3 High-Yield Banks Insiders Are Buying

The financial crisis may not be over, but the risk is not spread equally among America’s banks. The smaller regional banks focused on America’s heartland are in far better shape than the risk-taking growth names that recently saw their businesses collapse. One way to root out the good from the bad is to check out the insider buying activity, and there is some interesting data on Insidertrades.com’s tracking pages.

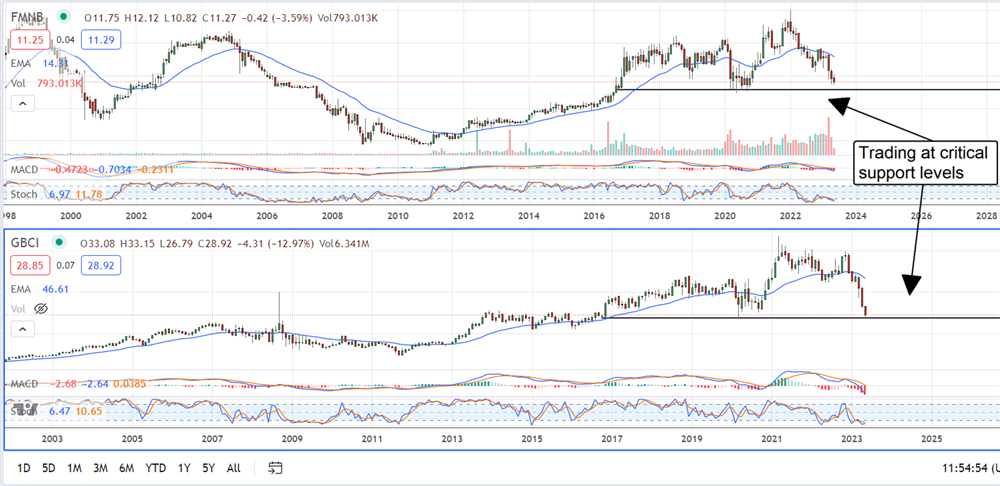

Among the names that appear on the list of regular insider buying are Glacier Bancorp (NASDAQ: GCBI), First Financial Bankshares (NYSE: FFIN), and Farmers National Banc Corp (NYSE: FMNB), which share another attractive trait; they pay high-yielding dividends. Taking the insider buys as a sign of company health, it looks like these stocks are trading at ridiculously low values, and the payouts are safe.

First Financial Bankshares: The Low-Yield Choice

First Financial Bankshares is the lowest-yielding of this group, but the 2.6% yield is attractive enough. The payout is less than 45% of the expected earnings and has been growing at a double-digit pace for 12 years, so there is an expectation for distribution growth as well. It is among the higher-valued bank stocks with a P/E near 17X, possibly because the consensus figures have fallen so low. Regarding insider activity, there has been no insider selling for years, and their buying picked up with the share price implosion.

Insidertrades.com has been tracking sales from 4 insiders, including 3 directors and the CFO since the banking crisis began. They have total holdings up to 4%, and the institutions are also buying. Institutional activity is mixed on a quarter-to-quarter basis but bullish on balance. The price action remains bearish, but this buying is evident in the charts. Signs of a potential bottom at the $27 level may be confirmed by summer.

Glacier Bancorp Yields 4.5%

Glacier Bancorp is slightly smaller than First Financial regarding the market cap, but it is a much better-yielding stock with a payout near 4.5%. It also offers better value trading at 13X earnings and the stock trading at critical support near a 10-year low. Insidertrades.com is tracking 4 insiders buying this stock, including the CEO, CAO, CFO and the Chairman of the Board. The insiders own only 0.44% of the company, but their buying is no-less telling, and high institutional ownership backs it up. The institutions own about 70% of this bank and have been buying since the crisis started.

At least 4 analysts have updated their targets since March, including price target reductions. Regardless, the community has the stock pegged at Moderate Buy with a target ranging from $40 to $47. That’s worth 37% of the upside at the low end of the range, and it could be reached quickly, given signs of stability in the banking sector.

Farmers National Banc Corp, 5.96% Looks Pretty Good

Farmers National Banc Corp (NASDAQ: FMNB) yields nearly 6.0%, with its shares trading near critical support levels. The payout is a cool 36% of the earnings outlook, so there are no red flags from that quarter. The company has been increasing the payout for 7 years, so there is also an expectation for increases, although the 22% pace it has sustained will likely slow.

Insidertrades.com is tracking 6 insiders buying this stock, including 4 directors, an SVP and the CEO. They have insider holdings up to 4.8%, and institutional activity is bullish as well. The institutions have been buying this stock for many quarters and have their holdings up to 39%. Their activity peaked in Q1 and slowed in Q2, but Q2 is on track for above-average buying. This stock is showing signs of support at the $11 level. This market could easily reach the $14 range if they are confirmed.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.