Visual content marketplace Getty Images (NYSE: GETY) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $240 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $946.5 million at the midpoint. Its non-GAAP profit of $0.08 per share was 84.5% above analysts’ consensus estimates.

Is now the time to buy Getty Images? Find out by accessing our full research report, it’s free for active Edge members.

Getty Images (GETY) Q3 CY2025 Highlights:

- Revenue: $240 million vs analyst estimates of $240 million (flat year on year, in line)

- Adjusted EPS: $0.08 vs analyst estimates of $0.04 (84.5% beat)

- Adjusted EBITDA: $78.71 million vs analyst estimates of $72.37 million (32.8% margin, 8.8% beat)

- The company reconfirmed its revenue guidance for the full year of $946.5 million at the midpoint

- EBITDA guidance for the full year is $292 million at the midpoint, above analyst estimates of $282.3 million

- Operating Margin: 18.8%, down from 23.9% in the same quarter last year

- Free Cash Flow was $7.89 million, up from -$1.84 million in the same quarter last year

- Market Capitalization: $734.2 million

“Third quarter results were in line with our expectations, with top-line growth flattening due to challenging year-over-year comparisons against last year’s robust event calendar,” said Craig Peters, Chief Executive Officer at Getty Images.

Company Overview

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE: GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $946.3 million in revenue over the past 12 months, Getty Images is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

