iShares S&P SmallCap 600 Value ETF (NY:IJS)All News about iShares S&P SmallCap 600 Value ETF

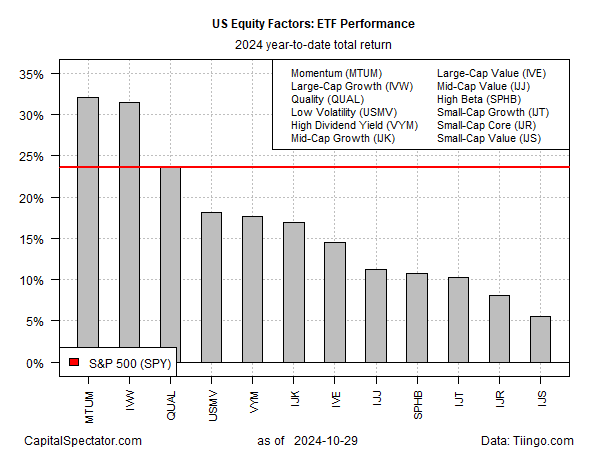

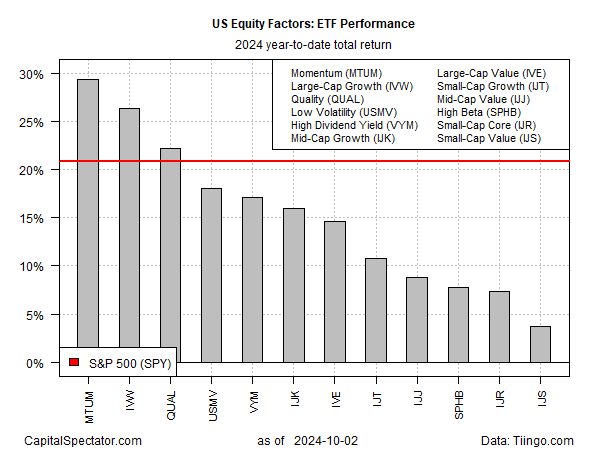

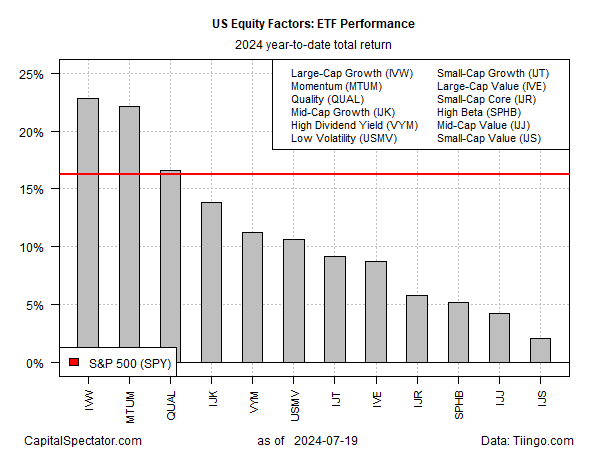

Momentum And Large-Cap Growth Still Lead Equity Factor Returns ↗

August 28, 2024

Via Talk Markets

Topics

ETFs

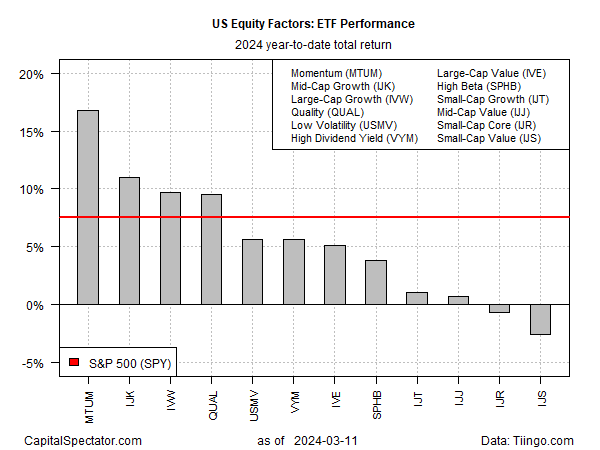

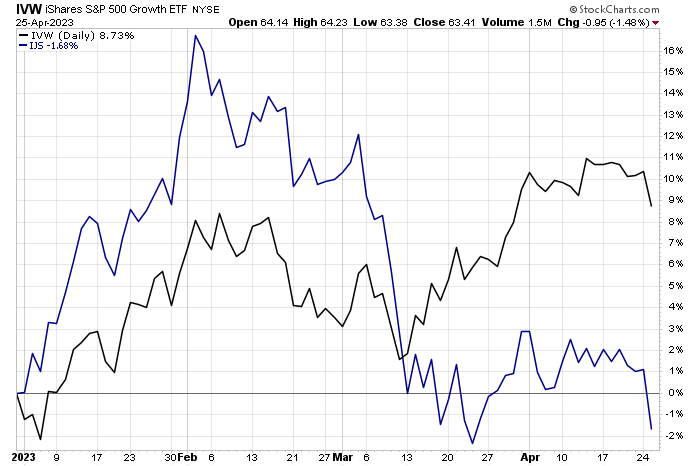

Large-Cap Stocks Continue To Lead US Equity Factors In 2023 ↗

October 26, 2023

Via Talk Markets

Topics

ETFs

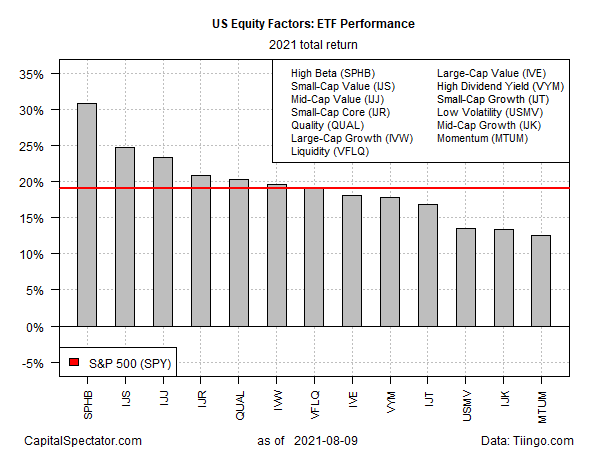

