| |||||||||

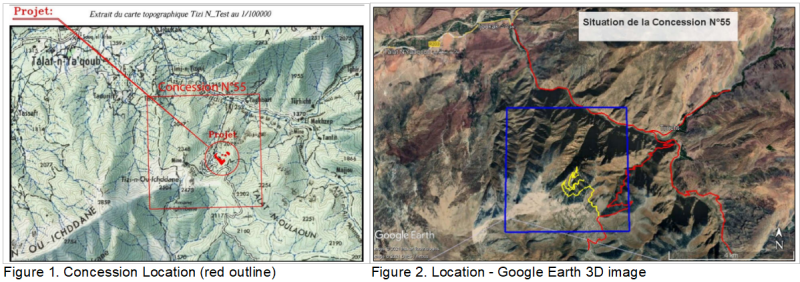

October 21st, 2025 – TheNewswire - Muskoka, Ontario – Steadright Critical Minerals Inc. (CSE: SCM) (“Steadright” or the “Company”) is pleased to announce a Memorandum of Understanding (MOU) has been signed with Ste Commerciale et Minière du Sahara (CMS) that is the license holder of an historic polymetallic Zinc-Lead-Silver-Copper-Gold mine, Production Concession Number 55 in the Goundafa area, known as the Goundafa Mine. Copper (Cu) and Zinc (Zn) are classified as Critical and Strategic Minerals in the U.S., Canada, Europe, and a significant number of other countries around the world. Figures 1 and 2 illustrate the location of the mining concession as per the “Rapport technique et financière d'évaluation de terrain minier de Goundafa”, 2022.

Steadright can earn up to 100% in the Goundafa Project, which holds Concession Number 55, with 1,600 hectares of a fully permitted Mining and Environmental Production License. The claim is in the Goundafa Area in South Central Morrocco, within the County of Ijoukak.

The Goundafa Mine was developed and mined by La Société des Mines de Goundafa (SMG) from the 1926 until 1956. Operations ceased due to political changes following Moroccan independence. A number of historical professional reports are available on the Goundafa Property. In 1928, two thousand tons with an average grade of 22.13% Zinc and 11.31% Lead were produced. The 1985 report, "Rapport sur les travaux souterrains et la cartographie miniere de la concession de Goundafa” from the Bureau de Rescherches et de Participations Minières (BRPM), Morocco’s former national mining agency, now ONHYM, indicated silver grades of up to 400g/t from high grade galena zones. As mining pursued deeper, increasing chalcopyrite and gold content were observed. In total, historical production of 320k tons of material was reportedly extracted until 1956.

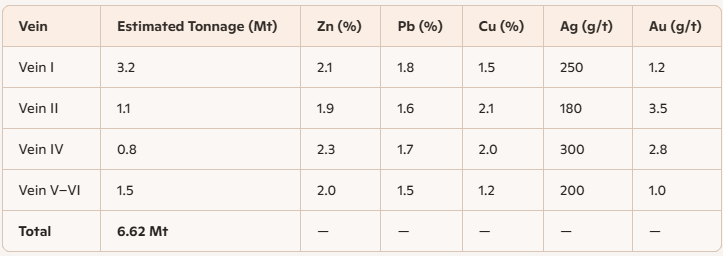

A 2022 geological report (non-NI 43-101 compliant), “Rapport Technique et Financier sur la Concession Minière de Goundafa – Commune d’Ijoukak, Province d’El Haouz, Maroc”, authored by Omar Guillou and prepared for CMS, the concession holder, identifies conceptual resources up to 6.62 million tons with grades of 2.1% Zn, 1.8% Pb and 1.5-2.1% Cu and up to 3.5 g/t gold in select zones — particularly from underground sampling at Vein II near Gallery L, of which 1.7 million tons are directly accessible through the historic multi-level works (as stated in the 1985 BRPM report). Recent XRF-measured grades inside of the mine showed strong potential for significant higher metal grades in some areas, consistent with historic mining. A network of well-maintained infrastructure remains at the historic operations allowing easy access to the mine.

The 2022 CMS report states: “the current estimate is limited to the 600 vertical meters through accessible workings; are within a vertical interval of approximately 600 meters, between the surface and the deepest accessible workings”. However, the conceptual resources DO NOT include “deeper speculative extensions”, and that “it could extend an additional 800 meters vertically, reaching depths of 1,400 meters below surface”. In addition, “the lateral extensions of Veins IV, V and Vi have been identified at surface through trenching and geological surveys. These extensions show structural continuity with the veins exploited at depth, but their potential remains to be confirmed by drilling. They are NOT INCLUDED in the main volumetric estimate of 6.62 Mt, although they represent significant additional potential.”

The Goundafa Mine is an early-stage polymetallic exploration project located in Morocco’s High Atlas Mountains — a region with a long mining history and favorable geology. The project is centered on a series of steeply dipping mineralized veins containing copper, zinc, gold, lead and silver. These veins are exposed at surface and have seen limited artisanal mining, providing a strong foundation for modern exploration.

