Database as a service company Couchbase (NASDAQ: BASE) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 12.7% year on year to $51.63 million. On the other hand, next quarter’s revenue guidance of $52.75 million was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP loss of $0.05 per share was 37.9% above analysts’ consensus estimates.

Is now the time to buy Couchbase? Find out by accessing our full research report, it’s free.

Couchbase (BASE) Q3 CY2024 Highlights:

- Revenue: $51.63 million vs analyst estimates of $50.77 million (12.7% year-on-year growth, 1.7% beat)

- Adjusted EPS: -$0.05 vs analyst estimates of -$0.08 (37.9% beat)

- Adjusted Operating Income: -$3.48 million vs analyst estimates of -$5.09 million (-6.7% margin, 31.7% beat)

- Revenue Guidance for Q4 CY2024 is $52.75 million at the midpoint, below analyst estimates of $53.98 million

- Operating Margin: -37.3%, up from -38.3% in the same quarter last year

- Free Cash Flow was -$17.48 million compared to -$5.71 million in the previous quarter

- Annual Recurring Revenue: $220.3 million at quarter end, up 16.7% year on year

- Market Capitalization: $1.05 billion

"I'm pleased with the continued operational progress of the entire Couchbase team," said Matt Cain, Chair, President and CEO of Couchbase.

Company Overview

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ: BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Sales Growth

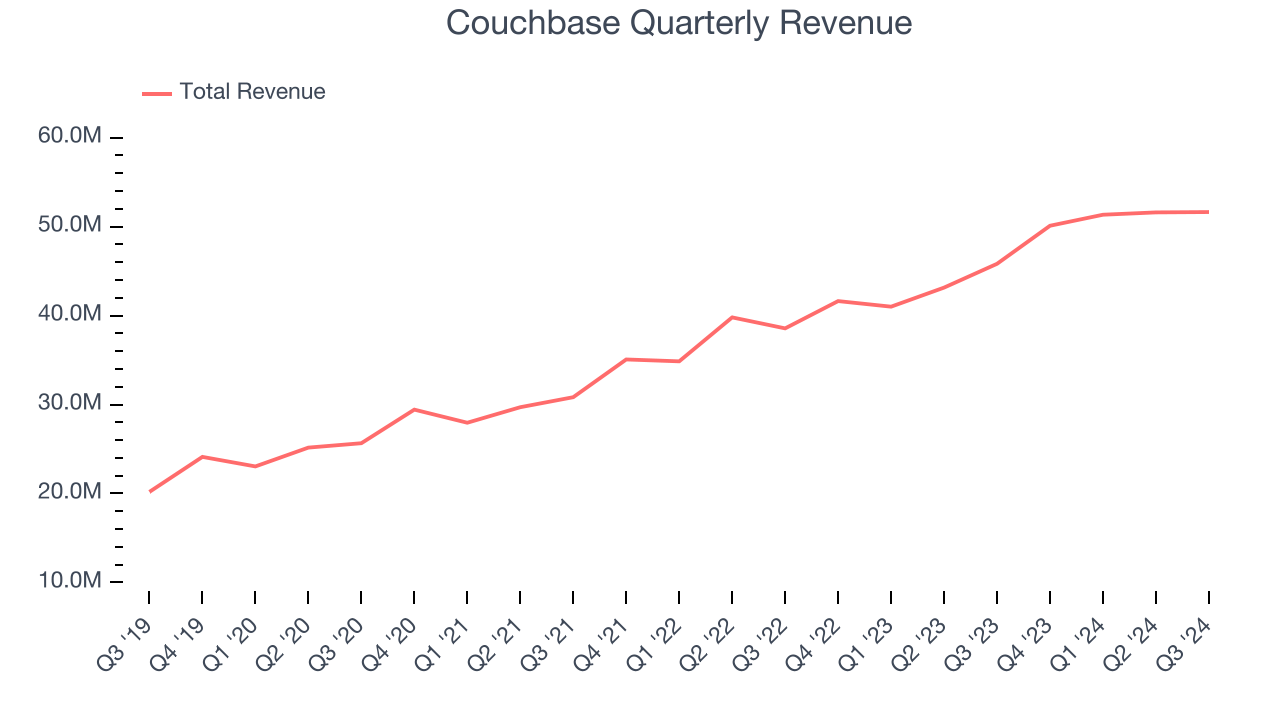

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Couchbase grew its sales at a decent 20.2% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Couchbase reported year-on-year revenue growth of 12.7%, and its $51.63 million of revenue exceeded Wall Street’s estimates by 1.7%. Company management is currently guiding for a 5.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Annual Recurring Revenue