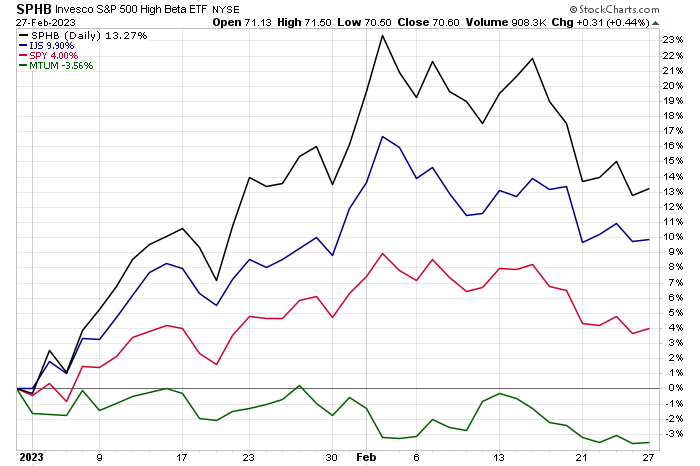

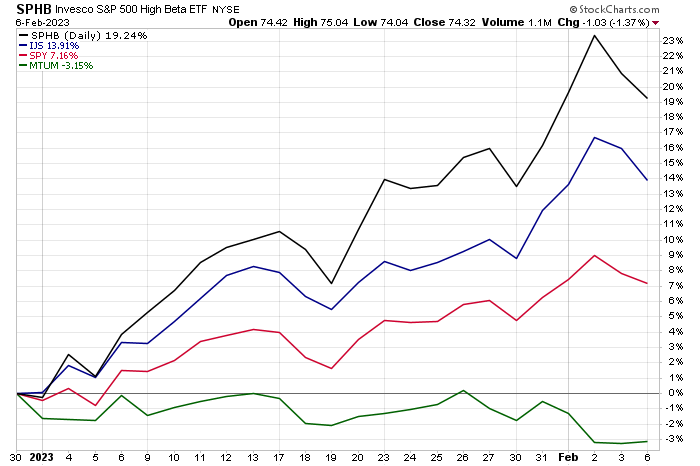

High Beta, Small Cap Value Top US Factor Returns In 2023’s Start ↗

January 17, 2023

Via Talk Markets

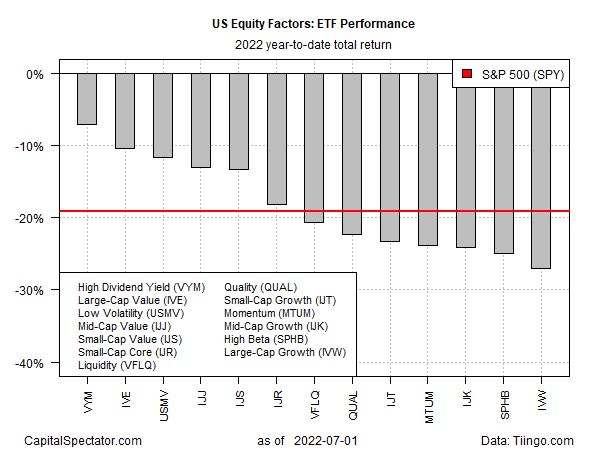

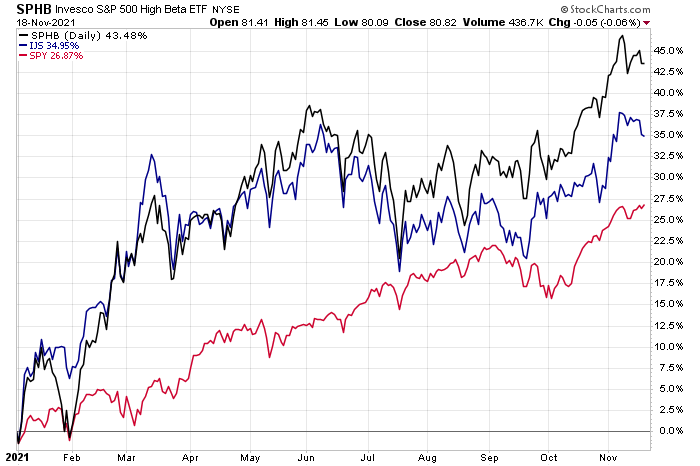

There's Nowhere To Hide From the Market's Carnage... Except Here ↗

October 05, 2021

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|

iShares S&P SmallCap 600 Value ETF (NY:IJS)All News about iShares S&P SmallCap 600 Value ETF

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|