As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the data storage industry, including DigitalOcean (NYSE: DOCN) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

The 5 data storage stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was 0.8% above.

While some data storage stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.2% since the latest earnings results.

DigitalOcean (NYSE: DOCN)

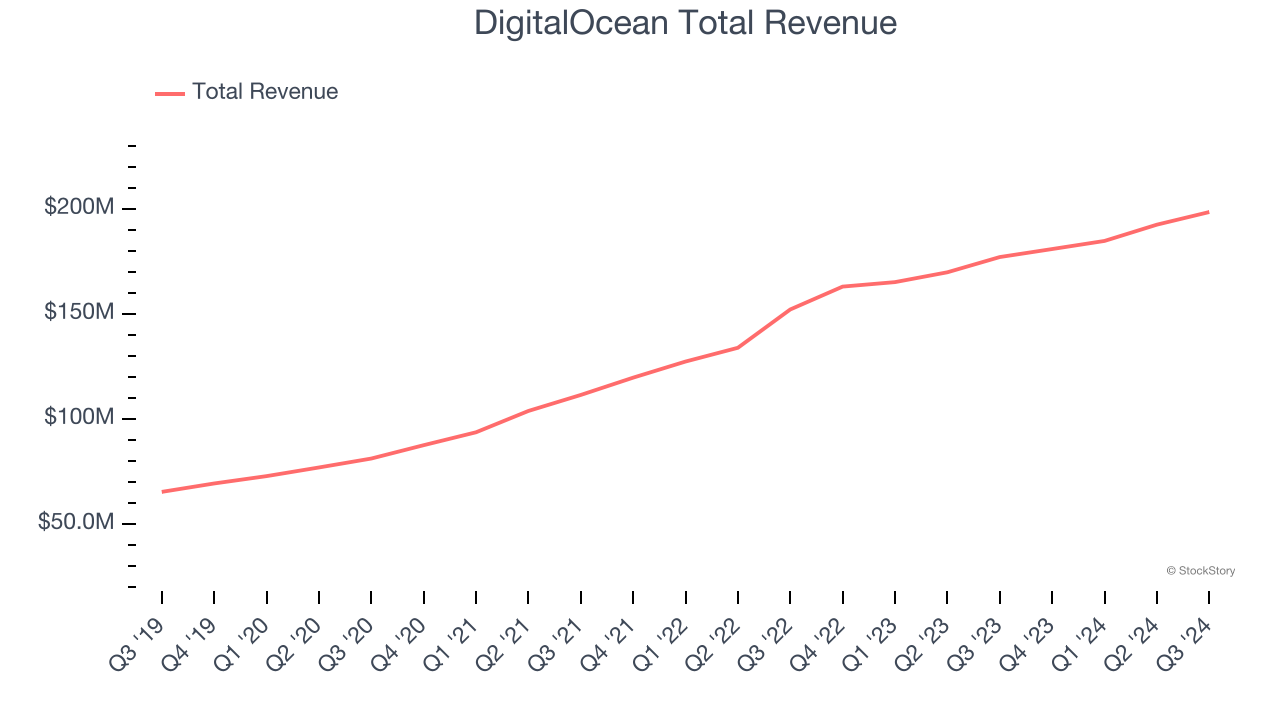

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $198.5 million, up 12.1% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

“We had a successful quarter, enabling us to raise our full year revenue guidance while still maintaining full year free cash flow margin guidance,” said Paddy Srinivasan, CEO of DigitalOcean.

DigitalOcean delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 12% since reporting and currently trades at $35.91.

Is now the time to buy DigitalOcean? Access our full analysis of the earnings results here, it’s free.

