Over the past six months, Dole has been a great trade, beating the S&P 500 by 12.5%. Its stock price has climbed to $14.78, representing a healthy 23.1% increase. This run-up might have investors contemplating their next move.

Is now the time to buy Dole, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're swiping left on Dole for now. Here are three reasons why you should be careful with DOLE and a stock we'd rather own.

Why Do We Think Dole Will Underperform?

Cherished for its delicious, world-famous pineapples and Hawaiian roots, Dole (NYSE: DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

1. Revenue Spiraling Downwards

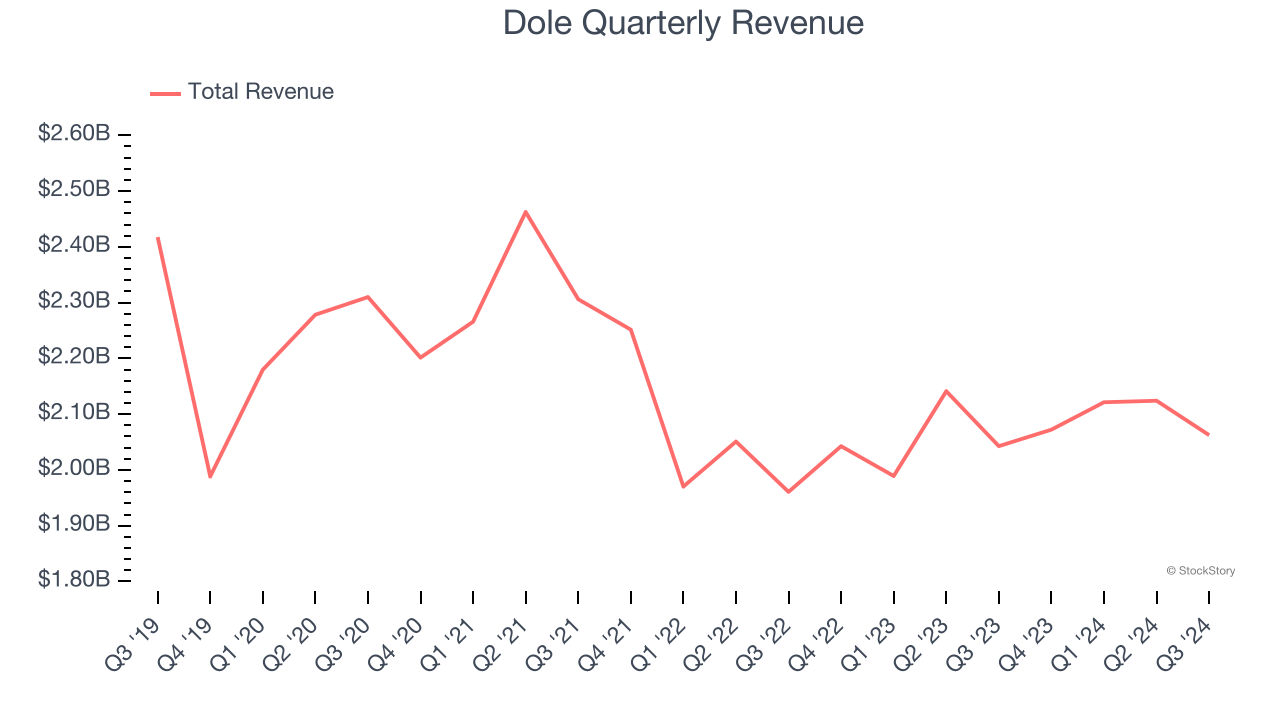

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Dole’s demand was weak over the last three years as its sales fell at a 3.2% annual rate. This fell short of our benchmarks and is a sign of poor business quality.

2. Low Gross Margin Reveals Weak Structural Profitability

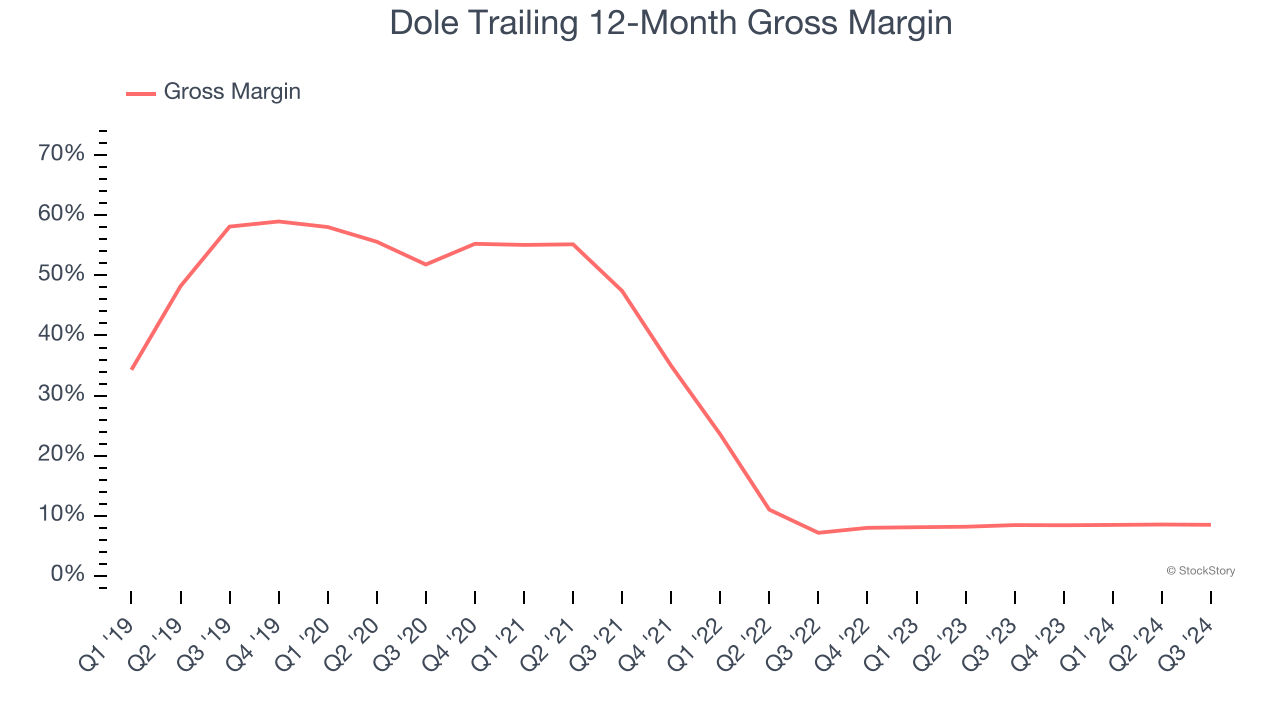

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Dole has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.5% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $91.53 went towards paying for raw materials, production of goods, transportation, and distribution.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Dole’s revenue to stall. Although this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

Final Judgment

We see the value of companies helping consumers, but in the case of Dole, we’re out. With its shares beating the market recently, the stock trades at 10.1× forward price-to-earnings (or $14.78 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Dole

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.