Discount treasure-hunt retailer Dollar Tree (NASDAQ: DLTR) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 37.2% year on year to $4.75 billion. Guidance for next quarter’s revenue was better than expected at $5.45 billion at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $1.21 per share was 11.8% above analysts’ consensus estimates.

Is now the time to buy Dollar Tree? Find out by accessing our full research report, it’s free for active Edge members.

Dollar Tree (DLTR) Q3 CY2025 Highlights:

- Revenue: $4.75 billion vs analyst estimates of $4.69 billion (37.2% year-on-year decline, 1.2% beat)

- Adjusted EPS: $1.21 vs analyst estimates of $1.08 (11.8% beat)

- Adjusted EBITDA: $553.8 million vs analyst estimates of $478.7 million (11.7% margin, 15.7% beat)

- Revenue Guidance for Q4 CY2025 is $5.45 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $5.70 at the midpoint, a 3.3% increase

- Operating Margin: 7.2%, up from 4.4% in the same quarter last year

- Free Cash Flow was -$57.1 million, down from $354.4 million in the same quarter last year

- Same-Store Sales rose 4.2% year on year (1.8% in the same quarter last year)

- Market Capitalization: $21.99 billion

Company Overview

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ: DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $18.96 billion in revenue over the past 12 months, Dollar Tree is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Dollar Tree likely needs to optimize its pricing or lean into international expansion.

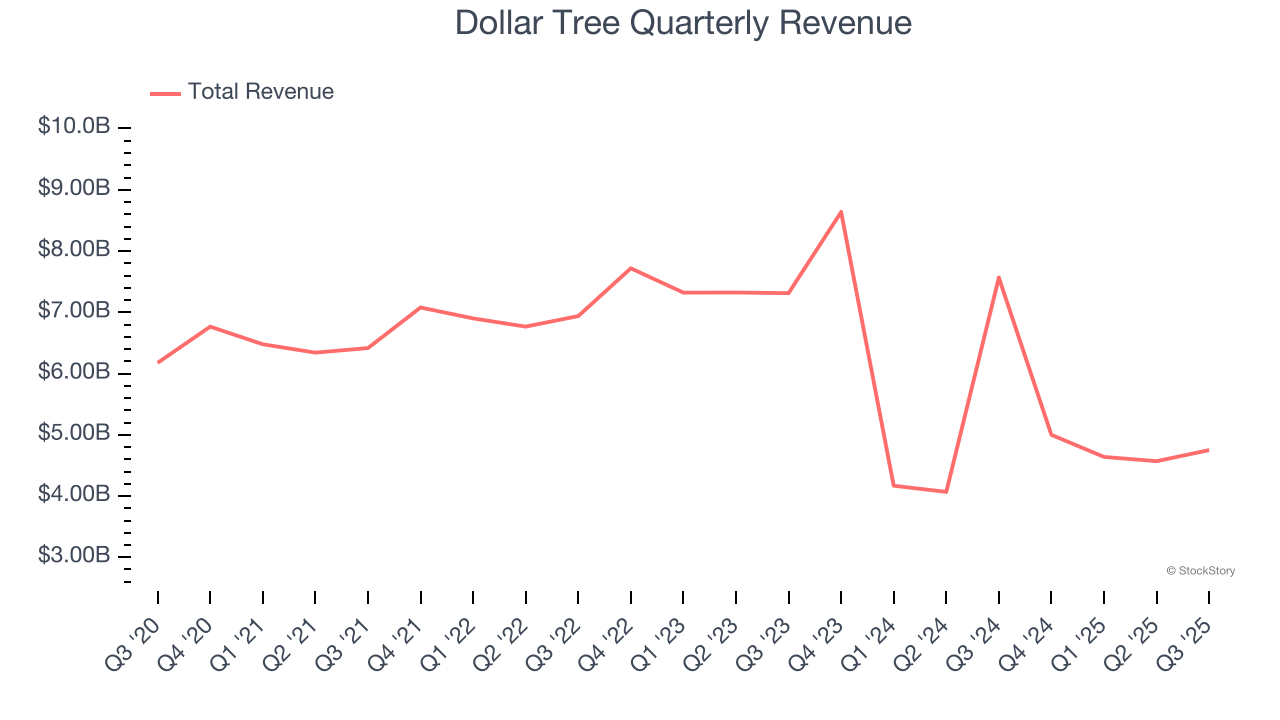

As you can see below, Dollar Tree’s revenue declined by 11.9% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Dollar Tree’s revenue fell by 37.2% year on year to $4.75 billion but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, an acceleration versus the last three years. This projection is particularly noteworthy for a company of its scale and indicates its newer products will catalyze better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

