Over the past six months, Palomar Holdings’s shares (currently trading at $115.84) have posted a disappointing 14.2% loss, well below the S&P 500’s 15.6% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy PLMR? Find out in our full research report, it’s free.

Why Is PLMR a Good Business?

Founded in 2013 to fill gaps in catastrophe insurance markets, Palomar Holdings (NASDAQ: PLMR) is a specialty insurance provider that offers property and casualty insurance products in underserved markets, with a focus on earthquake coverage.

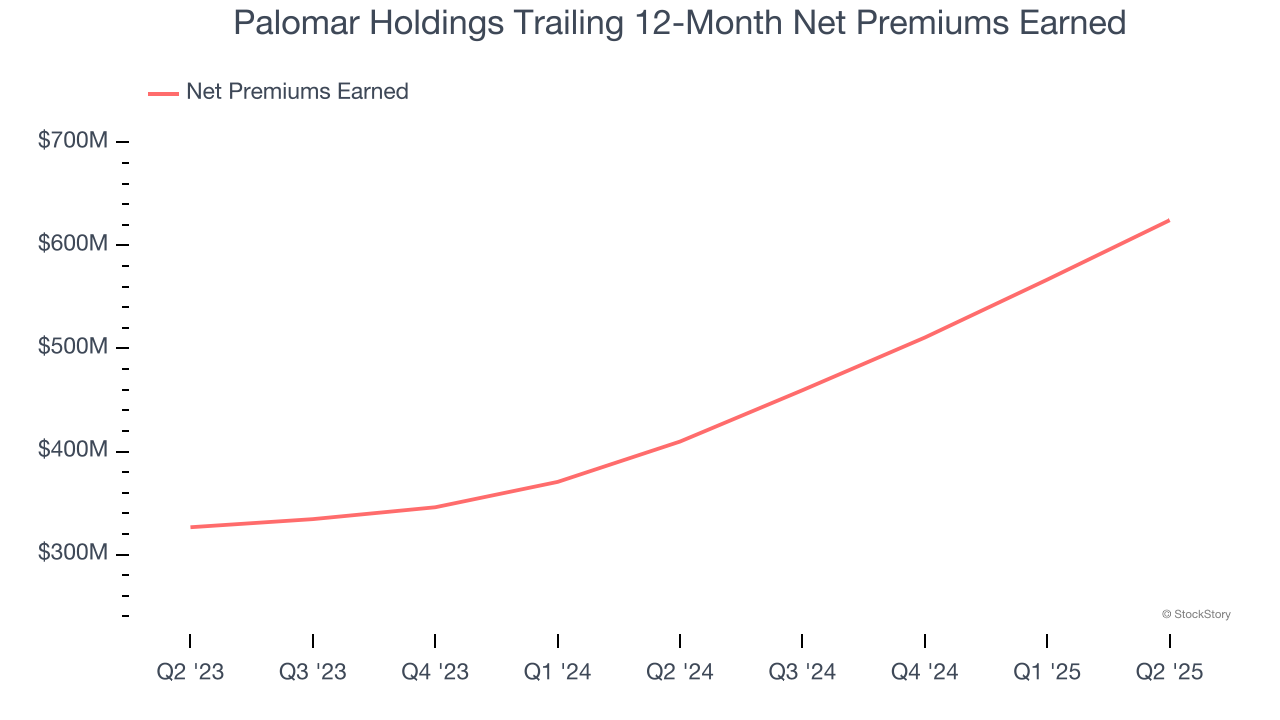

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

Palomar Holdings’s net premiums earned has grown at a 38.3% annualized rate over the last two years, much better than the broader insurance industry.

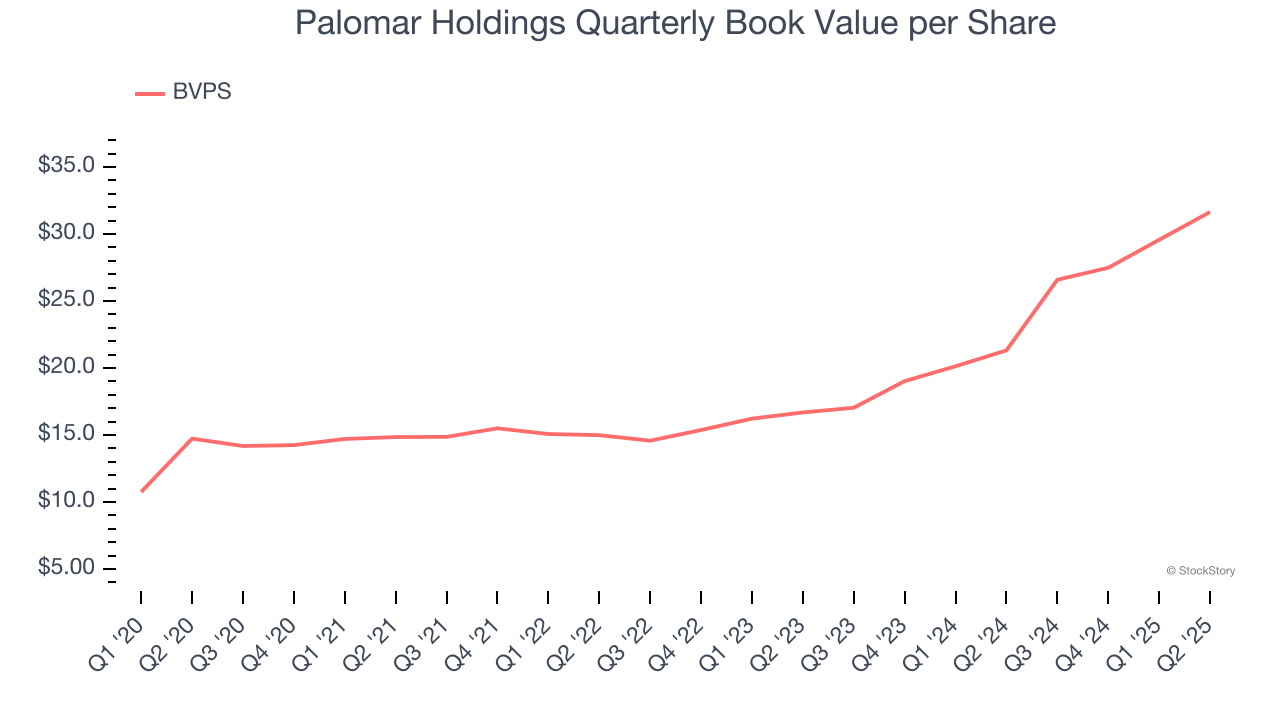

2. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Palomar Holdings’s BVPS increased by 16.5% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 37.7% annual clip over the past two years (from $16.69 to $31.64 per share).

3. Projected BVPS Growth Is Remarkable

The key to book value per share (BVPS) growth is an insurer’s ability to earn underwriting profits while generating strong returns on its float - Warren Buffet’s secret sauce.

Over the next 12 months, Consensus estimates call for Palomar Holdings’s BVPS to grow by 24.9% to $31.81, elite growth rate.

Final Judgment

These are just a few reasons why Palomar Holdings is one of the best insurance companies out there. With the recent decline, the stock trades at 3.4× forward P/B (or $115.84 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.