Best Q3: Commvault Systems (NASDAQ: CVLT)

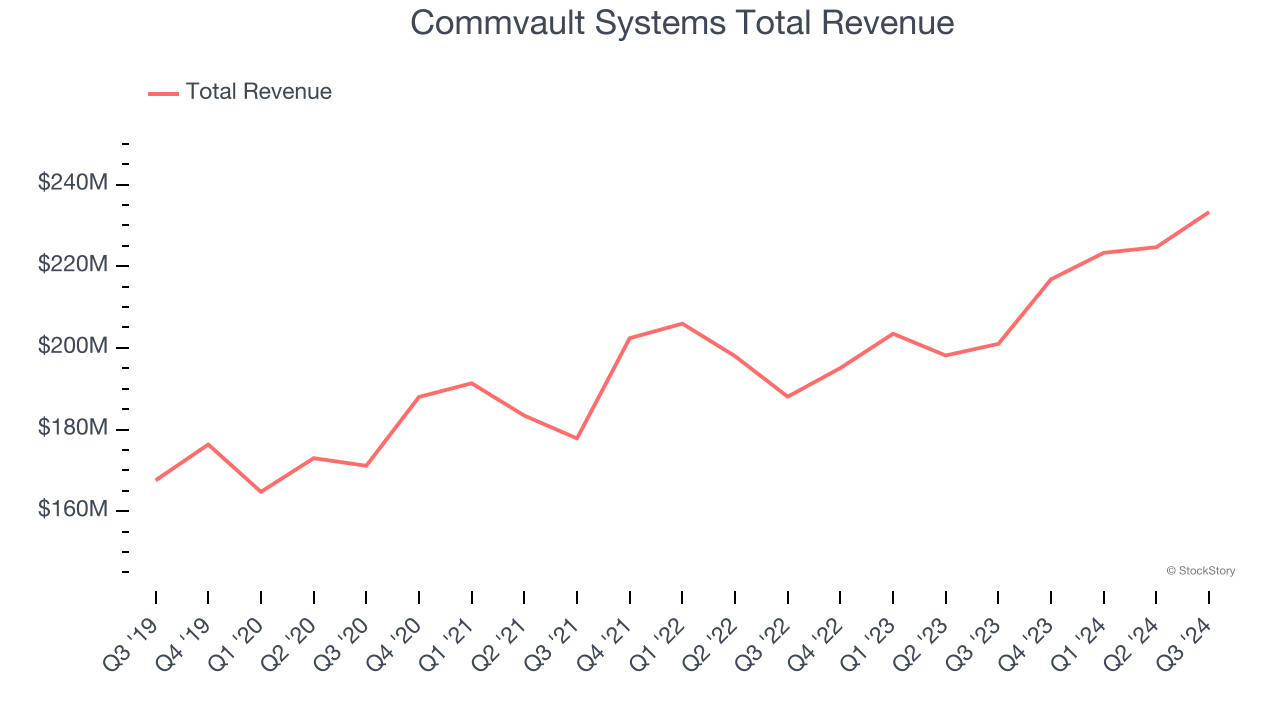

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Commvault Systems reported revenues of $233.3 million, up 16.1% year on year, outperforming analysts’ expectations by 5.6%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Commvault Systems pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 14.3% since reporting. It currently trades at $156.61.

Is now the time to buy Commvault Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Couchbase (NASDAQ: BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ: BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

Couchbase reported revenues of $51.63 million, up 12.7% year on year, exceeding analysts’ expectations by 1.7%. Still, it was a slower quarter as it posted a significant miss of analysts’ billings estimates.

Couchbase delivered the weakest full-year guidance update in the group. As expected, the stock is down 23.5% since the results and currently trades at $16.17.

Read our full analysis of Couchbase’s results here.

MongoDB (NASDAQ: MDB)

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $529.4 million, up 22.3% year on year. This print topped analysts’ expectations by 6.8%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

MongoDB scored the biggest analyst estimates beat among its peers. The company added 125 enterprise customers paying more than $100,000 annually to reach a total of 2,314. The stock is down 29.2% since reporting and currently trades at $248.25.

Read our full, actionable report on MongoDB here, it’s free.

Snowflake (NYSE: SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE: SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $942.1 million, up 28.3% year on year. This result surpassed analysts’ expectations by 4.9%. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

Snowflake pulled off the fastest revenue growth among its peers. The company added 32 enterprise customers paying more than $1 million annually to reach a total of 542. The stock is up 29.3% since reporting and currently trades at $167.02.

Read our full, actionable report on Snowflake here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.