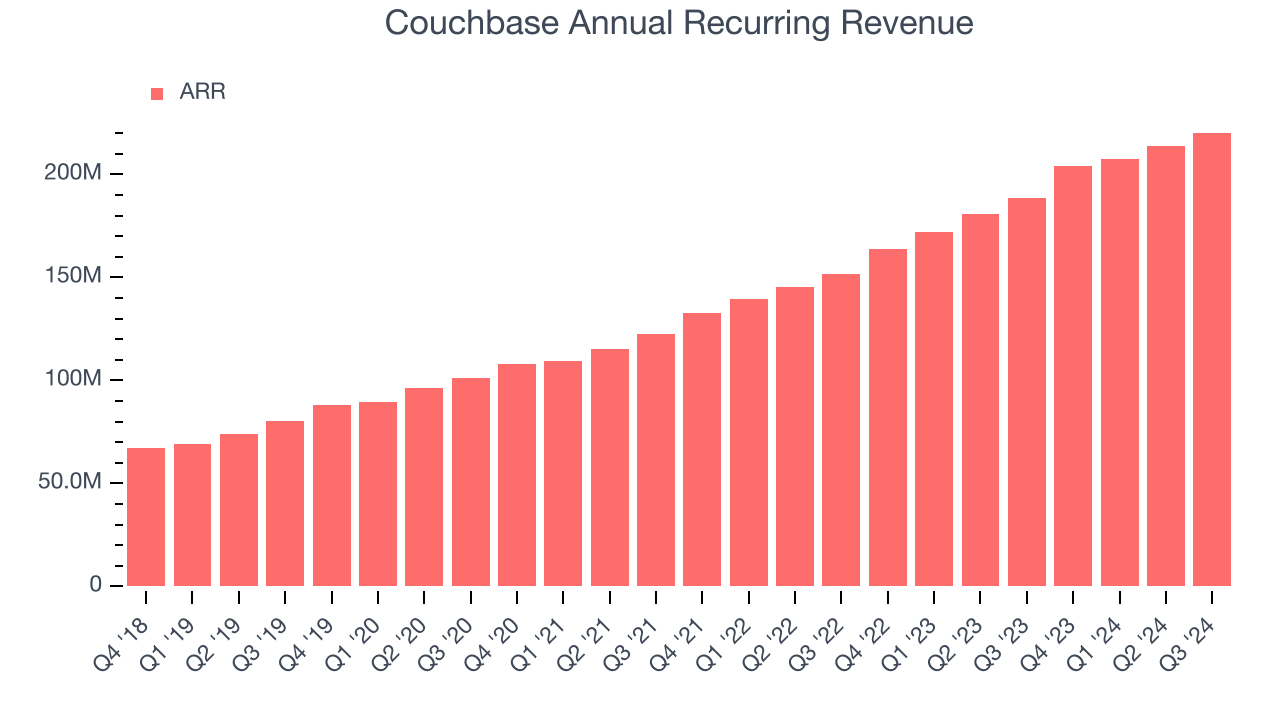

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Couchbase’s ARR punched in at $220.3 million in Q3, and over the last four quarters, its growth was impressive as it averaged 20.1% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Couchbase a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for Couchbase to acquire new customers as its CAC payback period checked in at 949.6 months this quarter. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Couchbase’s Q3 Results

It was encouraging to see Couchbase beat analysts’ revenue, EPS, and adjusted operating income expectations this quarter. On the other hand, its revenue guidance for next quarter missed significantly - this matters much more as markets are forward-looking. Overall, this quarter could have been better. The stock traded down 11.9% to $18.62 immediately following the results.

Couchbase’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.