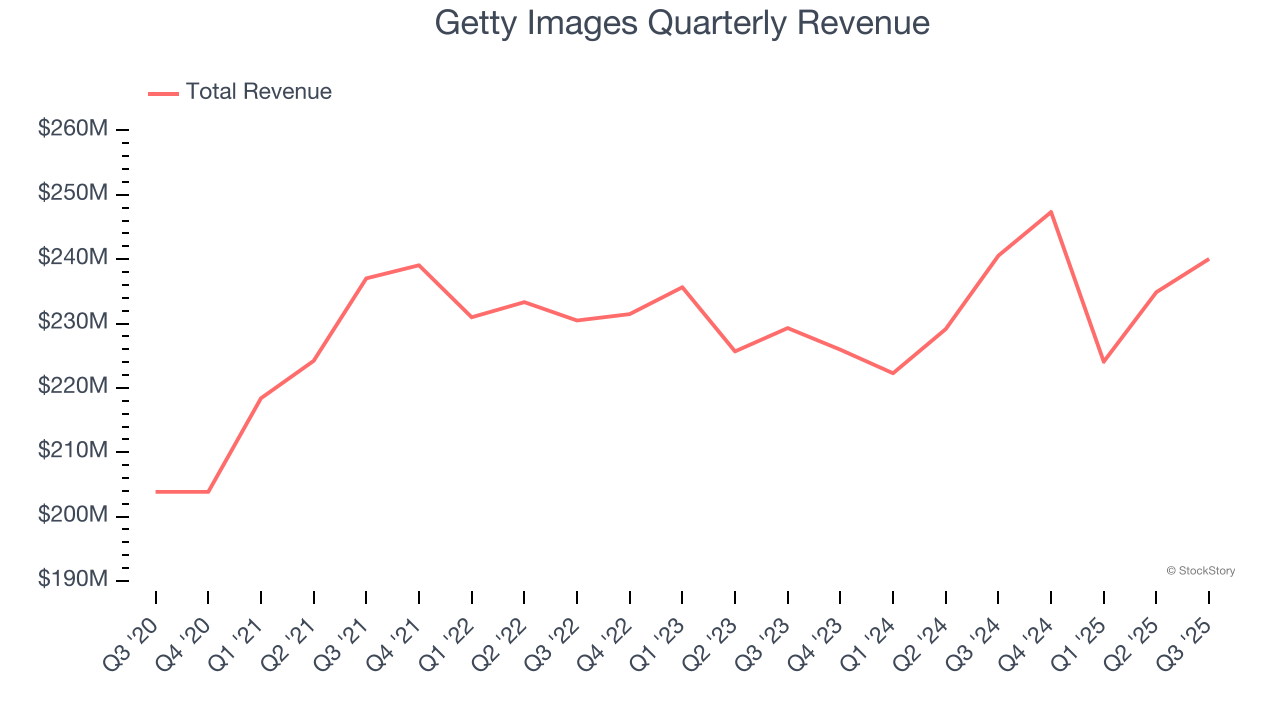

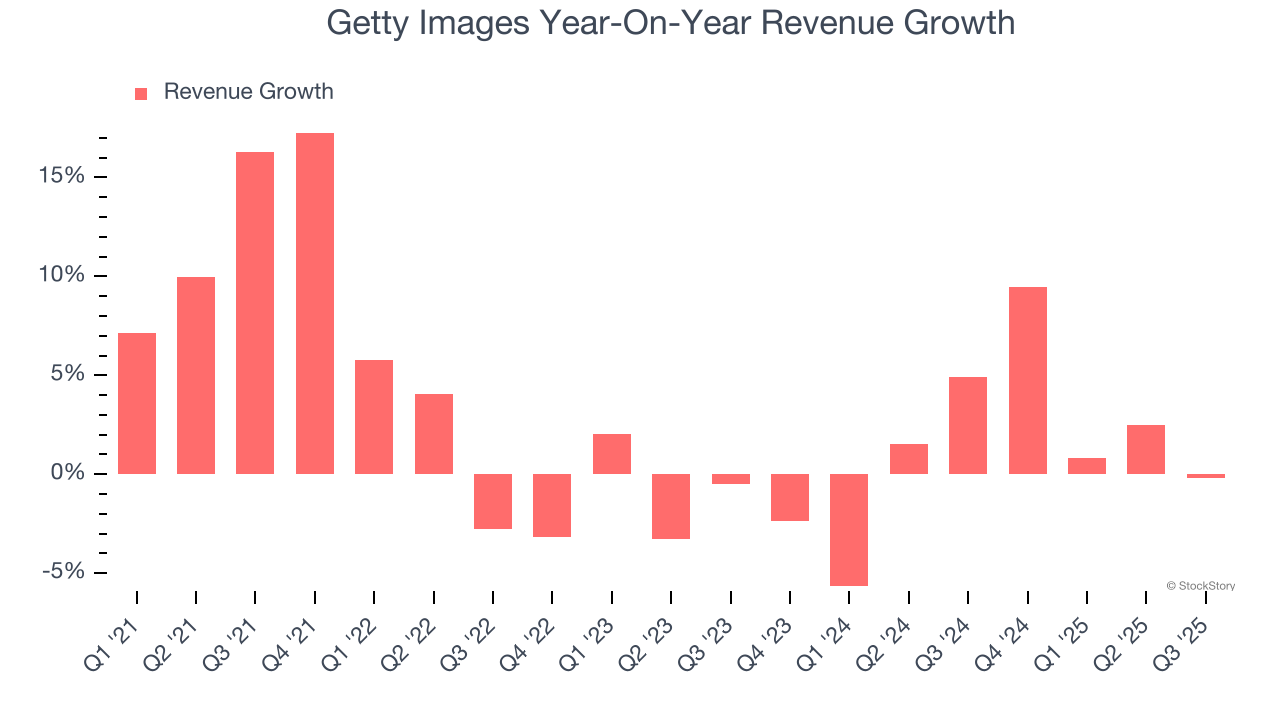

As you can see below, Getty Images grew its sales at a sluggish 2.7% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Getty Images’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.

This quarter, Getty Images’s $240 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

