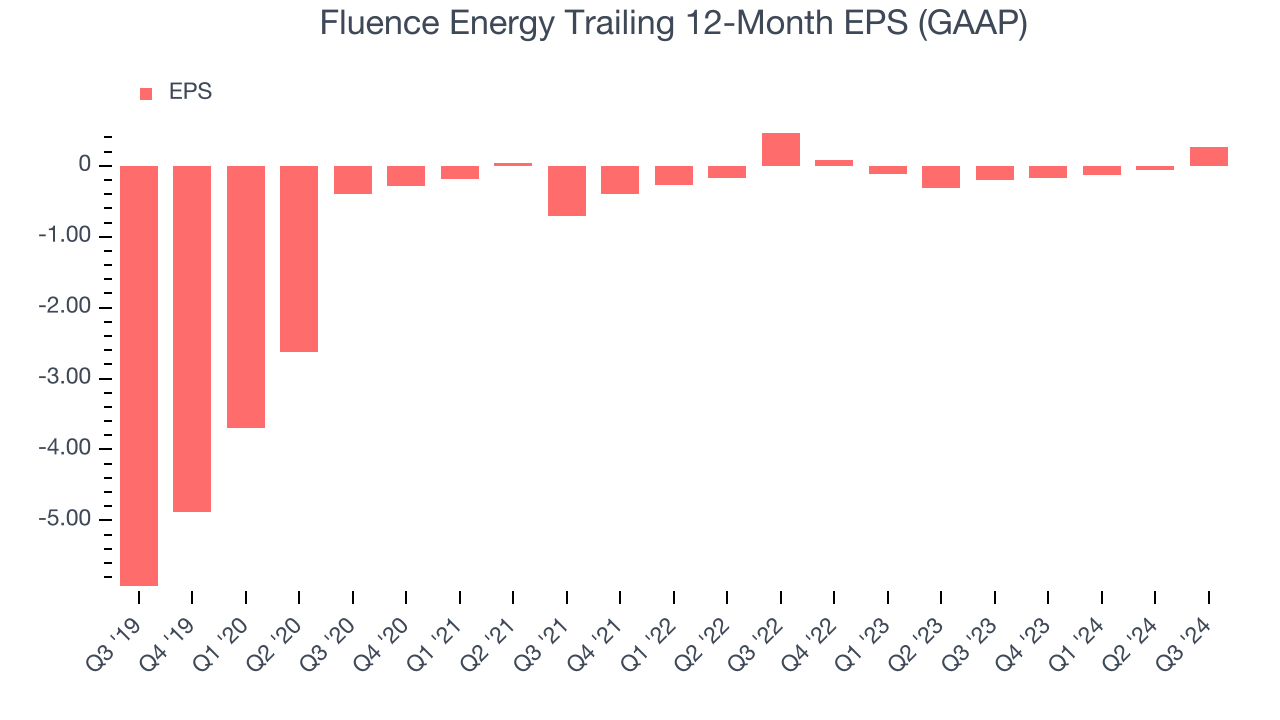

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Fluence Energy’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

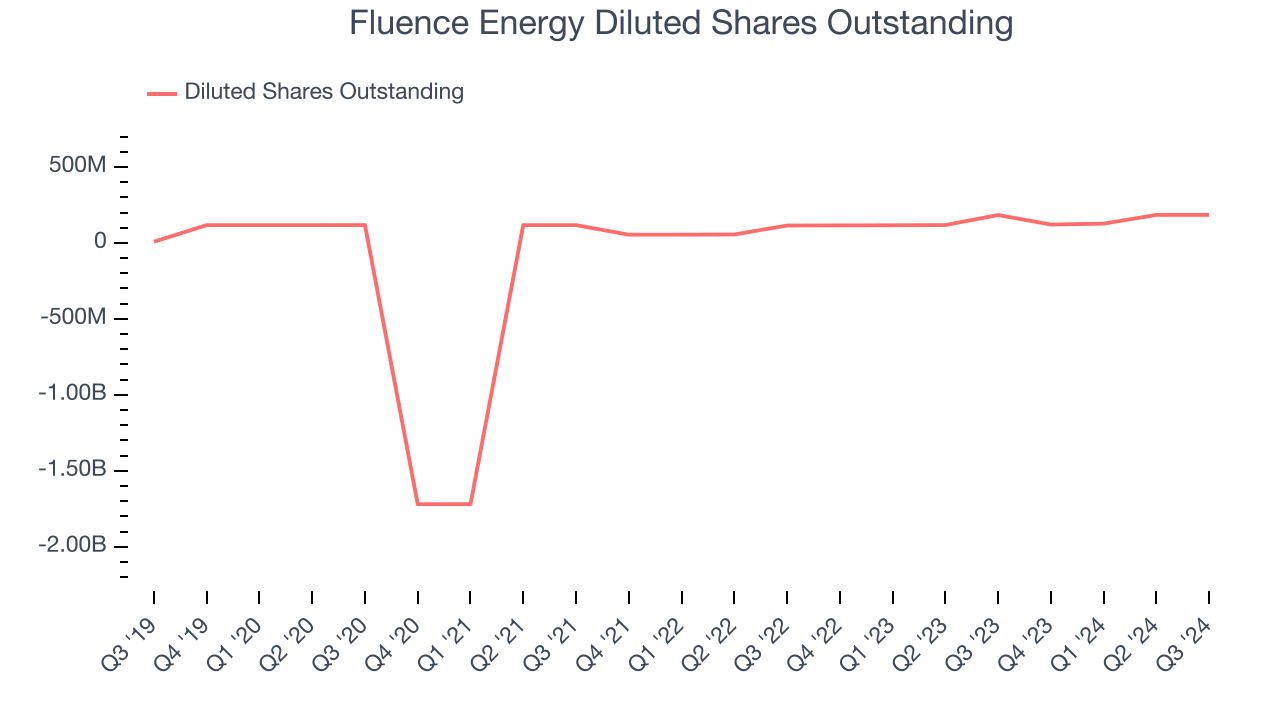

Sadly for Fluence Energy, its EPS declined by 24.4% annually over the last two years while its revenue grew by 50%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Fluence Energy’s earnings to better understand the drivers of its performance. A two-year view shows Fluence Energy has diluted its shareholders, growing its share count by 61.2%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Fluence Energy reported EPS at $0.34, up from $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Fluence Energy’s full-year EPS of $0.27 to grow by 119%.

Key Takeaways from Fluence Energy’s Q3 Results

We were impressed by how significantly Fluence Energy blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed significantly. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.2% to $24.75 immediately after reporting.

Fluence Energy had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.