Apartments.com Releases Multifamily Rent Growth Report for Second Quarter of 2025

Quarterly data shows rent growth easing in the second quarter of the year

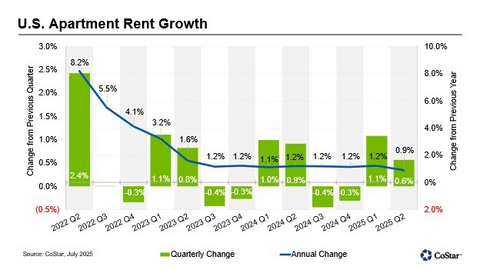

The national year-over-year asking rent growth for apartments was 0.9% in the second quarter of 2025, slightly slower than the 1.2% recorded in the first quarter. From mid-2023, year-over-year rent growth hovered between 1.0% and 1.2% after its rapid deceleration in 2021 and 2022. This was the first easing of rent growth since the first quarter of 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250707370880/en/

U.S. Apartment Rent Growth

The national rent per unit ended the quarter at $1,773, compared to a revised $1,763 recorded at the end of the first quarter of 2025 and $1,757 at the end of the second quarter of 2024. Quarter-over-quarter rents rose by 0.6%, a slowdown from the prior quarter’s gain of 1.1%. The vacancy rate held steady at 8.2% for its third consecutive quarter.

The second quarter recorded 151,440 units of absorption, a 21% increase over the previous quarter but 9% below absorption in the second quarter of 2024. Supply additions in the quarter numbered 175,655, a 37% increase over the previous quarter, but 11% below the supply additions in the second quarter of 2024. While supply additions exceeded absorption in the second quarter, following a trend that has persisted since the fourth quarter of 2021, construction starts have been on a long downward trend for two years, suggesting future deliveries will slow.

San Francisco ended the second quarter with the strongest annual asking rent growth of the top 50 markets nationwide, at 5.1%. Chicago followed at 3.8%, with San Jose at 3.0%, and Cincinnati and Norfolk at 2.8% were not far behind. Many of the best-performing markets are in the Midwest and Northeast, where modest supply additions were better aligned with demand conditions.

At the opposite end of the scale, rents fell by 4.3% over the past 12 months in Austin, followed by Denver at -3.3% and Phoenix at -2.6%. Fifteen markets saw rents fall compared to the second quarter of 2024, with all but one of those markets in the Sun Belt, where oversupply conditions have yet to stabilize fully.

Absorption was again led by 4&5-Star units, with roughly 115,000 units in the quarter, or about 75% of all units absorbed. With most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment and finished June at 0.5%, with a vacancy rate of 11.5%. This contrasts with mid-priced assets that benefited from rising demand for 3-Star properties, where the vacancy is 7.5% at the end of the second quarter, producing annual rent growth of 1.1%.

The multifamily market is projected to add 485,000 new units in 2025, 30% fewer than were delivered in 2024. As the post-pandemic supply wave recedes, balance will likely return to the market. However, market conditions could vary widely among markets and quality segments.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; and Homes.com, the fastest-growing residential real estate marketplace. CoStar Group’s industry-leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible, STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted over 130 million average monthly unique visitors in the first quarter of 2025, serving clients around the world. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements," including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2024 and Quarterly Report Form 10-Q for the quarter ended March 31, 2025, which are filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof. CoStar assumes no obligation to update or revise any forward-looking statements, whether due to new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250707370880/en/

Contacts

NEWS MEDIA:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202)-346-6775

mblocher@costar.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.