How Long Can Wingstop Stock Continue to Defy Gravity?

Fast casual restaurant Wingstop Inc. (NASDAQ: WING) stock has been defying all odds screaming to a new all-time high of $193 on Feb. 22, 2023. A combination of solid earnings and a short squeeze has caused shares to resist the macroeconomic market NYSE: YUM">pressures. It competes with other fast-food and casual NASDAQ: WING">restaurant brands, including Yum! Brands Inc. (NYSE: YUM), Papa John’s International Inc. (NASDAQ PZZA), Domino’s Pizza, Inc. (NYSE: DPZ), and Mcdonald's Co. (NYSE: MCD). However, these are far from their all-time highs.

Wingstop had grown its total system-wide store count from 845 when it went public in 2015 to 1,951 by the end of 2022. While analysts remain bullish on the long-term story, many are concerned about the overvaluation in its shares, already pricing too much upside.

Earnings Beat

On Feb. 22, 2023, Wingstop released its fiscal fourth-quarter fiscal 2022 results for the quarter ending December 2022. Wingstop benefitted from an additional 53rd week in Q4 2022 versus Q4 2021. The Company reported a non-GAAP diluted earnings-per-share (EPS) of $0.60, beating analyst estimates of $0.41 by $0.19. Revenues rose 45.7% year-over-year (YoY) to $104.9 million, beating analyst estimates of $100.96 million.

For fiscal Q4 2022, system-wide sales rose 28.9% to 775.7 million. Wingstop had 61 net new openings in the quarter. Domestic same-store sales rose 8.7%. Domestic restaurant AUV was $1.6 million. Digital sales increased to 63.2% of revenues. Net income rose 155.7% to $17.6 million or $0.59 per diluted share versus $6.9 million or $0.23 per diluted share in the year-ago period.

For the fiscal full-year 2022, Wingstop saw system-wide sales grow 16.8% to $2.7 billion. System-wide restaurants grew 13.2% to 1,969 locations worldwide, with 228 net new openings. Domestic same-store sales rose by 3.4%. Wingstop reaffirmed its three to five-year outlook for mid-single-digit same-store sales in the U.S.

Upbeat CEO Comments

Wingstop CEO Michael Skipworth commented, "Wingstop delivered another record year in 2022 highlighted by 13.2% unit growth and an industry-leading 19th consecutive year of positive same-store sales growth. In addition, we delivered 8.7% domestic same-store sales growth over the prior fiscal fourth quarter, driven entirely by transaction growth." He pointed out that strong top-line growth and significant deflation help strengthen brand partners' unit economics.

Analyst Actions

Cowen reiterated its Outperform rating with a $200 price target shortly after the earnings release. Analyst Andrew Charles noted that the higher multiple was justified because of the growth story in shares.

BTIG downgraded shares to a Neutral from Buy. Analyst Peter Saleh likes the long-term outlook but doesn’t see the momentum continuing into 2023. He commented, "While we expect the double-digit same-store sales momentum to continue into 1Q23, we see shares as fully valued and would wait for a better entry point” UBS kept its Neutral rating on shares but raised its target price to $190.

On Feb. 24, 2023, BMO Capital Markets cut its rating to Market Perform with a $190 price target, down from Outperform. The analyst team commented, “WING appears very well positioned in the near term and remains among the most compelling long-term growth stories in restaurants. However, we believe the market is better appreciating WING's positives with shares at current levels and, to be fair, 2H growth likely will be more muted.”

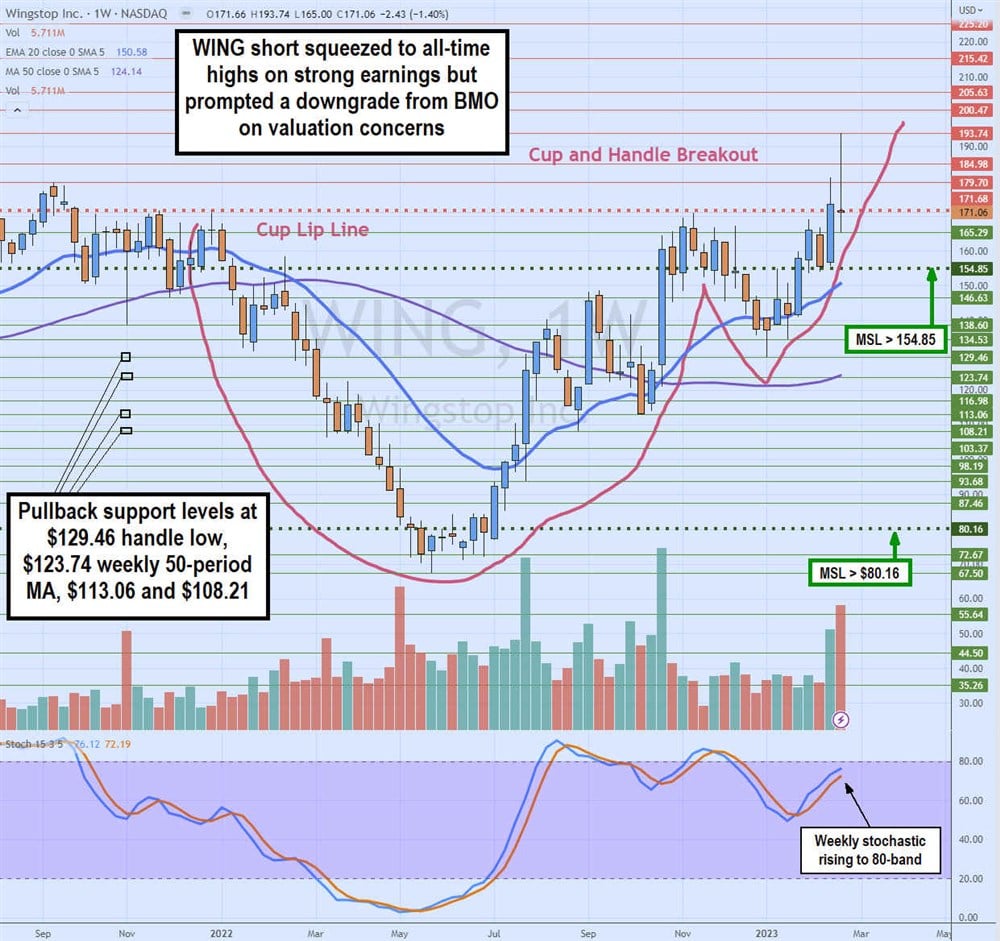

Weekly Cup and Handle

The weekly candlestick chart shows a cup and handles breakout pattern. First, the cup lip line formed at $171.68 in December 2021 as shares cratered to hit a low of $67.50 by May 2022. Next, shares triggered a market structure low (MSL) breakout through $80.16 in July 2022. Finally, WING climbed to retest the cup lip line in November 2022 before returning to $129.46 by January 2023.

The handle formed after triggering a second MSL breakout through $154.85. The cup and handle breakout triggered the break of the lip line at $171.68, but bears may be trying to push shares back under the lip line.

The weekly 50-period exponential moving average (EMA) support is climbing at $150.58. The 50-period MA is slowly rising near $123.74. The weekly stochastic is still rising as it nears the 80-band. Pullback support levels are at the $129.46 handle low, $123.74 weekly 50-period MA, $113.06, and $108.21.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.