The past six months have been a windfall for Boot Barn’s shareholders. The company’s stock price has jumped 108%, hitting $184.99 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Boot Barn, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Boot Barn Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Boot Barn for now. Here are three reasons there are better opportunities than BOOT and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

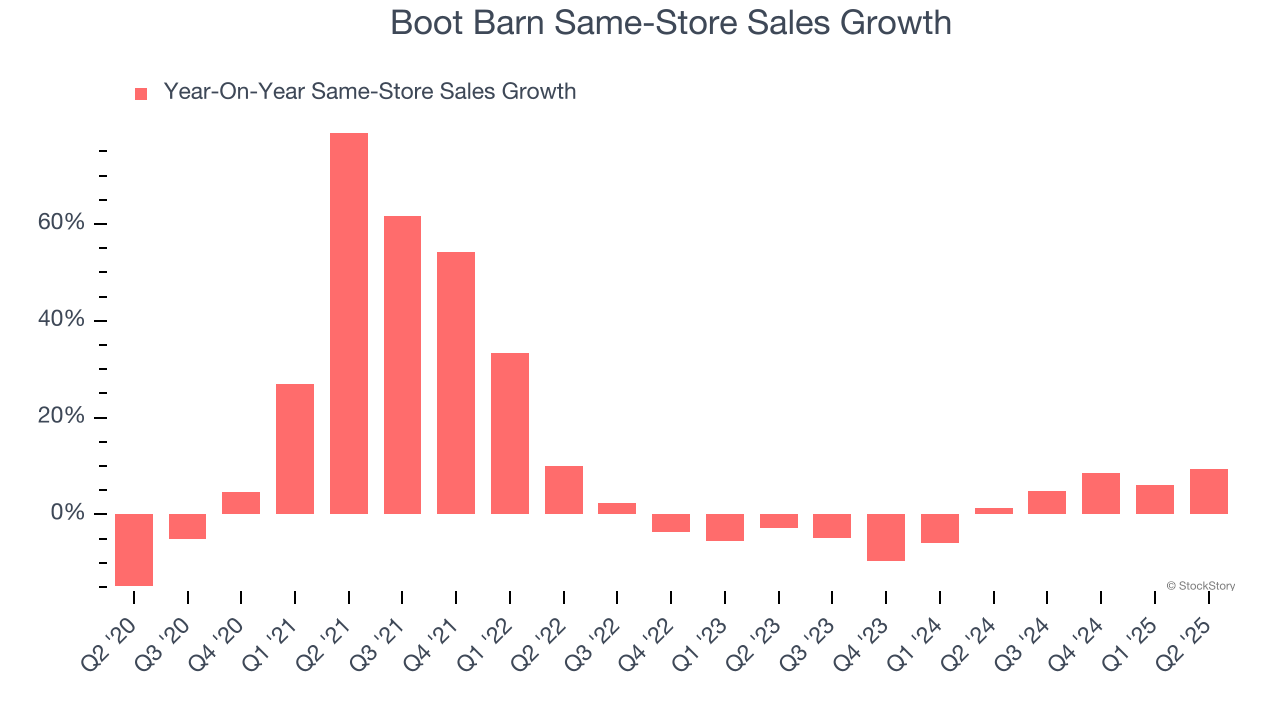

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Boot Barn’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.2% per year.

2. Fewer Distribution Channels Limit its Ceiling

With $1.99 billion in revenue over the past 12 months, Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

3. Free Cash Flow Margin Dropping

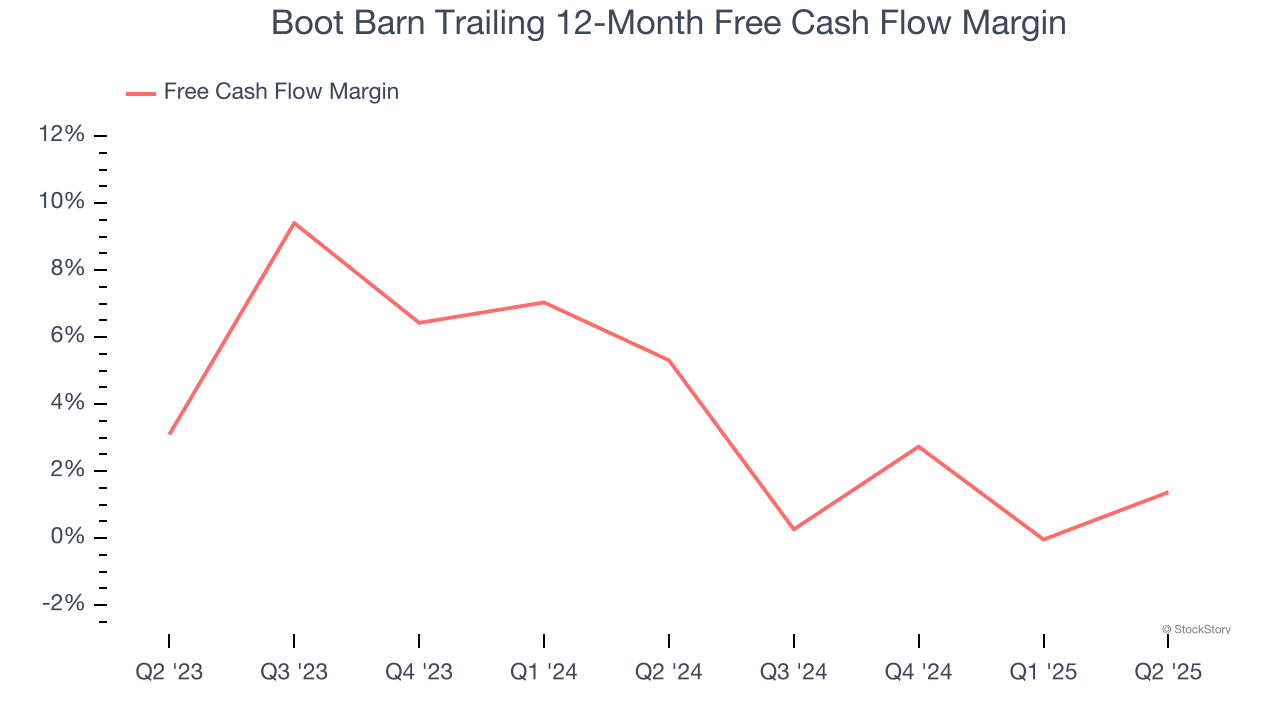

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Boot Barn’s margin dropped by 3.9 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Final Judgment

Boot Barn isn’t a terrible business, but it isn’t one of our picks. Following the recent surge, the stock trades at 27.8× forward P/E (or $184.99 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Boot Barn

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.