The past six months have been a windfall for Veritex Holdings’s shareholders. The company’s stock price has jumped 40.9%, hitting $34.78 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Veritex Holdings, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Veritex Holdings Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Veritex Holdings. Here are three reasons you should be careful with VBTX and a stock we'd rather own.

1. Revenue Tumbling Downwards

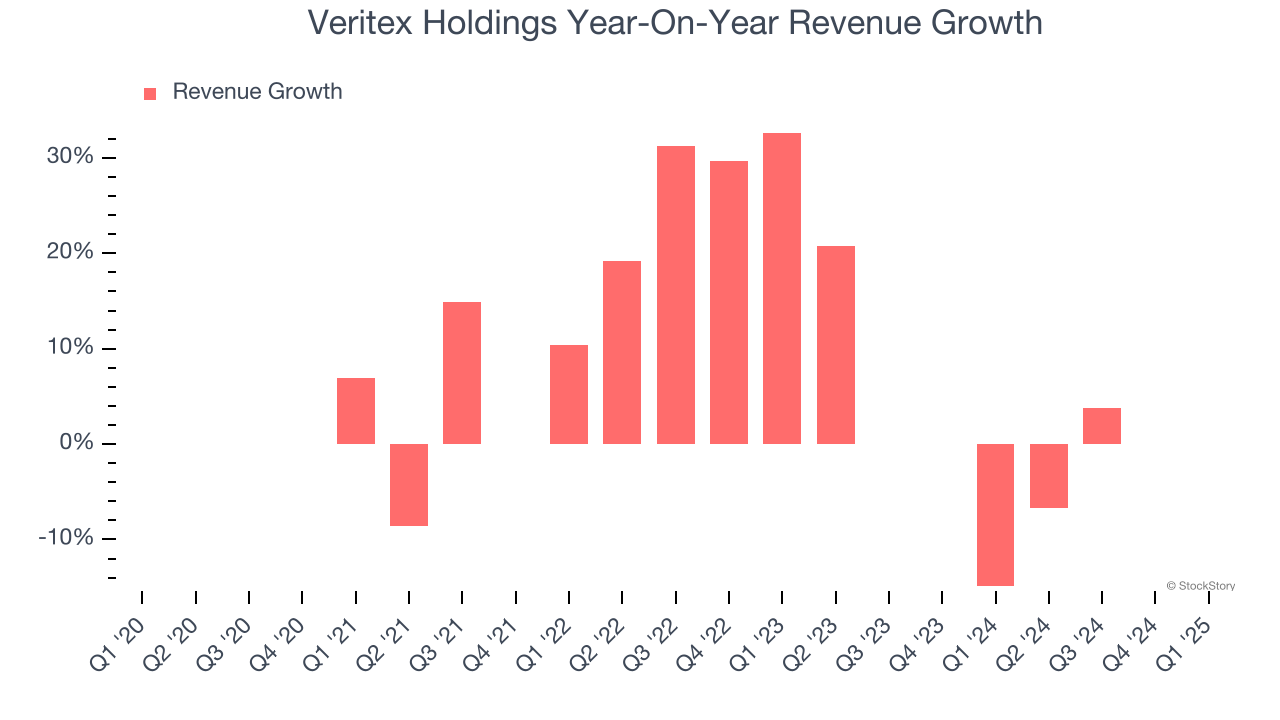

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Veritex Holdings’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.1% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Veritex Holdings’s net interest income to rise by 2.6%.

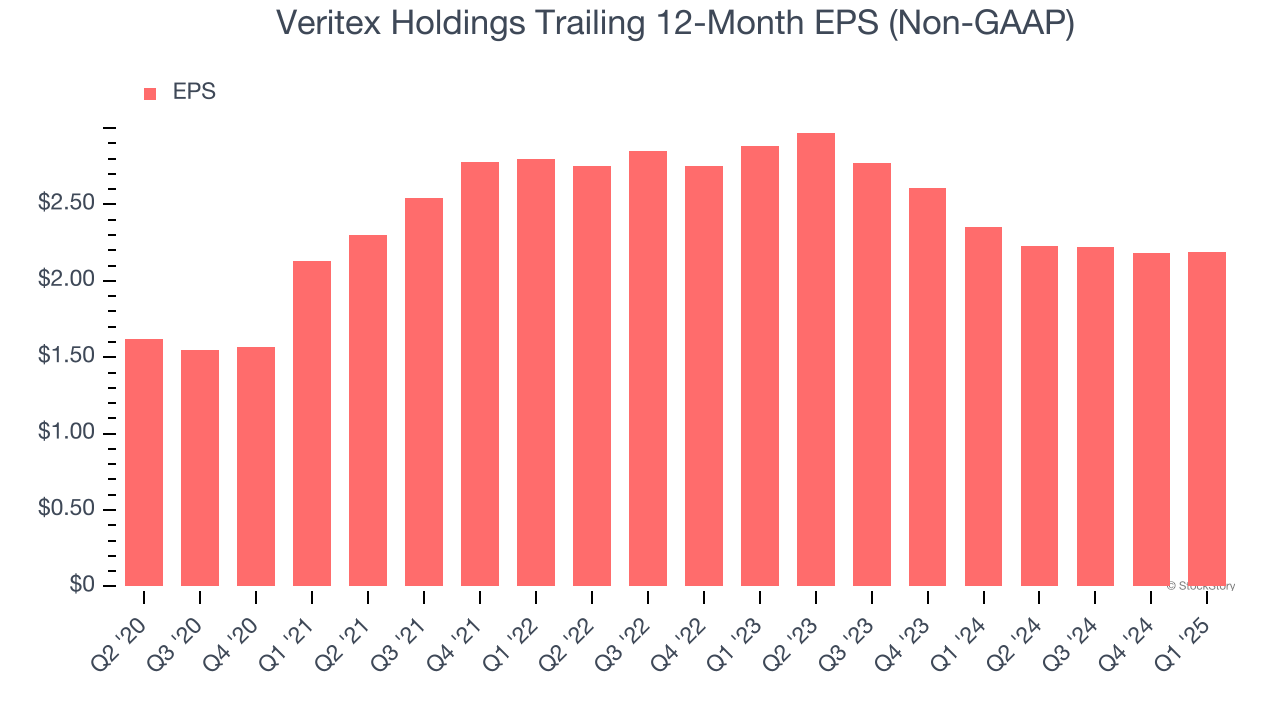

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Veritex Holdings, its EPS declined by more than its revenue over the last two years, dropping 12.8%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Veritex Holdings isn’t a terrible business, but it isn’t one of our picks. After the recent surge, the stock trades at 1.1× forward P/B (or $34.78 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.