While the 2022 report for CMS estimate does not meet the requirements of NI 43-101 and is not a formal mineral resource, it reflects the potential scale of the system.

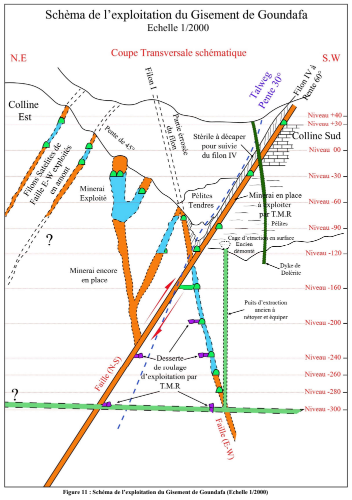

The convergence of multiple mineralized veins, historical production from Vein I, and surface geochemical anomalies across Veins IV–VI suggest meaningful upside. Combined with accessible infrastructure and a mining-friendly jurisdiction, Goundafa presents a compelling opportunity for value-driven exploration and future resource development. See Figure 3 “Longitudinal section of Vein I showing the distribution of mineralised zones and historical workings” below from the 2022 Report.

Figure 3. Longitudinal section of Vein I showing the distribution of mineralised zones and historical workings

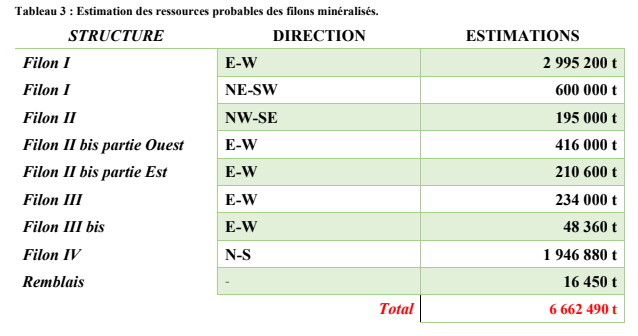

The 2022 technical report was compiled and authored by Mr. Omar Guillou, who led the integration of historical data, field observations, and sampling results into a cohesive evaluation of the concession’s potential. Dr. Abdelaziz El Hadi, a senior structural geologist and academic researcher with over three decades of experience in Moroccan mineral systems, contributed to the geological interpretation and structural modeling. His work focused on vein geometry, structural stacking, and volumetric projections that informed the conceptual tonnage estimate. See Table 1 (Tableau 3) Historical Estimation of Insitu Tonnage by Vein (title modified) from the 2022 report and Table 2: Reconstructed Tons and Grade by Vein.

Table 1 (Tableau 3): Historical Estimation of Insitu Tonnage by Vein (title modified)

Table 2: Reconstructed Tons and Grade by Vein

Dr. Abdelaziz El Hadi contributed to the 2022 Goundafa report by developing a conceptual geological model based on existing data. His interpretation of the underground vein geometry was derived from:

- Historical mine plans and legacy schematics of Veins I and II

- Underground sampling records, including assays from Gallery L

- Surface trenching and geochemical anomalies used to infer subsurface continuity

- Regional structural context from prior academic research in the Anti-Atlas and High Atlas

regions

Dr. El Hadi did not conduct new underground surveys or remap historical workings. His modeling was conceptual, based on the 1985 BRPM report and intended to guide exploration targeting, not to produce compliant resource estimates.

While Dr. El Hadi is not a Qualified Person (QP) under NI 43-101 and did not perform formal resource estimation, his insights were instrumental in shaping the geological rationale and exploration strategy. Together, their collaboration provides a robust technical foundation for advancing Goundafa toward drill-supported resource classification. With systematic drilling and qualified resource modeling, the project is well-positioned to evolve into a formally classified polymetallic asset with early-stage copper-gold leverage.

Historical Mapping Reference – 1985 BRPM Report

The 1985 report prepared by the Bureau de Recherches et de Participations Minières is considered the most detailed historical source of underground mapping for the Goundafa concession. It includes schematic plans of underground galleries, vein exposures, and sampling records — particularly around Veins I and II — and has served as a foundational reference for subsequent geological interpretations.

This report provides valuable insight into the spatial layout and historical workings of the deposit, including early production zones and accessible galleries such as Gallery L. Its documentation has informed structural modeling efforts, including the 2022 conceptual tonnage estimate developed by Dr. Abdelaziz El Hadi.

Statement Regarding Historical Mineral Resource Estimates

The Company advises that it is referencing a historical estimate for the Goundafa polymetallic project (Concession No. 55, Province of Al Haouz, Morocco). The estimate is taken directly from:

Guillou, O. (2022). Rapport technique et financière d’évaluation de terrain minier de Goundafa. Prepared for Ste Commerciale et Minière du Sahara (CMS), Casablanca, Morocco. Dated November 28, 2022.

