What a fantastic six months it’s been for SmartRent. Shares of the company have skyrocketed 96.7%, hitting $1.77. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy SMRT? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Does SmartRent Spark Debate?

Founded by an employee at a real estate rental company, SmartRent (NYSE: SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

Two Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

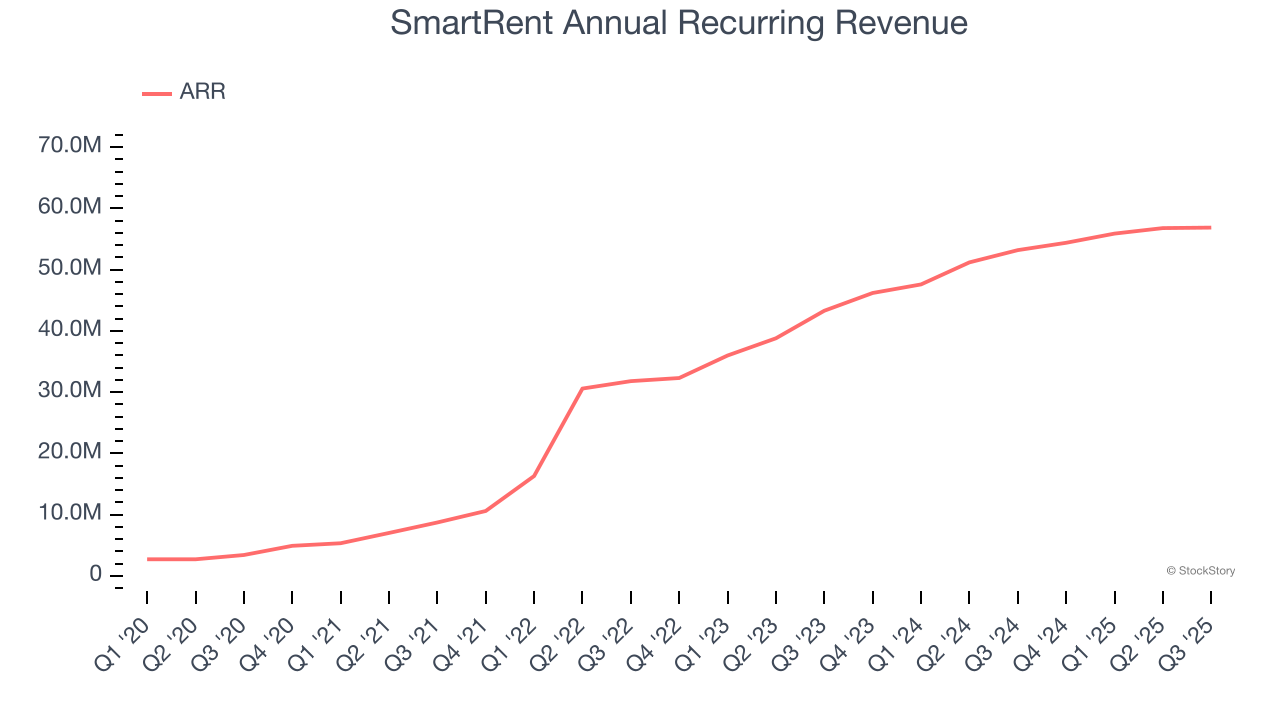

We can better understand Internet of Things companies by analyzing their ARR, or annual recurring revenue. This metric shows how much SmartRent expects to collect from its existing customer base in the next 12 months, giving visibility into its future revenue streams.

SmartRent’s ARR punched in at $56.88 million in the latest quarter, and over the last two years, its year-on-year growth averaged 22.9%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s product offerings. Its growth also makes SmartRent a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. New Investments Bear Fruit as ROIC Jumps

