Marriott has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13.9% to $295.98 per share while the index has gained 15.3%.

Is there a buying opportunity in Marriott, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Marriott Will Underperform?

We're sitting this one out for now. Here are three reasons there are better opportunities than MAR and a stock we'd rather own.

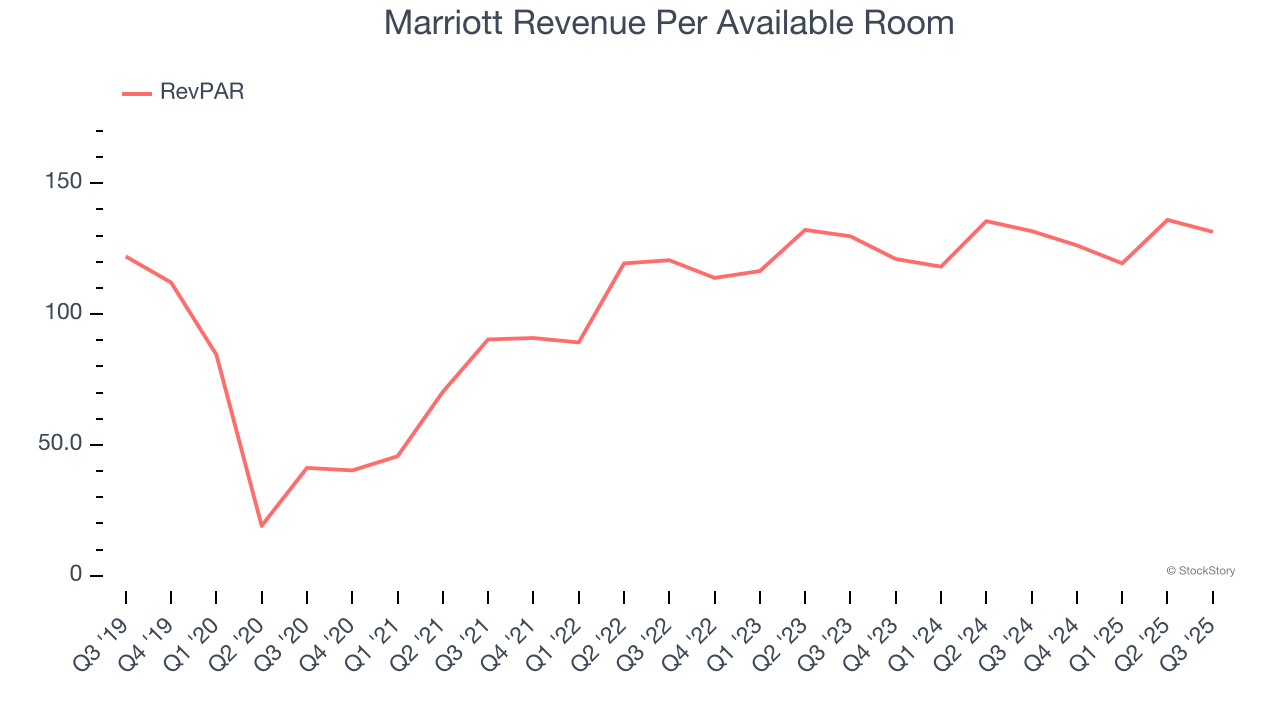

1. Weak RevPAR Growth Points to Soft Demand

We can better understand Travel and Vacation Providers companies by analyzing their RevPAR, or revenue per available room. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Marriott’s demand characteristics.

Marriott’s RevPAR came in at $131.43 in the latest quarter, and over the last two years, its year-on-year growth averaged 2.2%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