Number of Stores

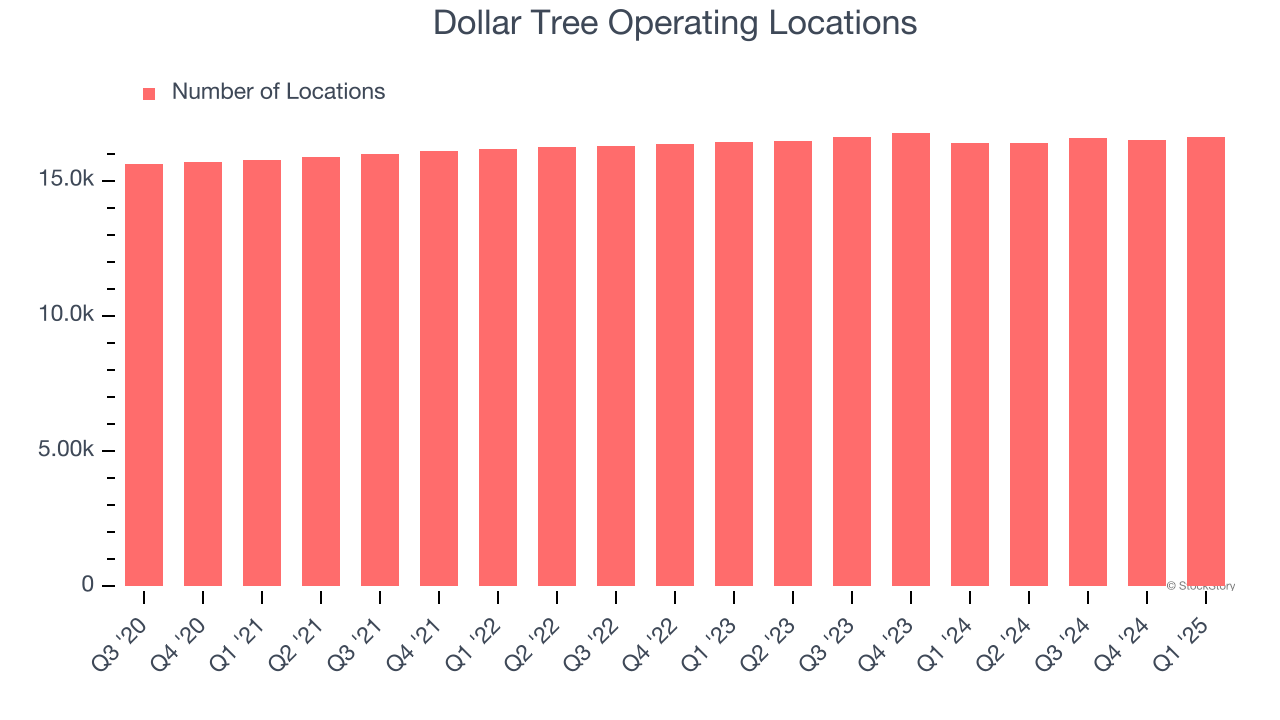

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Dollar Tree has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Dollar Tree reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

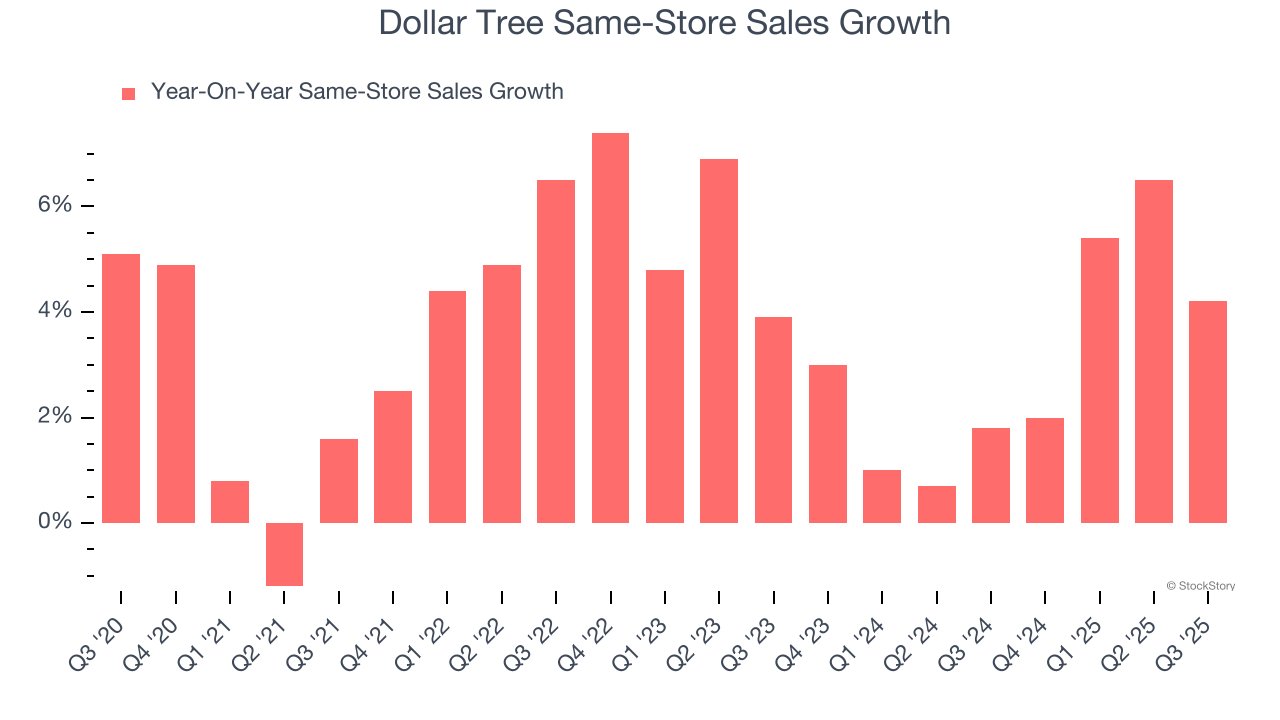

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Dollar Tree’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 3.1% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Dollar Tree’s same-store sales rose 4.2% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Dollar Tree’s Q3 Results

We were impressed by how significantly Dollar Tree blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.7% to $110.85 immediately after reporting.

Dollar Tree had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.