The historical estimate reports a total of approximately 6.66 million tonnes of mineralized material across multiple veins (Filons I, II, II bis, III, IV, and associated structures). The report indicates average grades across the total tonnage in the range of ~2–5% Zn, ~1–3% Pb, and ~0.5–1% Cu, with silver and gold present in trace to moderate concentrations. Certain localized zones within individual veins were reported with significantly higher grades (Zn > 10%, Pb > 7%, Cu > 2%, Ag > 100 ppm, Au > 4 ppm), but these are not representative of the overall historical estimate.

Parameters and assumptions disclosed in the source report include:

• Historical geological mapping, underground sampling, and limited drilling

conducted by BRPM and earlier operators

• Sampling and underground geological surveys conducted by CMS in 2022

• Average vein thicknesses ranging from 0.8 m to 1.5 m

• Bulk density of 2.6 t/m³ applied to mineralized material

• Volumetric calculation methods (length × height × thickness × density)

• Recognition of vertical zonation of mineralization (Pb–Zn–Cu) in Filons I and II

Reliability and relevance: The Company considers the historical estimate relevant as it demonstrates the presence of significant polymetallic mineralization in the Goundafa concession. However, the reliability is uncertain due to the absence of modern QA/QC protocols, limited drilling, and reliance on historical underground sampling.

Comparison to CIM Definition Standards: The categories of the historical estimate were not prepared in accordance with the current CIM Definition Standards (2014, as amended). Therefore, the historical estimate cannot be directly compared to current categories of mineral resources or reserves.

More recent estimates: The Company is not aware of any more recent estimates for the Goundafa project.

Work required to upgrade/verify: To verify and potentially upgrade the historical estimate to a current mineral resource, the Company anticipates that confirmatory drilling, modern sampling and assaying with QA/QC protocols, updated geological modeling, and estimation using CIM‑compliant methods will be required.

Qualified Person statement: A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources or reserves. The Company is not treating the historical estimate as current mineral resources or reserves.

Disclosure:

The terms of the MOU with CMS are a 3-month due diligence period for Steadright, $8,000,000 USD for the Mineral License that is approved for Mining Production Operations, along with a to-be-determined number of shares of Steadright not to exceed 9 percent of the Company’s outstanding shares and a 1% Net Smelter Royality (NSR). $500,000 USD is required as a non- refundable deposit within a 3 Month period within the MOU. Steadright has the right to negotiate with 3rd parties interested in partnering or obtaining the rights to the Historical Mine Site. Upon a successful definitive agreement, the purchase cash price will be subject to a 5% finders’ fee.

In recent years the world has seen increased demand for critical minerals, growing supply chain disruptions and rising raw material costs.

CEO, Matt Lewis states, “There is a lot of historical information that our Geological team is going through with regards to the due diligence. The historic mine works are very compelling to investigate further considering the potential in this friendly mining jurisdiction of Morocco. The fully permitted historic mining operation with two critical minerals is an ideal place to be while the world races to access and secure these ever-increasing value metals.”

Qualified Person

Mr. Robert Palkovits, P. Geo, VP Exploration for Steadright, who is a qualified person (“QP”) under the National Instrument 43-101 – Standards of Disclosure of Mineral Projects has reviewed and approved the scientific and technical information in this press release. WITH NOTICE TO THE READER THAT ALL INFORMATION REQUIRERS VERIFICATION.

ABOUT STREADRIGHT CRITICAL MINERALS INC.

Steadright Critical Minerals Inc. is a mineral exploration company established in 2019. Steadright has been focused in 2025 on finding exploration projects that can be brought into production within the critical mineral space focused in Morocco. Steadright currently has mineral exploration claims known as the RAM project near Port Cartier, Quebec within the Côte-Nord Region, which is accessible by route 138. The RAM project is comprised of over 11,000 acres and is located on an Anorthositic complex that is in a highly prospective geological unit and historically been under explored for Ni, Cu, Co and precious metals.

ON BEHALF OF THE BOARD OF DIRECTORS

For further information, please contact:

Matt Lewis

CEO & Director

Steadright Critical Minerals Inc.

Email: enquires@steadright.ca

Tel: 1-905-410-0587

Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors which may cause the actual results, level of activity, performance or achievements of Steadright to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: there is no certainty that the ongoing programs will result in significant or successful exploration and development of Steadright’s properties; uncertainty as to the actual results of exploration and development or operational activities; uncertainty as to the availability and terms of future financing on acceptable terms; uncertainty as to timely availability of permits and other governmental approvals; general business, economic, competitive, political and social uncertainties; capital market conditions and market prices for securities, junior market securities and mining exploration company securities; commodity prices; the actual results of current exploration and development or operational activities; competition; changes in project parameters as plans continue to be refined; accidents and other risks inherent in the mining industry; lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation or income tax legislation, affecting Steadright; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

Copyright (c) 2025 TheNewswire - All rights reserved.