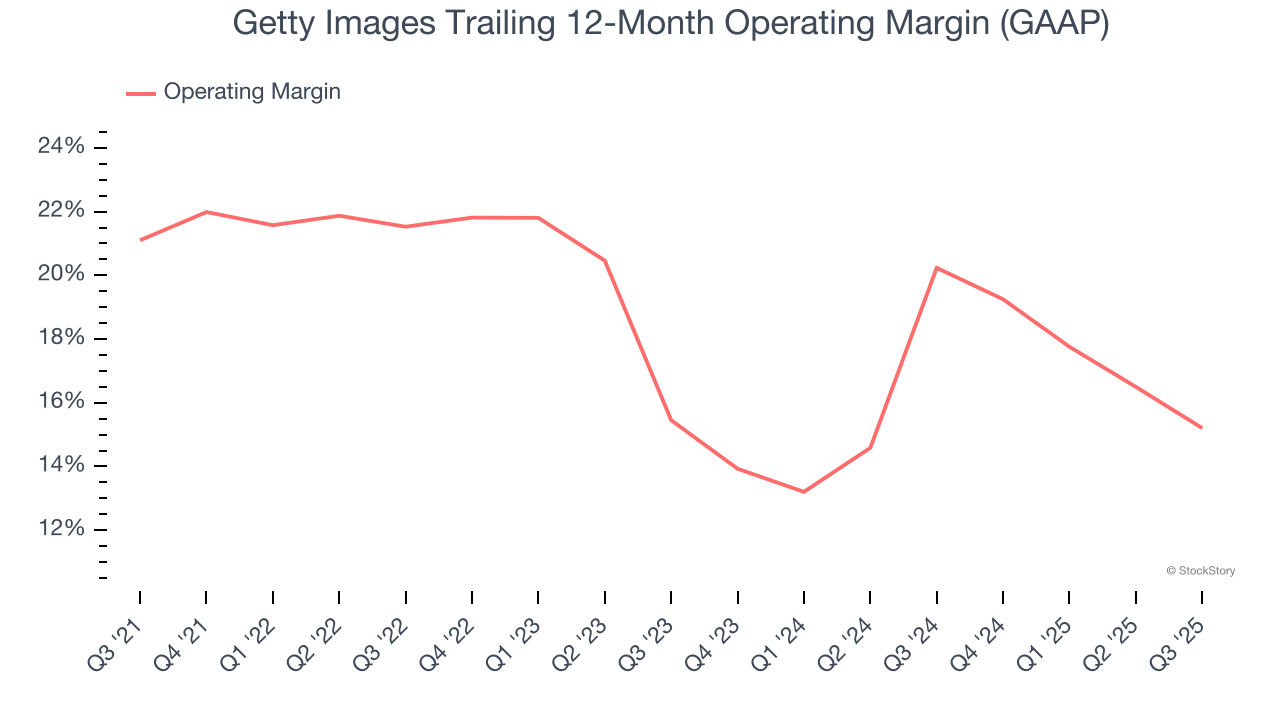

Getty Images has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.7%.

Analyzing the trend in its profitability, Getty Images’s operating margin decreased by 5.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Getty Images generated an operating margin profit margin of 18.8%, down 5.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

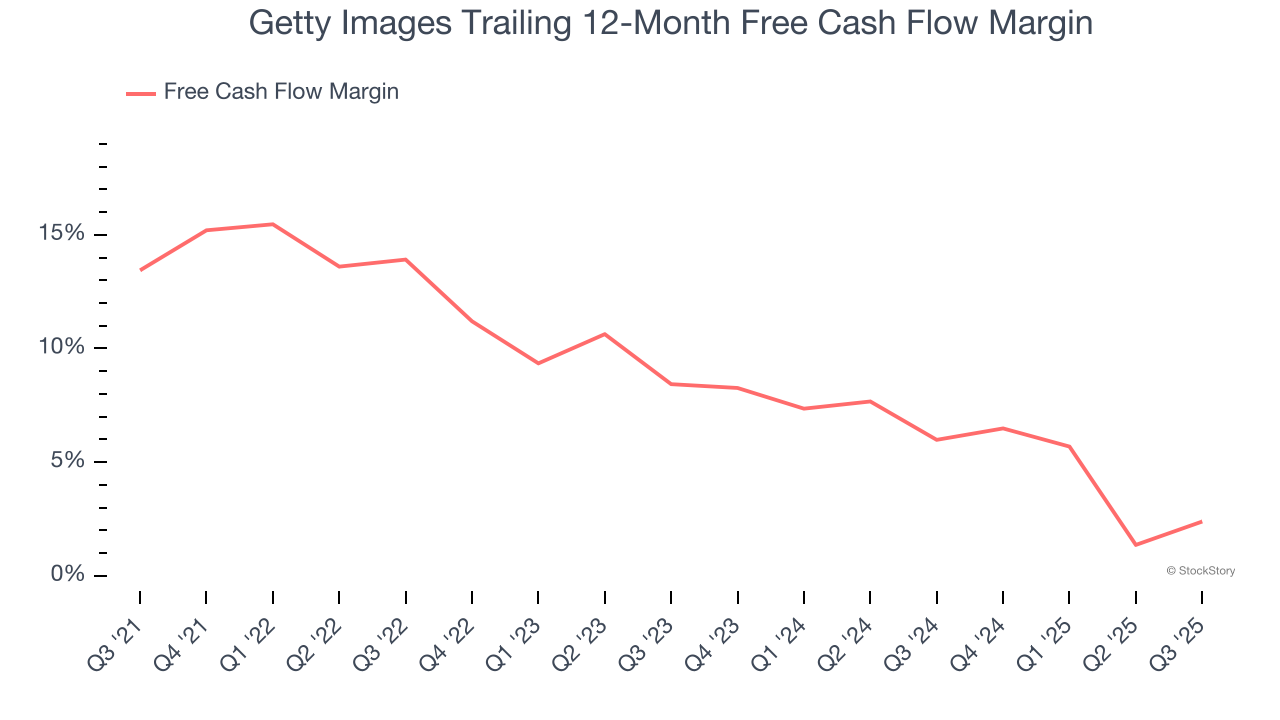

Getty Images has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader business services sector.

Taking a step back, we can see that Getty Images’s margin dropped by 11.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Getty Images’s free cash flow clocked in at $7.89 million in Q3, equivalent to a 3.3% margin. This result was good as its margin was 4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Getty Images’s Q3 Results

It was good to see Getty Images beat analysts’ EPS expectations this quarter. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 3.2% to $1.78 immediately following the results.

Getty Images may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.