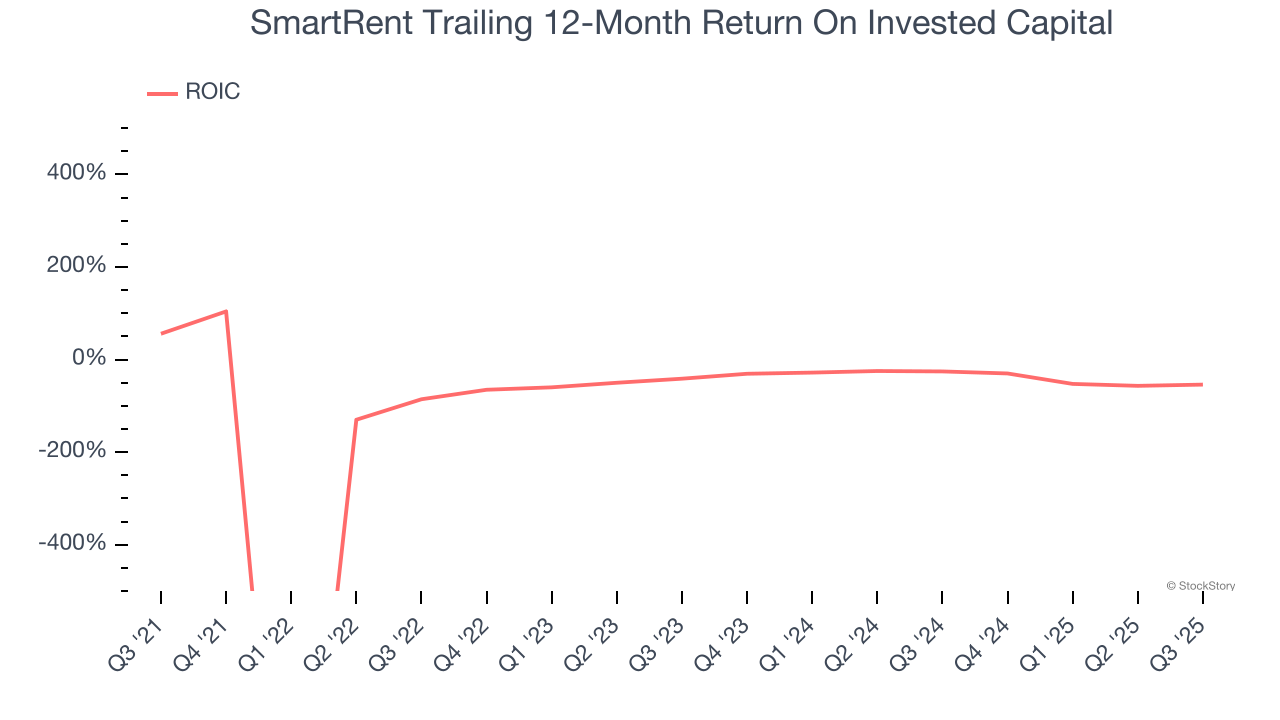

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, SmartRent’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

Revenue Tumbling Downwards

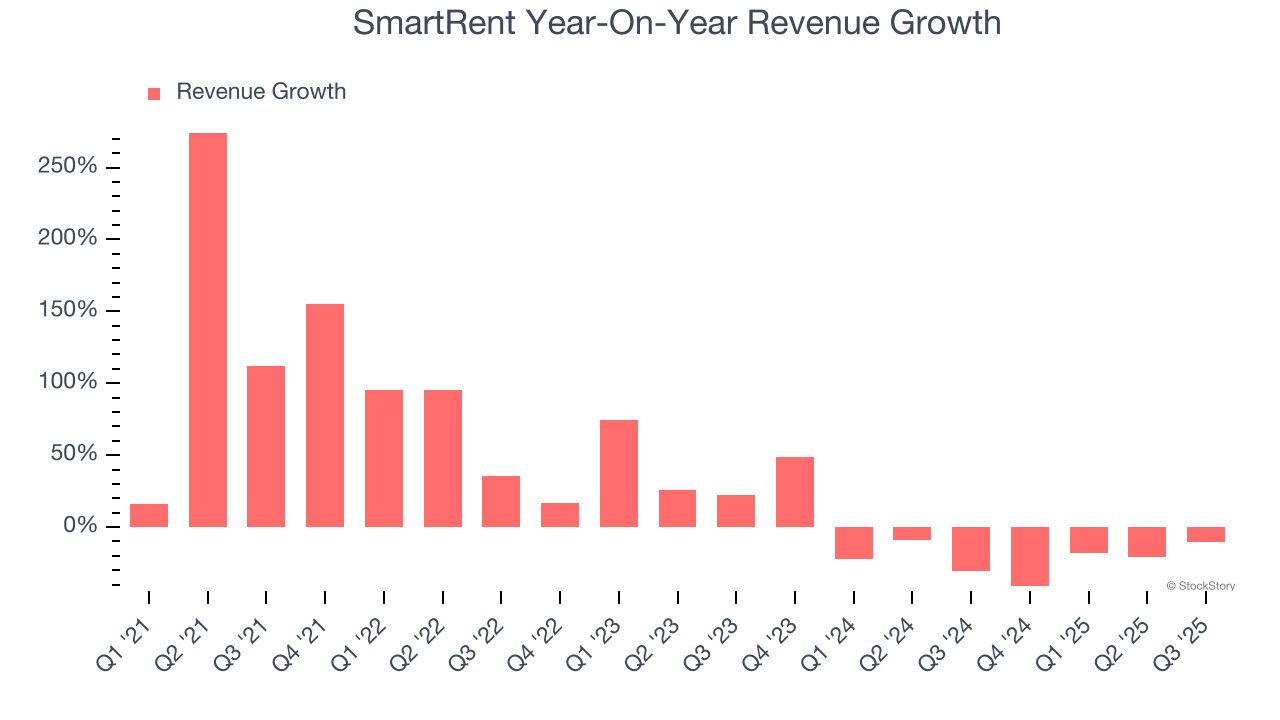

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. SmartRent’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 16.5% over the last two years.

Final Judgment

SmartRent’s merits more than compensate for its flaws, and after the recent rally, the stock trades at 110.4× forward EV-to-EBITDA (or $1.77 per share). Is now the time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than SmartRent

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.