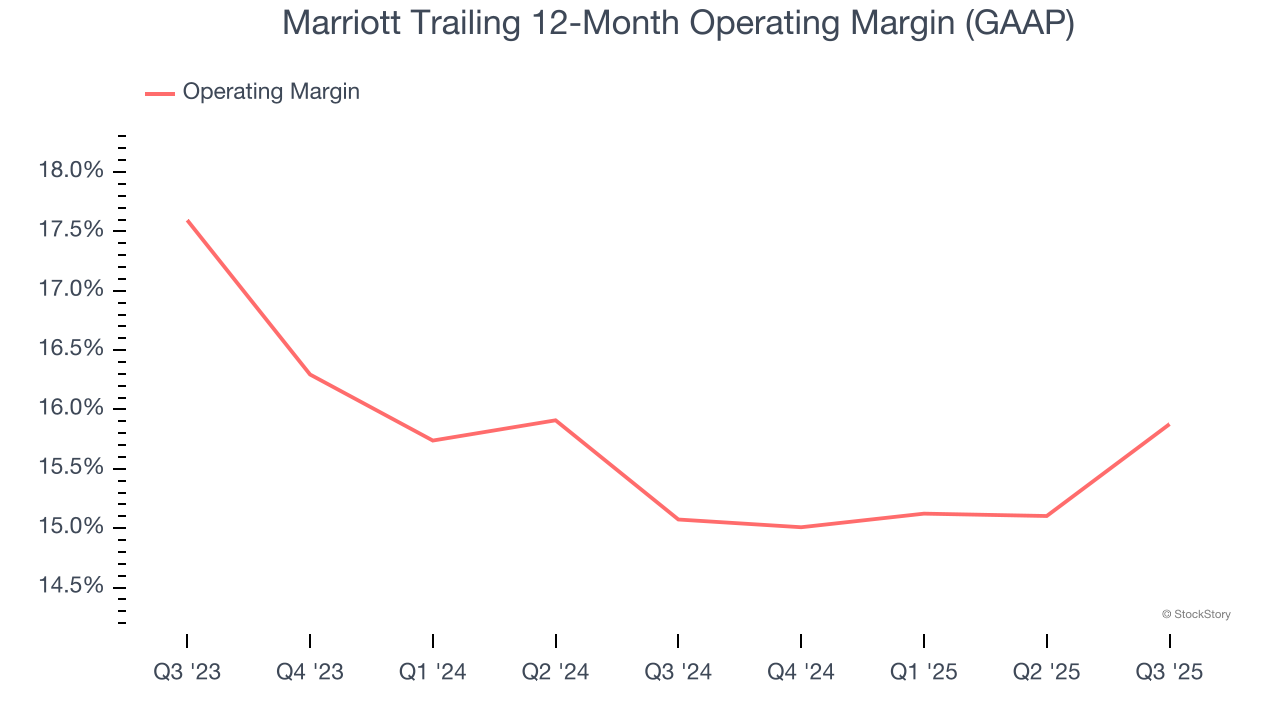

2. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Marriott’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 15.5% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

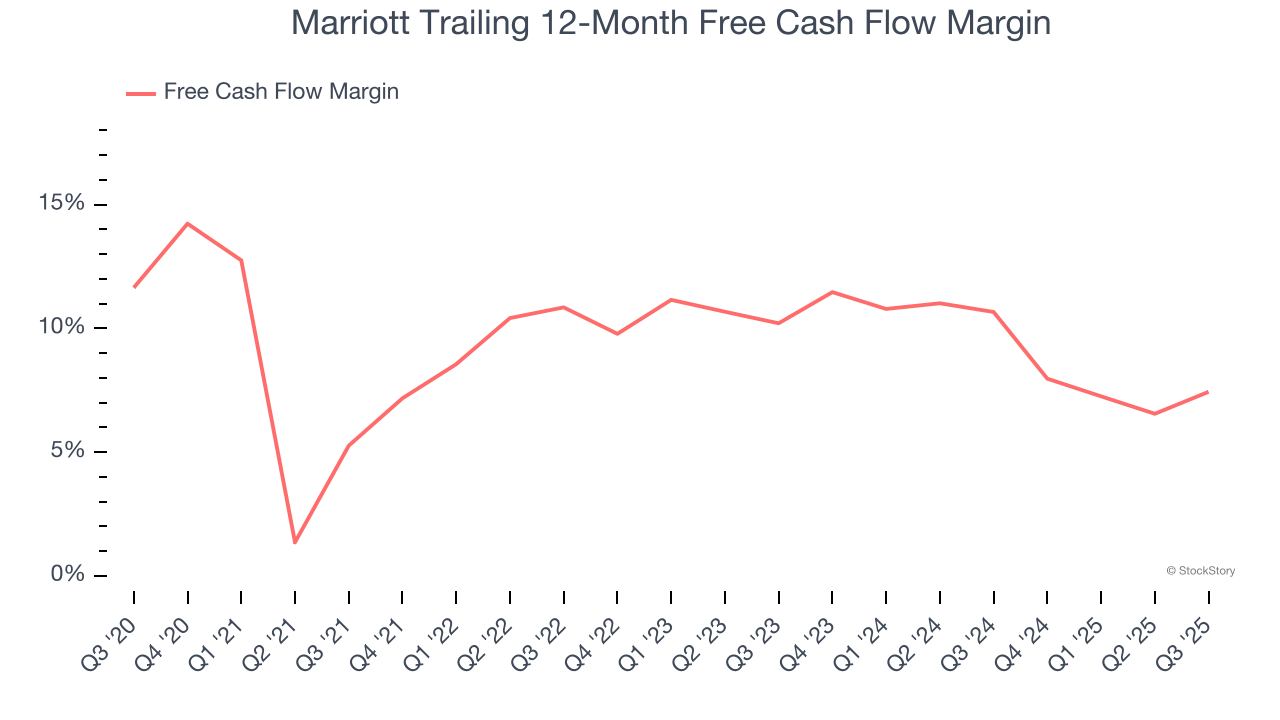

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Marriott has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9%, lousy for a consumer discretionary business.

Final Judgment

Marriott falls short of our quality standards. That said, the stock currently trades at 27.9× forward P/E (or $295.98 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Marriott

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.